Filing taxes can be a daunting task, especially when dealing with the complexities of trust and estate taxes. One crucial form that requires attention is Form IL-1041, the Illinois Fiduciary Income and Replacement Tax Return. In this article, we will delve into the world of trust and estate taxes, focusing on five essential facts about Form IL-1041 that you need to know.

Who Needs to File Form IL-1041?

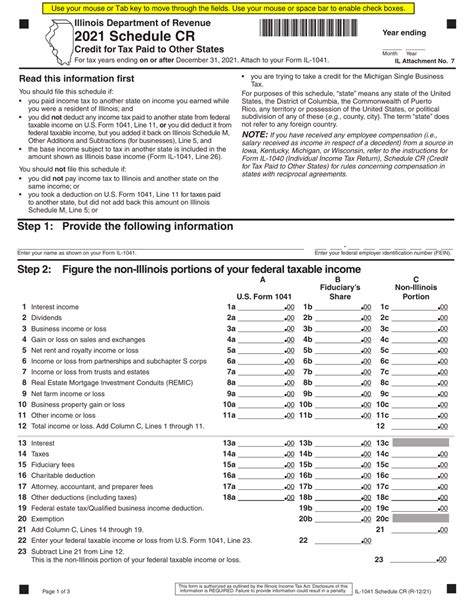

Form IL-1041 is required for fiduciaries of trusts and estates that have Illinois taxable income. This includes administrators, executors, personal representatives, and trustees who manage trusts or estates with Illinois-sourced income. If you are responsible for managing a trust or estate with Illinois income, it is essential to understand the requirements of Form IL-1041.

Key Facts About Form IL-1041

1. Filing Requirements and Deadlines

Form IL-1041 is typically due on the 15th day of the fourth month following the close of the tax year. For calendar-year filers, the deadline is April 15th. However, the Illinois Department of Revenue may grant an automatic six-month extension if Form IL-4762 is filed by the original due date. It is crucial to meet the filing deadline to avoid penalties and interest.

2. Types of Income Reported on Form IL-1041

Form IL-1041 reports the trust or estate's Illinois taxable income, including:

- Interest and dividends from Illinois-sourced investments

- Rents and royalties from Illinois properties

- Capital gains from the sale of Illinois assets

- Business income from Illinois-based operations

The form also requires the reporting of deductions and exemptions, such as the Illinois exemption allowance.

3. Tax Rates and Credits

The tax rate for trusts and estates in Illinois is a flat rate of 4.95%. However, the trust or estate may be eligible for credits, such as the Illinois property tax credit or the education expense credit. These credits can help reduce the tax liability.

4. Special Provisions for Estates and Trusts

Form IL-1041 has specific provisions for estates and trusts, including the requirement to file a Schedule K-1 for each beneficiary who receives a distribution of income. The K-1 schedule reports the beneficiary's share of income, deductions, and credits.

5. E-Filing and Payment Options

The Illinois Department of Revenue encourages e-filing of Form IL-1041 through their website or through an approved tax software provider. Electronic payments can also be made through the website or by phone. E-filing and e-payment options can help reduce errors and expedite the refund process.

Additional Requirements and Considerations

In addition to Form IL-1041, fiduciaries may need to file other forms, such as the federal Form 1041, U.S. Income Tax Return for Estates and Trusts. It is essential to consult with a tax professional to ensure compliance with all state and federal tax requirements.

Practical Tips and Reminders

- Keep accurate records of trust and estate income, deductions, and credits.

- Consult with a tax professional to ensure compliance with Illinois and federal tax laws.

- Take advantage of e-filing and e-payment options to reduce errors and expedite the refund process.

- Review and update beneficiary information to ensure accurate reporting on Schedule K-1.

By understanding the essential facts about Form IL-1041, fiduciaries can navigate the complexities of trust and estate taxes with confidence. Remember to seek professional advice to ensure compliance with all tax requirements.

What's Next?

If you have questions or concerns about Form IL-1041 or trust and estate taxes in general, we encourage you to comment below or share this article with others who may find it helpful. Stay informed about Illinois tax laws and regulations to ensure compliance and avoid potential penalties.

Who is required to file Form IL-1041?

+Fiduciaries of trusts and estates with Illinois taxable income are required to file Form IL-1041.

What is the deadline for filing Form IL-1041?

+The deadline for filing Form IL-1041 is the 15th day of the fourth month following the close of the tax year.

Can Form IL-1041 be e-filed?

+Yes, Form IL-1041 can be e-filed through the Illinois Department of Revenue website or through an approved tax software provider.