Completing tax forms can be a daunting task, especially for those who are new to the process. The IT-558 form, specifically designed for New York State income tax purposes, can be a challenge to navigate. However, with the right guidance, filling out this form can be a breeze. In this article, we will provide a step-by-step guide on how to complete Form IT-558 with ease.

What is Form IT-558?

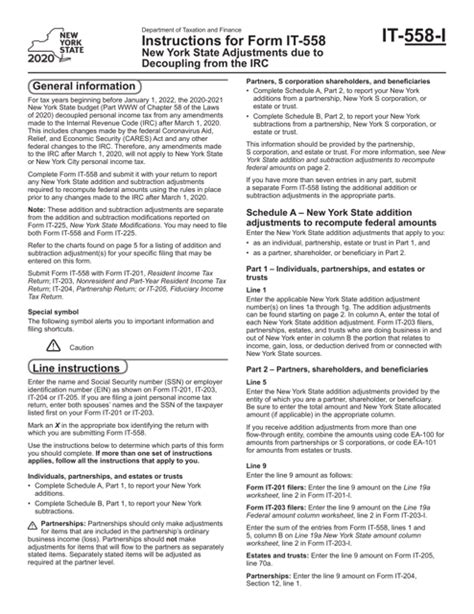

Form IT-558 is a New York State income tax form used to report and claim a credit for certain taxes paid to other states. This form is designed to help taxpayers avoid double taxation on income earned in multiple states. By claiming a credit for taxes paid to other states, taxpayers can reduce their New York State income tax liability.

Who Needs to File Form IT-558?

Not all taxpayers need to file Form IT-558. This form is specifically designed for individuals who:

- Have income from sources outside of New York State

- Paid taxes to another state or states on that income

- Want to claim a credit for those taxes paid to reduce their New York State income tax liability

Gathering Required Information and Documents

Before starting to fill out Form IT-558, gather all necessary information and documents. You will need:

- Your New York State income tax return (Form IT-201)

- Your federal income tax return (Form 1040)

- Tax returns from other states where you paid taxes

- W-2 forms and 1099 forms showing income earned in other states

- Proof of taxes paid to other states, such as cancelled checks or receipts

Step-by-Step Instructions for Completing Form IT-558

Now that you have gathered all necessary information and documents, follow these step-by-step instructions to complete Form IT-558:

Step 1: Identify the States Where You Paid Taxes

List all states where you paid taxes on income earned. This information can be found on your W-2 forms and 1099 forms.

Step 2: Calculate the Taxes Paid to Other States

Calculate the total amount of taxes paid to each state. This information can be found on your tax returns from other states.

Step 3: Complete Part 1 of Form IT-558

Part 1 of Form IT-558 requires you to list the states where you paid taxes and the amount of taxes paid to each state. Use the information gathered in Steps 1 and 2 to complete this section.

Step 4: Complete Part 2 of Form IT-558

Part 2 of Form IT-558 requires you to calculate the credit for taxes paid to other states. Use the information gathered in Steps 1 and 2 to complete this section.

Step 5: Complete Part 3 of Form IT-558

Part 3 of Form IT-558 requires you to list any adjustments to the credit calculated in Part 2. Use this section to report any additional taxes paid or credits claimed.

Step 6: Review and Sign Form IT-558

Review Form IT-558 for accuracy and completeness. Sign and date the form.

Additional Tips and Reminders

- Always keep a copy of Form IT-558 and supporting documentation for your records.

- If you have any questions or concerns, consult the New York State Department of Taxation and Finance website or contact a tax professional.

- Be sure to file Form IT-558 with your New York State income tax return (Form IT-201) by the required deadline.

Conclusion

Completing Form IT-558 may seem daunting, but with the right guidance, it can be a straightforward process. By following these step-by-step instructions and gathering all necessary information and documents, you can ensure accuracy and completeness. Remember to review and sign Form IT-558, and always keep a copy for your records.

We hope this guide has been helpful in completing Form IT-558. If you have any further questions or concerns, please don't hesitate to comment below.

What is the deadline for filing Form IT-558?

+The deadline for filing Form IT-558 is the same as the deadline for filing your New York State income tax return (Form IT-201).

Can I claim a credit for taxes paid to other states if I didn't file a tax return in that state?

+No, you can only claim a credit for taxes paid to other states if you filed a tax return in that state and paid taxes on income earned.

Can I amend my New York State income tax return to claim a credit for taxes paid to other states?

+Yes, you can amend your New York State income tax return to claim a credit for taxes paid to other states, but you must do so within the required time frame.