As a property owner or a real estate professional in New York City, you're likely familiar with the complexities of the city's tax laws and regulations. One of the most crucial documents you'll need to navigate is the NYC 204 Form, also known as the "Income and Expense Statement." This form is used to report the income and expenses of a rental property in New York City, and it's essential to complete it accurately to avoid any potential penalties or fines.

In this article, we'll break down the five ways to complete Form NYC 204 successfully, including understanding the form's requirements, gathering necessary documents, calculating income and expenses, avoiding common mistakes, and seeking professional help when needed.

Understanding the Form's Requirements

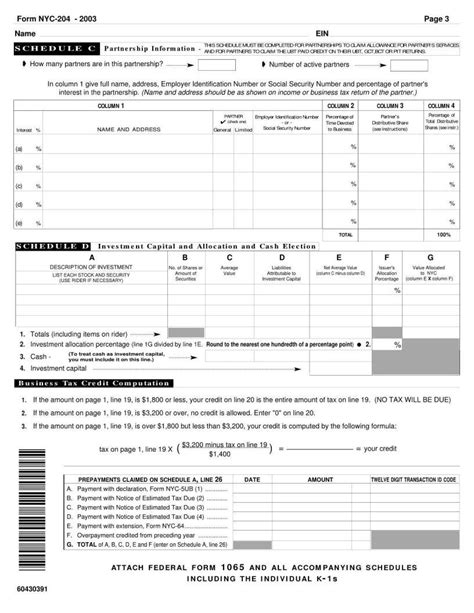

Before you start filling out the form, it's essential to understand its requirements. The NYC 204 Form is used to report the income and expenses of a rental property in New York City for a specific tax year. The form is divided into several sections, including:

- Section 1: Property Information

- Section 2: Income

- Section 3: Expenses

- Section 4: Depreciation and Amortization

- Section 5: Recap of Income and Expenses

You'll need to provide detailed information about your rental property, including its address, owner's name, and tax identification number. You'll also need to report all income and expenses related to the property, including rent, mortgage interest, property taxes, and maintenance expenses.

Types of Properties That Require the NYC 204 Form

The NYC 204 Form is required for all rental properties in New York City, including:

- Residential buildings with six or more units

- Commercial properties

- Industrial properties

- Mixed-use properties

Gathering Necessary Documents

To complete the NYC 204 Form accurately, you'll need to gather several documents, including:

- Rental income statements

- Mortgage interest statements

- Property tax bills

- Maintenance and repair receipts

- Depreciation and amortization schedules

You'll also need to have a clear understanding of your property's financial performance, including its income, expenses, and cash flow.

How to Obtain Necessary Documents

You can obtain the necessary documents from various sources, including:

- Your property management company

- Your accountant or bookkeeper

- Your lender or mortgage company

- Your property tax assessor

Calculating Income and Expenses

Calculating income and expenses is a critical part of completing the NYC 204 Form. You'll need to report all income related to your rental property, including:

- Rent

- Parking income

- Laundry income

- Vending machine income

You'll also need to report all expenses related to your rental property, including:

- Mortgage interest

- Property taxes

- Maintenance and repair expenses

- Utilities

- Insurance

How to Calculate Depreciation and Amortization

Depreciation and amortization are critical components of the NYC 204 Form. You'll need to calculate the depreciation and amortization of your property's assets, including:

- Buildings

- Equipment

- Furniture and fixtures

You can use the Modified Accelerated Cost Recovery System (MACRS) to calculate depreciation and amortization.

Avoiding Common Mistakes

Common mistakes on the NYC 204 Form can result in penalties and fines. Some of the most common mistakes include:

- Inaccurate reporting of income and expenses

- Failure to report depreciation and amortization

- Incorrect calculation of taxable income

- Failure to sign and date the form

How to Avoid Common Mistakes

To avoid common mistakes, it's essential to:

- Carefully review the form's instructions

- Gather all necessary documents

- Double-check your calculations

- Seek professional help when needed

Seeking Professional Help When Needed

Completing the NYC 204 Form can be complex and time-consuming. If you're unsure about any aspect of the form, it's essential to seek professional help. You can hire a:

- Certified public accountant (CPA)

- Enrolled agent (EA)

- Tax attorney

A professional can help you navigate the form's requirements, gather necessary documents, and calculate income and expenses.

Benefits of Seeking Professional Help

Seeking professional help can provide several benefits, including:

- Accurate completion of the form

- Reduced risk of penalties and fines

- Increased confidence in your tax compliance

- More time to focus on your business

What is the NYC 204 Form?

+The NYC 204 Form is an Income and Expense Statement used to report the income and expenses of a rental property in New York City.

Who needs to file the NYC 204 Form?

+The NYC 204 Form is required for all rental properties in New York City, including residential buildings with six or more units, commercial properties, industrial properties, and mixed-use properties.

What documents do I need to complete the NYC 204 Form?

+You'll need to gather several documents, including rental income statements, mortgage interest statements, property tax bills, maintenance and repair receipts, and depreciation and amortization schedules.

By following these five ways to complete Form NYC 204 successfully, you'll be able to navigate the complexities of the form and ensure compliance with New York City's tax laws. Remember to take your time, gather all necessary documents, and seek professional help when needed. With the right approach, you'll be able to complete the form accurately and confidently.