The IRS Form 1120 is a crucial tax document for corporations, and understanding how to file it accurately is essential for compliance and avoiding penalties. In this article, we will delve into the world of corporate taxation and provide a comprehensive, step-by-step guide on how to complete and file the 1120 form.

Filing the 1120 form can be a daunting task, especially for small businesses or those without extensive tax experience. However, with the right guidance, you can navigate the process with confidence. Whether you're a seasoned tax professional or a business owner looking to file your corporate taxes, this guide will walk you through the process, highlighting key sections, deductions, and requirements.

Understanding the 1120 Form

Before diving into the instructions, it's essential to understand the purpose of the 1120 form. The IRS Form 1120, also known as the U.S. Corporation Income Tax Return, is the primary tax document used by corporations to report their income, deductions, and tax liability. The form is used to calculate the corporation's taxable income, which is then used to determine the amount of taxes owed.

Gathering Necessary Information

Before starting the filing process, it's crucial to gather all necessary information and documents. This includes:

- Corporate financial statements (balance sheet, income statement, and cash flow statement)

- Tax identification number (EIN)

- Business address and contact information

- List of shareholders and their ownership percentages

- Depreciation schedules and asset listings

- Records of income, deductions, and credits

Step 1: Identifying the Corporation Type

The first step in completing the 1120 form is to identify the type of corporation. This includes:

- C-Corporation (standard corporation)

- S-Corporation (pass-through entity)

- Personal Service Corporation (PSC)

Each type of corporation has unique tax implications, and selecting the correct type is essential for accurate filing.

Step 2: Completing the Form 1120

The Form 1120 is divided into several sections, each requiring specific information. The following steps will guide you through the completion of each section:

Section 1: Corporation Information

- Enter the corporation's name, address, and EIN

- Indicate the type of corporation (C, S, or PSC)

- List the shareholders and their ownership percentages

Section 2: Income

- Report total income from all sources (sales, services, interest, etc.)

- Calculate gross income and net income

Section 3: Deductions

- List and calculate total deductions (cost of goods sold, operating expenses, etc.)

- Claim depreciation and amortization deductions

Section 4: Tax Liability

- Calculate the corporation's tax liability using the tax tables or rate schedules

- Claim any available tax credits

Step 3: Schedules and Attachments

In addition to the main form, several schedules and attachments may be required. These include:

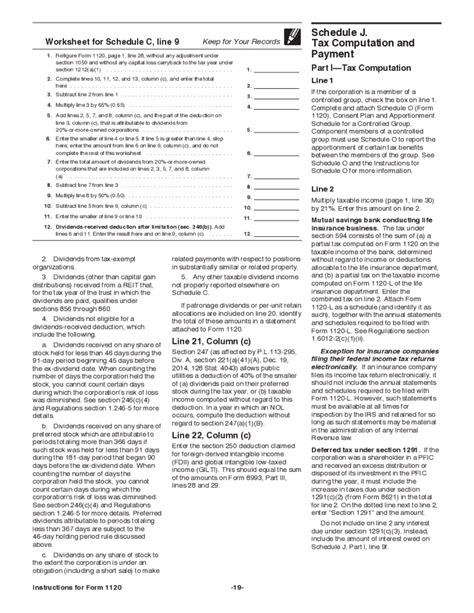

- Schedule C: Additional Income and Deductions

- Schedule D: Capital Gains and Losses

- Schedule E: Supplemental Income and Loss

- Form 4562: Depreciation and Amortization

Step 4: Filing the 1120 Form

Once the form is complete, it's time to file. The 1120 form can be filed electronically or by mail. The IRS recommends electronic filing for faster processing and reduced errors.

Tips and Reminders

- File the 1120 form by the deadline (usually March 15th for calendar-year corporations)

- Ensure accurate and complete information to avoid penalties and delays

- Keep records of all tax-related documents and correspondence

By following these steps and guidelines, you'll be well on your way to accurately completing and filing the 1120 form. Remember to stay organized, and don't hesitate to seek professional help if needed.

We'd love to hear from you! Share your experiences or questions about filing the 1120 form in the comments below. Don't forget to like and share this article with others who may find it helpful.

What is the deadline for filing the 1120 form?

+The deadline for filing the 1120 form is usually March 15th for calendar-year corporations.

Can I file the 1120 form electronically?

+Yes, the IRS recommends electronic filing for faster processing and reduced errors.

What are the consequences of late filing or inaccurate information?

+Late filing or inaccurate information can result in penalties, fines, and delays in processing.