Filling out tax forms can be a daunting task, especially for those who are new to the process or have complex financial situations. The Form OR-40N, also known as the Oregon Non-Resident Income Tax Return, is a crucial document for individuals who have earned income in Oregon but are not residents of the state. In this article, we will break down the process of filling out Form OR-40N into seven manageable steps.

Step 1: Gather Required Documents and Information

Before starting the filling process, it's essential to gather all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Oregon income tax withholding statement (Form W-2 or 1099)

- Any other relevant tax-related documents, such as receipts for charitable donations or medical expenses

- Your federal income tax return (Form 1040)

- Any other state income tax returns you've filed

What to Expect from Form OR-40N

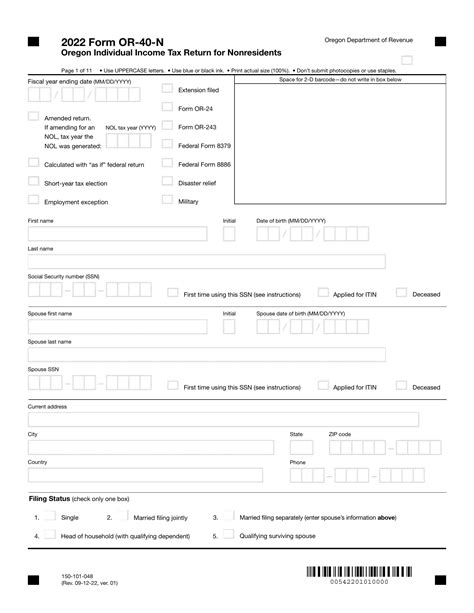

Form OR-40N is a three-page document that requires you to report your Oregon income, claim any applicable deductions and credits, and calculate your tax liability. The form is divided into sections, each addressing a specific aspect of your tax situation.

Step 2: Determine Your Filing Status

Your filing status affects your tax rates and the deductions you're eligible for. Oregon recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that applies to you, and make sure to check the correct box on Form OR-40N.

Special Considerations for Non-Residents

As a non-resident, you'll only report income earned in Oregon on Form OR-40N. This may include wages, salaries, tips, and income from self-employment or investments. You won't report income earned outside of Oregon on this form.

Step 3: Report Your Income

Report your Oregon income on Form OR-40N, using the following lines:

- Line 1: Wages, salaries, tips, and other employee compensation

- Line 2: Taxable interest income

- Line 3: Dividend income

- Line 4: Capital gains (or losses)

- Line 5: Business income (or loss)

- Line 6: Other income (such as rental income or royalties)

Make sure to include all income earned in Oregon, even if it's not reported on a W-2 or 1099.

Claiming Business Expenses

If you have business expenses related to your Oregon income, you may be able to claim them as deductions. Keep accurate records of your expenses, as you'll need to report them on Schedule C (Form 1040) or Schedule E (Form 1040).

Step 4: Claim Deductions and Credits

Oregon offers various deductions and credits that can reduce your tax liability. Some of the most common deductions and credits include:

- Standard deduction

- Itemized deductions (such as medical expenses or charitable donations)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Claim any deductions and credits you're eligible for on Form OR-40N.

Understanding Oregon's Tax Credits

Oregon offers several tax credits, including the EITC and the Child Tax Credit. These credits can significantly reduce your tax liability, so make sure to claim them if you're eligible.

Step 5: Calculate Your Tax Liability

Once you've reported your income and claimed any deductions and credits, calculate your tax liability using the Oregon income tax tables or the Oregon tax rate schedule.

Understanding Oregon's Tax Rates

Oregon has a progressive tax system, with tax rates ranging from 5% to 9.9%. Your tax rate will depend on your taxable income and filing status.

Step 6: Complete the Remaining Sections

After calculating your tax liability, complete the remaining sections of Form OR-40N, including:

- Section 3: Tax credits and payments

- Section 4: Refund or payment information

- Section 5: Sign and date the form

Make sure to sign and date the form, as this is required for processing.

What to Do with Your Completed Form OR-40N

Once you've completed Form OR-40N, you can submit it to the Oregon Department of Revenue. You can file electronically or by mail.

Step 7: Review and Submit Your Return

Before submitting your return, review it carefully to ensure accuracy and completeness. Make sure to:

- Check your math calculations

- Verify your income and deductions

- Ensure you've signed and dated the form

Submit your return to the Oregon Department of Revenue by the tax filing deadline to avoid penalties and interest.

What to Expect After Submitting Your Return

After submitting your return, the Oregon Department of Revenue will process it and issue a refund or bill you for any additional tax due. You can check the status of your return online or by contacting the department directly.

By following these seven steps, you'll be able to accurately and efficiently fill out Form OR-40N. Remember to take your time, and don't hesitate to seek help if you need it.

What is the deadline for filing Form OR-40N?

+The deadline for filing Form OR-40N is typically April 15th, but this may vary depending on your specific situation. Check with the Oregon Department of Revenue for specific deadlines and requirements.

Do I need to file Form OR-40N if I have no Oregon income?

+No, you don't need to file Form OR-40N if you have no Oregon income. However, if you have Oregon income but are exempt from filing, you may still need to file a return to report your income and claim any applicable deductions and credits.

Can I file Form OR-40N electronically?

+Yes, you can file Form OR-40N electronically through the Oregon Department of Revenue's website. Electronic filing is fast, secure, and convenient, and it can help reduce errors and processing time.