Completing Form IT-204, also known as the New York State Corporate Tax Return, can be a daunting task for many businesses. The form requires detailed financial information, and any errors or omissions can lead to delays, penalties, or even audits. However, with a clear understanding of the process and a step-by-step approach, businesses can navigate the complexities of Form IT-204 and ensure successful submission.

In this article, we will break down the 7 essential steps to complete Form IT-204 successfully. Whether you're a seasoned tax professional or a business owner tackling the form for the first time, this guide will provide you with the knowledge and confidence to navigate the process with ease.

Understanding the Importance of Form IT-204

Before we dive into the steps, it's essential to understand the significance of Form IT-204. This form is used by the New York State Department of Taxation and Finance to report a corporation's income, taxes, and other financial information. The form is typically due on the 15th day of the third month following the close of the corporation's tax year.

Step 1: Gather Required Documents and Information

To begin the process, gather all necessary documents and information, including:

- Federal income tax return (Form 1120)

- New York State corporate tax return (Form IT-204) from the previous year

- Financial statements (balance sheet, income statement, and cash flow statement)

- Depreciation and amortization schedules

- Capital gains and losses schedules

- Dividend and interest income schedules

- Any other relevant tax-related documents

Step 2: Determine the Filing Status and Accounting Method

Filing Status and Accounting Method

Next, determine the corporation's filing status and accounting method. The filing status will depend on the corporation's type (C-corporation, S-corporation, or partnership) and its tax year. The accounting method will depend on the corporation's financial reporting requirements.

- Filing status options:

- C-corporation

- S-corporation

- Partnership

- Accounting method options:

- Cash method

- Accrual method

- Hybrid method

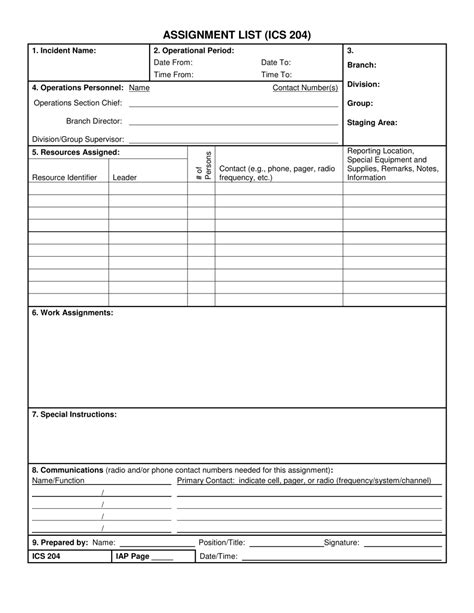

Step 3: Complete the Form IT-204

Now, complete the Form IT-204, following the instructions provided by the New York State Department of Taxation and Finance. Ensure accuracy and completeness, as any errors or omissions can lead to delays or penalties.

- Complete the header information, including the corporation's name, address, and federal employer identification number (FEIN)

- Report the corporation's income, taxes, and other financial information

- Complete the schedules for depreciation, amortization, capital gains, and losses

- Complete the schedules for dividend and interest income

Step 4: Calculate the Tax Liability

Calculating the Tax Liability

Calculate the corporation's tax liability, using the information reported on the Form IT-204. This will include the calculation of the corporation's taxable income, tax credits, and any applicable tax penalties.

- Calculate the taxable income, using the corporation's financial statements and schedules

- Calculate the tax credits, including any applicable credits for depreciation, amortization, and research and development

- Calculate the tax penalties, including any applicable penalties for late filing or payment

Step 5: Complete the Supporting Schedules

Complete the supporting schedules, including the schedules for depreciation, amortization, capital gains, and losses. These schedules will provide detailed information about the corporation's financial activities.

- Complete the depreciation schedule (Schedule A)

- Complete the amortization schedule (Schedule B)

- Complete the capital gains and losses schedule (Schedule C)

- Complete the dividend and interest income schedule (Schedule D)

Step 6: Review and Verify the Form IT-204

Review and Verification

Review and verify the Form IT-204, ensuring accuracy and completeness. Check for any errors or omissions, and make any necessary corrections.

- Review the header information, ensuring accuracy and completeness

- Review the income, taxes, and other financial information, ensuring accuracy and completeness

- Review the schedules, ensuring accuracy and completeness

Step 7: Submit the Form IT-204

Finally, submit the Form IT-204, either electronically or by mail. Ensure timely submission, as late filing or payment can result in penalties and interest.

- Submit the form electronically, using the New York State Department of Taxation and Finance's online portal

- Submit the form by mail, using the address provided by the New York State Department of Taxation and Finance

Conclusion

Completing Form IT-204 successfully requires attention to detail, accuracy, and completeness. By following these 7 essential steps, businesses can navigate the complexities of the form and ensure successful submission. Remember to review and verify the form carefully, and submit it timely to avoid any penalties or interest.

We hope this article has provided you with the knowledge and confidence to complete Form IT-204 successfully. If you have any questions or concerns, please feel free to comment below. Share this article with your colleagues and friends, and don't hesitate to reach out if you need any further assistance.

FAQ Section

What is Form IT-204?

+Form IT-204 is the New York State Corporate Tax Return, used to report a corporation's income, taxes, and other financial information.

Who needs to file Form IT-204?

+C-corporations, S-corporations, and partnerships that conduct business in New York State need to file Form IT-204.

What is the deadline for filing Form IT-204?

+The deadline for filing Form IT-204 is the 15th day of the third month following the close of the corporation's tax year.