New York City is one of the most populous and economically vibrant cities in the world, with a complex and intricate tax system. For property owners, navigating this system can be daunting, especially when it comes to filing taxes on their properties. One crucial form in this process is the New York City Form 210, which is used to report income and expenses related to rental properties. In this comprehensive guide, we will delve into the world of New York City Form 210, exploring its purpose, requirements, and benefits.

Understanding the Purpose of New York City Form 210

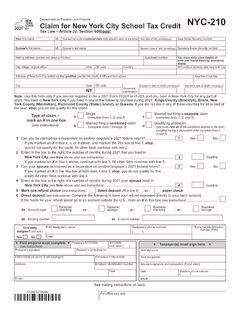

New York City Form 210, also known as the "Unincorporated Business Tax (UBT) Return," is a critical tax form used by the New York City Department of Finance to collect taxes on unincorporated businesses, including rental properties. The form is used to report income and expenses related to these properties, as well as to calculate the tax liability owed to the city.

Who Needs to File New York City Form 210?

Not all property owners in New York City need to file Form 210. The form is specifically designed for unincorporated businesses, which include:

- Sole proprietors

- Partnerships

- Limited liability companies (LLCs)

- Estates and trusts

If you own a rental property in New York City and your business is structured as one of the above, you will likely need to file Form 210.

Benefits of Filing New York City Form 210

Filing Form 210 provides several benefits to property owners, including:

- Reduced tax liability: By accurately reporting income and expenses, property owners can minimize their tax liability and avoid potential penalties.

- Compliance with tax laws: Filing Form 210 ensures compliance with New York City tax laws and regulations, reducing the risk of audits and fines.

- Record-keeping: The form helps property owners maintain accurate records of their income and expenses, making it easier to manage their finances.

How to File New York City Form 210

Filing Form 210 can be a complex process, but it can be broken down into several manageable steps:

- Gather necessary documents: Collect all necessary documents, including rental income statements, expense records, and depreciation schedules.

- Complete Form 210: Fill out Form 210, making sure to accurately report income and expenses.

- Attach supporting schedules: Attach supporting schedules, such as Schedule A (income) and Schedule B (expenses).

- Submit the form: Submit the completed form to the New York City Department of Finance by the deadline.

Common Mistakes to Avoid When Filing New York City Form 210

When filing Form 210, it's essential to avoid common mistakes that can lead to delays, penalties, or even audits. Some common mistakes to avoid include:

- Inaccurate reporting: Ensure that income and expenses are accurately reported to avoid errors or discrepancies.

- Missing supporting schedules: Attach all necessary supporting schedules to avoid delays or penalties.

- Late filing: Submit the form by the deadline to avoid late-filing penalties.

Tips for Filing New York City Form 210

To make the filing process smoother, consider the following tips:

- Consult a tax professional: If you're unsure about the filing process, consider consulting a tax professional.

- Use tax software: Utilize tax software to streamline the filing process and reduce errors.

- Keep accurate records: Maintain accurate records of income and expenses to ensure accurate reporting.

Conclusion

Filing New York City Form 210 is a critical step in managing your rental property's tax obligations. By understanding the purpose, requirements, and benefits of the form, you can ensure compliance with tax laws and regulations, minimize your tax liability, and maintain accurate records. Remember to avoid common mistakes and consider consulting a tax professional or using tax software to streamline the filing process.

Final Thoughts

Filing New York City Form 210 is just one aspect of managing your rental property's tax obligations. Stay informed about changes to tax laws and regulations, and consider consulting a tax professional to ensure you're taking advantage of all available tax savings.

What is New York City Form 210?

+New York City Form 210 is a tax form used to report income and expenses related to rental properties.

Who needs to file New York City Form 210?

+Sole proprietors, partnerships, limited liability companies (LLCs), and estates and trusts that own rental properties in New York City need to file Form 210.

What are the benefits of filing New York City Form 210?

+Filing Form 210 provides several benefits, including reduced tax liability, compliance with tax laws, and accurate record-keeping.