If you're an individual or business entity with assets or interests in Rhode Island, you may receive a tax information request in the form of Ri Form 92-19. This form is used by the Rhode Island Division of Taxation to request specific information from taxpayers, and it's essential to understand its purpose and what's required of you.

Receiving a tax information request can be daunting, especially if you're not familiar with the process or the form itself. However, responding accurately and promptly is crucial to avoid any potential penalties or delays. In this article, we'll delve into the details of Ri Form 92-19, explaining its purpose, the information required, and the steps to follow when completing and submitting the form.

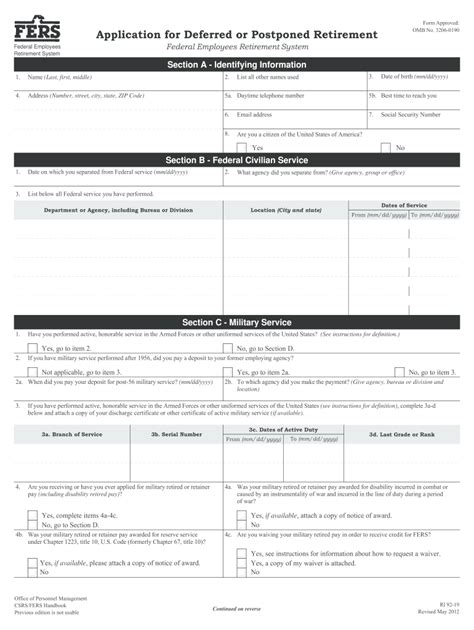

What is Ri Form 92-19?

Ri Form 92-19 is a tax information request form used by the Rhode Island Division of Taxation to gather specific information from taxpayers. The form is typically used to verify or obtain additional information related to a taxpayer's return, claim, or credit. The Division of Taxation may use this form to request information for various purposes, including:

- Verifying income or expenses reported on a tax return

- Determining eligibility for a tax credit or deduction

- Investigating potential tax liabilities or discrepancies

- Updating taxpayer records or accounts

Why Did I Receive Ri Form 92-19?

You may receive Ri Form 92-19 for various reasons, including:

- Incomplete or missing information on your tax return

- Discrepancies or inconsistencies in your tax return or supporting documentation

- Changes to your tax account or records

- Selection for a tax audit or examination

How to Complete Ri Form 92-19

When completing Ri Form 92-19, it's essential to follow the instructions carefully and provide accurate information. Here are some general guidelines to keep in mind:

- Read the instructions and questions carefully before responding.

- Provide complete and accurate information, as incomplete or inaccurate responses may lead to delays or penalties.

- Attach supporting documentation, such as receipts, invoices, or bank statements, as required.

- Sign and date the form, as required.

- Submit the completed form and supporting documentation by the specified deadline.

What Information is Required?

The information required on Ri Form 92-19 will vary depending on the specific purpose of the request. However, common information requested may include:

- Taxpayer identification information (e.g., name, address, Social Security number)

- Business or entity information (e.g., name, address, federal Employer Identification Number)

- Income or expense information (e.g., wages, interest, dividends, expenses)

- Supporting documentation (e.g., receipts, invoices, bank statements)

Consequences of Not Responding or Providing Incomplete Information

Failing to respond or providing incomplete information on Ri Form 92-19 can lead to consequences, including:

- Penalties and interest on any tax liabilities

- Delays in processing your tax return or claim

- Potential tax audit or examination

- Loss of tax credits or deductions

How to Submit Ri Form 92-19

Once you've completed Ri Form 92-19, you can submit it to the Rhode Island Division of Taxation via:

- Mail: Send the completed form and supporting documentation to the address specified in the instructions.

- Fax: Fax the completed form and supporting documentation to the number specified in the instructions.

- Email: Email the completed form and supporting documentation to the email address specified in the instructions.

Seeking Professional Help

If you're unsure about how to complete Ri Form 92-19 or need assistance with the process, consider seeking professional help from a qualified tax professional or attorney. They can provide guidance on the specific requirements and ensure you're in compliance with Rhode Island tax laws and regulations.

Conclusion

Receiving Ri Form 92-19 can be a daunting experience, but understanding its purpose and what's required of you can make the process less overwhelming. By following the instructions carefully and providing accurate information, you can ensure a smooth and efficient process. If you're unsure or need assistance, don't hesitate to seek professional help.

Now that you've learned more about Ri Form 92-19, we encourage you to share your experiences or ask questions in the comments below. Your input can help others who may be facing similar situations.

FAQ Section

What is the purpose of Ri Form 92-19?

+Ri Form 92-19 is a tax information request form used by the Rhode Island Division of Taxation to gather specific information from taxpayers.

Why did I receive Ri Form 92-19?

+You may receive Ri Form 92-19 for various reasons, including incomplete or missing information on your tax return, discrepancies or inconsistencies in your tax return or supporting documentation, changes to your tax account or records, or selection for a tax audit or examination.

What information is required on Ri Form 92-19?

+The information required on Ri Form 92-19 will vary depending on the specific purpose of the request, but common information requested may include taxpayer identification information, business or entity information, income or expense information, and supporting documentation.