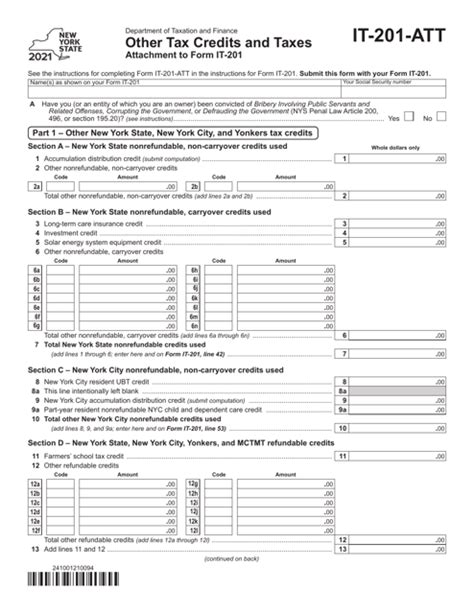

The IT-201-ATT form, also known as the "Resident Income Tax Return - Attachment," is a document used by New York State residents to report their income tax. It can be a bit daunting to fill out, but don't worry, we've got you covered. Here are 5 ways to make filling out the IT-201-ATT form a breeze.

Understanding the IT-201-ATT Form

The IT-201-ATT form is used to report various types of income, deductions, and credits that are not included on the main IT-201 form. This includes income from self-employment, rental properties, and investments, as well as deductions for things like mortgage interest and charitable donations.

What You'll Need to Fill Out the Form

Before you start filling out the IT-201-ATT form, make sure you have all the necessary documents and information. This includes:

- Your IT-201 form

- Your W-2 forms

- Your 1099 forms

- Your Schedule C (Form 1040) if you're self-employed

- Your mortgage interest statements (Form 1098)

- Your charitable donation receipts

Method 1: Filling Out the Form Manually

If you prefer to fill out the form by hand, make sure you have a copy of the IT-201-ATT form and a pen. Start by filling out the top section, which includes your name, address, and social security number. Then, move on to the income sections, where you'll report your income from various sources.

Use the instructions provided with the form to help you fill out each section. Make sure to read the instructions carefully and fill out the form accurately to avoid errors.

Tips for Filling Out the Form Manually

- Use a pen with black ink to fill out the form.

- Make sure to fill out the form in a well-lit area to avoid mistakes.

- Use a ruler to help you keep your writing straight.

- If you make a mistake, use a correction fluid to correct it.

Method 2: Using Tax Preparation Software

If you prefer to use tax preparation software to fill out the IT-201-ATT form, there are several options available. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

These programs will guide you through the process of filling out the form and will help you avoid errors. They'll also help you identify deductions and credits you may be eligible for.

Tips for Using Tax Preparation Software

- Make sure to choose a reputable tax preparation software.

- Follow the instructions provided by the software carefully.

- Make sure to enter your information accurately to avoid errors.

Method 3: Hiring a Tax Professional

If you're not comfortable filling out the IT-201-ATT form yourself, you may want to consider hiring a tax professional. A tax professional can help you navigate the form and ensure that you're taking advantage of all the deductions and credits you're eligible for.

Tips for Hiring a Tax Professional

- Make sure to choose a reputable tax professional.

- Ask questions before hiring a tax professional to make sure they're a good fit for you.

- Make sure to provide your tax professional with all the necessary documents and information.

Method 4: Using Online Resources

There are many online resources available to help you fill out the IT-201-ATT form. Some popular resources include the New York State Department of Taxation and Finance website and the IRS website.

These resources can provide you with instructions, forms, and FAQs to help you navigate the form.

Tips for Using Online Resources

- Make sure to use reputable online resources.

- Follow the instructions provided by the online resources carefully.

- Make sure to enter your information accurately to avoid errors.

Method 5: Using a Tax Preparation Service

If you prefer to have your taxes prepared for you, you may want to consider using a tax preparation service. A tax preparation service can help you navigate the IT-201-ATT form and ensure that you're taking advantage of all the deductions and credits you're eligible for.

Tips for Using a Tax Preparation Service

- Make sure to choose a reputable tax preparation service.

- Ask questions before hiring a tax preparation service to make sure they're a good fit for you.

- Make sure to provide your tax preparation service with all the necessary documents and information.

What is the IT-201-ATT form?

+The IT-201-ATT form is a document used by New York State residents to report their income tax.

What do I need to fill out the IT-201-ATT form?

+You'll need your IT-201 form, W-2 forms, 1099 forms, Schedule C (Form 1040) if you're self-employed, mortgage interest statements (Form 1098), and charitable donation receipts.

How do I fill out the IT-201-ATT form?

+You can fill out the form manually, use tax preparation software, hire a tax professional, use online resources, or use a tax preparation service.