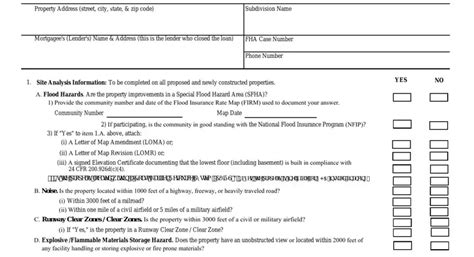

Filling out forms can be a daunting task, especially when it comes to government documents like the HUD-92541. The U.S. Department of Housing and Urban Development (HUD) requires this form to be completed accurately and thoroughly, as it serves as a critical tool for evaluating the eligibility of borrowers for FHA-insured mortgage loans. In this article, we will break down the essential steps to correctly fill out the HUD-92541 form, ensuring that you avoid potential pitfalls and delays in the mortgage process.

Understanding the HUD-92541 Form

The HUD-92541 form, also known as the "Certification of Consistency with the Fair Housing Act," is a mandatory document that must be completed by borrowers seeking an FHA-insured mortgage. The form requires borrowers to provide detailed information about their identity, income, and credit history, as well as to certify that they have not engaged in any discriminatory practices.

Step 1: Verify Borrower Information

The first section of the HUD-92541 form requires borrowers to provide accurate and up-to-date information about themselves, including their name, date of birth, and social security number. This information must match the borrower's identification documents, such as their driver's license or passport. It is essential to ensure that the information provided is accurate, as any discrepancies may delay the mortgage process.

- Tips:

- Use the borrower's full name, as it appears on their identification documents.

- Verify the borrower's date of birth and social security number.

- Make sure to update the borrower's information if there have been any changes since the initial application.

Step 2: Disclose Income and Employment Information

The HUD-92541 form requires borrowers to disclose their income and employment information, including their occupation, employer, and income level. This information is used to evaluate the borrower's creditworthiness and ability to repay the mortgage loan.

- Tips:

- Provide detailed information about the borrower's income, including their salary, wages, and any additional sources of income.

- Verify the borrower's employment history and ensure that the information is accurate and up-to-date.

- Make sure to include any documentation that supports the borrower's income and employment claims.

Step 3: Report Credit History and Liabilities

The HUD-92541 form requires borrowers to report their credit history and liabilities, including any outstanding debts, collections, or credit inquiries. This information is used to evaluate the borrower's creditworthiness and ability to manage debt.

- Tips:

- Provide detailed information about the borrower's credit history, including any outstanding debts, collections, or credit inquiries.

- Verify the borrower's credit report and ensure that the information is accurate and up-to-date.

- Make sure to include any documentation that supports the borrower's credit history and liability claims.

Step 4: Certify Compliance with Fair Housing Act

The HUD-92541 form requires borrowers to certify that they have not engaged in any discriminatory practices, as prohibited by the Fair Housing Act. This certification is a critical component of the form, as it ensures that borrowers are aware of and comply with federal fair housing laws.

- Tips:

- Read the certification statement carefully and ensure that the borrower understands the requirements.

- Make sure to sign and date the certification statement, as required.

- Retain a copy of the signed certification statement for the borrower's records.

Step 5: Review and Sign the Form

The final step is to review the HUD-92541 form carefully and ensure that all information is accurate and complete. Borrowers must sign and date the form, acknowledging that the information provided is true and accurate.

- Tips:

- Review the form carefully and ensure that all information is accurate and complete.

- Make sure to sign and date the form, as required.

- Retain a copy of the signed form for the borrower's records.

By following these steps, borrowers can ensure that their HUD-92541 form is completed accurately and thoroughly, reducing the risk of delays or complications in the mortgage process. Remember to review the form carefully and seek assistance if needed, as accuracy and completeness are crucial to a successful mortgage application.

Additional Tips for Completing the HUD-92541 Form

- Use black ink to sign the form, as this is the recommended color.

- Make sure to keep a copy of the signed form for the borrower's records.

- If the borrower is unable to sign the form, a power of attorney may be required.

- The HUD-92541 form must be completed and signed by the borrower, as it is a critical component of the mortgage application process.

Frequently Asked Questions

- Q: What is the purpose of the HUD-92541 form? A: The HUD-92541 form is used to evaluate the eligibility of borrowers for FHA-insured mortgage loans.

- Q: Who must complete the HUD-92541 form? A: Borrowers seeking an FHA-insured mortgage loan must complete the HUD-92541 form.

- Q: What information is required on the HUD-92541 form? A: The HUD-92541 form requires borrowers to provide detailed information about their identity, income, credit history, and liabilities.

What happens if the HUD-92541 form is not completed accurately?

+If the HUD-92541 form is not completed accurately, it may delay or complicate the mortgage process.

Can I complete the HUD-92541 form online?

+No, the HUD-92541 form must be completed and signed in ink.

How long does it take to complete the HUD-92541 form?

+The time it takes to complete the HUD-92541 form will vary depending on the borrower's individual circumstances.