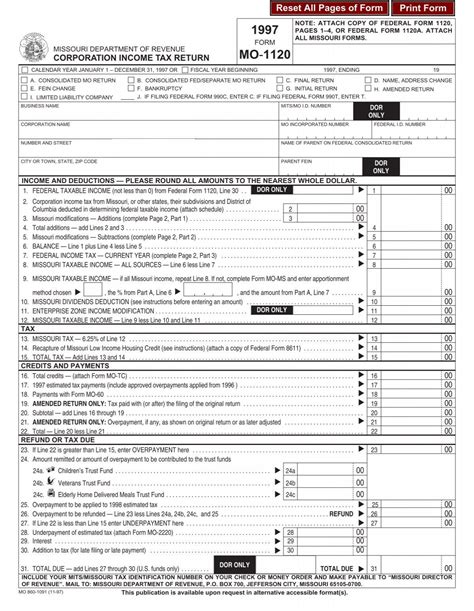

As a business owner in Missouri, it's essential to understand the state's corporate income tax requirements. The Missouri Corporate Income Tax Return Form MO-1120 is a critical document that businesses must file annually to report their income and pay taxes. In this comprehensive guide, we'll walk you through the process of completing the MO-1120 form, highlighting key sections, deadlines, and tips to ensure you're in compliance with the state's tax regulations.

Who Needs to File Form MO-1120?

Any corporation that conducts business in Missouri must file Form MO-1120, regardless of whether they have a physical presence in the state. This includes:

- C-corporations

- S-corporations

- Limited liability companies (LLCs) that elect to be taxed as corporations

- Trusts and estates that engage in business activities

When is the Filing Deadline?

The filing deadline for Form MO-1120 is typically April 15th for calendar-year taxpayers. However, if your business operates on a fiscal year, your deadline will be the 15th day of the fourth month after your fiscal year ends.

Preparing Form MO-1120

Before starting the filing process, ensure you have the necessary information and documents, including:

- Federal tax return (Form 1120 or 1120S)

- Missouri income tax withholding statements (Form MO-W-3)

- Any other relevant tax schedules and statements

Step 1: Complete the Business Information Section

The first section of Form MO-1120 requires you to provide your business's identifying information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Missouri Secretary of State business ID number

Step 2: Report Income and Deductions

The next section requires you to report your business's income and deductions. This includes:

- Gross income from all sources

- Deductions for expenses, such as salaries, rent, and utilities

- Net operating loss (NOL) carryovers

Calculating Missouri Tax Liability

To calculate your Missouri tax liability, you'll need to complete the tax computation section. This involves:

- Calculating your federal taxable income

- Applying the Missouri tax rate (currently 4.225%)

- Claiming any applicable tax credits

Step 3: Complete the Tax Credits Section

Missouri offers various tax credits that can reduce your tax liability. Some common credits include:

- Jobs creation credit

- Research and development credit

- Historic preservation credit

Filing and Payment Options

You can file Form MO-1120 electronically or by mail. If you owe taxes, you can pay online, by phone, or by mail.

Electronic Filing

The Missouri Department of Revenue offers an online filing system, which provides several benefits, including:

- Faster processing

- Reduced errors

- Ability to pay taxes online

Penalties and Interest

Failure to file or pay taxes on time can result in penalties and interest. To avoid these consequences, ensure you:

- File Form MO-1120 by the deadline

- Pay any tax due by the deadline

- Respond promptly to any notices or inquiries from the Missouri Department of Revenue

Conclusion

Completing Form MO-1120 requires attention to detail and a thorough understanding of Missouri's corporate income tax laws. By following this guide, you'll be well on your way to ensuring your business is in compliance with the state's tax regulations. If you have any questions or concerns, consider consulting a tax professional or contacting the Missouri Department of Revenue.

What is the deadline for filing Form MO-1120?

+The filing deadline for Form MO-1120 is typically April 15th for calendar-year taxpayers. However, if your business operates on a fiscal year, your deadline will be the 15th day of the fourth month after your fiscal year ends.

What are the penalties for late filing or payment?

+Failure to file or pay taxes on time can result in penalties and interest. The Missouri Department of Revenue may impose a penalty of up to 5% of the unpaid tax for each month or part of a month that the return is late.

Can I file Form MO-1120 electronically?

+Yes, the Missouri Department of Revenue offers an online filing system for Form MO-1120. Electronic filing provides several benefits, including faster processing, reduced errors, and the ability to pay taxes online.