As a business owner in Illinois, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One of the crucial tax forms you'll need to file is the IL-941, also known as the Illinois Quarterly Tax Return. In this comprehensive guide, we'll walk you through the process of filing the IL-941, including who needs to file, what information you'll need to provide, and how to submit the form.

Who Needs to File IL-941?

The IL-941 is a quarterly tax return that must be filed by all employers in Illinois who have employees and pay wages. This includes:

- Businesses with employees who work in Illinois

- Employers who pay wages to employees in Illinois

- Employers who are required to withhold Illinois income tax from employee wages

What Information Do I Need to Provide on the IL-941?

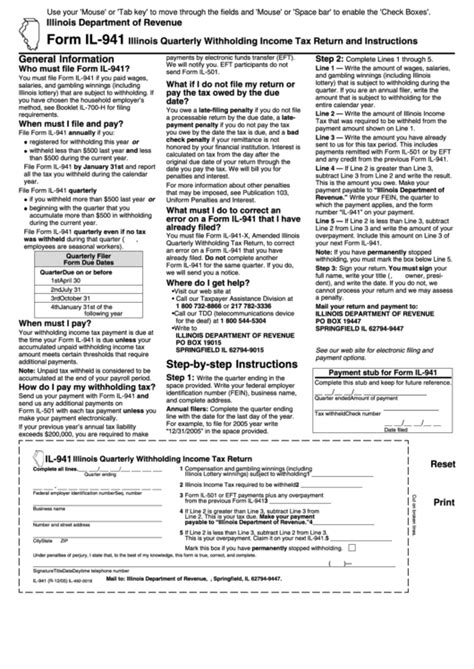

To complete the IL-941, you'll need to provide the following information:

- Your business's name, address, and Federal Employer Identification Number (FEIN)

- The quarter for which you're filing the return

- The total amount of wages paid to employees during the quarter

- The total amount of Illinois income tax withheld from employee wages during the quarter

- The total amount of tax due or overpayment for the quarter

How to Complete the IL-941 Form

The IL-941 form consists of several sections, including:

- Section 1: Business Information: Enter your business's name, address, and FEIN.

- Section 2: Quarterly Tax Liability: Calculate your quarterly tax liability based on the total amount of wages paid and Illinois income tax withheld.

- Section 3: Quarterly Tax Payment: Enter the total amount of tax due or overpayment for the quarter.

How to File the IL-941 Form

You can file the IL-941 form electronically or by mail.

- Electronic Filing: You can file the IL-941 form electronically through the Illinois Department of Revenue's website. You'll need to create an account and follow the online instructions.

- Mail Filing: You can also file the IL-941 form by mail. Make sure to sign the form and include any required supporting documentation.

IL-941 Filing Deadlines

The IL-941 form is due on the last day of the month following the end of each quarter. The due dates are:

- April 30th: For the first quarter (January 1 - March 31)

- July 31st: For the second quarter (April 1 - June 30)

- October 31st: For the third quarter (July 1 - September 30)

- January 31st: For the fourth quarter (October 1 - December 31)

Penalties for Late Filing

If you fail to file the IL-941 form on time, you may be subject to penalties and fines. The Illinois Department of Revenue may impose a penalty of up to 10% of the tax due, plus interest on the unpaid tax.

Additional Resources

For more information on filing the IL-941 form, you can visit the Illinois Department of Revenue's website or contact their customer service department.

Common Mistakes to Avoid

When filing the IL-941 form, make sure to avoid the following common mistakes:

- Incorrect Business Information: Make sure to enter your business's correct name, address, and FEIN.

- Incorrect Quarterly Tax Liability: Calculate your quarterly tax liability correctly based on the total amount of wages paid and Illinois income tax withheld.

- Late Filing: File the IL-941 form on time to avoid penalties and fines.

Conclusion

Filing the IL-941 form is a crucial part of your business's tax obligations in Illinois. By following the steps outlined in this guide, you can ensure that you're filing the form correctly and on time. Remember to avoid common mistakes and take advantage of additional resources if you need help.

We hope this guide has been helpful in navigating the IL-941 form. If you have any questions or need further assistance, don't hesitate to comment below.

What is the IL-941 form?

+The IL-941 form is the Illinois Quarterly Tax Return, which must be filed by all employers in Illinois who have employees and pay wages.

Who needs to file the IL-941 form?

+The IL-941 form must be filed by all employers in Illinois who have employees and pay wages, including businesses with employees who work in Illinois and employers who pay wages to employees in Illinois.

What is the deadline for filing the IL-941 form?

+The IL-941 form is due on the last day of the month following the end of each quarter. The due dates are April 30th, July 31st, October 31st, and January 31st.