Railroad retirement benefits are a crucial aspect of compensation for railroad workers, providing them with a steady income stream after retirement. However, navigating the complexities of these benefits can be daunting, especially when it comes to tax season. This is where the RRB 1099 R form comes into play. In this article, we'll delve into the world of railroad retirement benefits, exploring the ins and outs of the RRB 1099 R form and how it impacts your tax obligations.

The Railroad Retirement Board (RRB) is responsible for administering retirement benefits to eligible railroad workers. The RRB 1099 R form is a tax document that reports the amount of railroad retirement benefits paid to recipients during the tax year. This form is crucial for taxpayers who receive railroad retirement benefits, as it helps them report their income accurately on their tax returns.

What is the RRB 1099 R Form?

The RRB 1099 R form is a tax document that reports the gross amount of railroad retirement benefits paid to recipients during the tax year. The form includes the following information:

- The recipient's name and address

- The recipient's Social Security number or Railroad Retirement number

- The gross amount of railroad retirement benefits paid during the tax year

- The amount of federal income tax withheld from the benefits

The RRB 1099 R form is typically mailed to recipients by January 31st of each year, and it's essential to review the form carefully for accuracy.

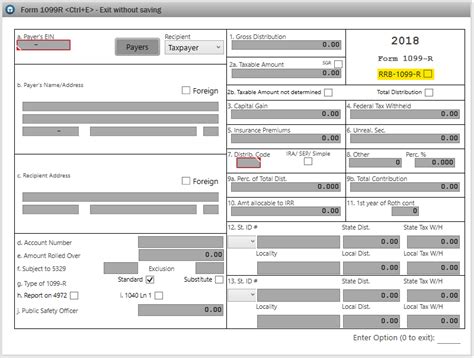

How to Read the RRB 1099 R Form

Reading the RRB 1099 R form can be overwhelming, especially if you're not familiar with tax documents. Here's a breakdown of the key sections:

- Box 1: Gross Distribution: This box shows the total amount of railroad retirement benefits paid to you during the tax year.

- Box 2a: Taxable Amount: This box shows the amount of benefits that are subject to federal income tax.

- Box 4: Federal Income Tax Withheld: This box shows the amount of federal income tax withheld from your benefits.

Taxation of Railroad Retirement Benefits

Railroad retirement benefits are taxable, and the amount of tax you owe depends on your income level and filing status. The taxation of railroad retirement benefits is similar to Social Security benefits, with some key differences.

- Up to 85% of your railroad retirement benefits may be subject to federal income tax, depending on your income level.

- If you're married and file jointly, you may be subject to a higher tax rate than if you file separately.

Reporting Railroad Retirement Benefits on Your Tax Return

When reporting railroad retirement benefits on your tax return, you'll need to complete Form 1040 and attach a copy of the RRB 1099 R form. Here are the steps to follow:

- Report the gross amount of railroad retirement benefits in Box 1 of the RRB 1099 R form on Line 4a of Form 1040.

- Report the taxable amount of railroad retirement benefits in Box 2a of the RRB 1099 R form on Line 4b of Form 1040.

- Claim the federal income tax withheld from your benefits on Line 25b of Form 1040.

Common Mistakes to Avoid

When dealing with the RRB 1099 R form, it's essential to avoid common mistakes that can delay your tax refund or trigger an audit. Here are some mistakes to avoid:

- Failing to report railroad retirement benefits on your tax return.

- Incorrectly reporting the taxable amount of benefits.

- Failing to claim federal income tax withheld from benefits.

Seeking Professional Help

If you're unsure about how to complete the RRB 1099 R form or report railroad retirement benefits on your tax return, it's essential to seek professional help. A tax professional or accountant can guide you through the process and ensure you're in compliance with tax laws.

Conclusion

The RRB 1099 R form is a critical tax document for railroad workers receiving retirement benefits. Understanding how to read and report these benefits on your tax return is essential for avoiding common mistakes and ensuring you're in compliance with tax laws. By following the tips outlined in this article, you'll be well on your way to navigating the complexities of railroad retirement benefits and ensuring a smooth tax filing process.

Final Thoughts

Railroad retirement benefits are a vital aspect of compensation for railroad workers, and understanding the RRB 1099 R form is crucial for tax compliance. By staying informed and seeking professional help when needed, you can ensure a smooth tax filing process and avoid common mistakes.

We encourage you to share your thoughts and experiences with the RRB 1099 R form in the comments section below. If you have any questions or concerns, please don't hesitate to reach out to us.

What is the RRB 1099 R form?

+The RRB 1099 R form is a tax document that reports the gross amount of railroad retirement benefits paid to recipients during the tax year.

How do I report railroad retirement benefits on my tax return?

+Report the gross amount of railroad retirement benefits in Box 1 of the RRB 1099 R form on Line 4a of Form 1040. Report the taxable amount of railroad retirement benefits in Box 2a of the RRB 1099 R form on Line 4b of Form 1040.

Can I claim federal income tax withheld from my benefits?

+Yes, you can claim federal income tax withheld from your benefits on Line 25b of Form 1040.