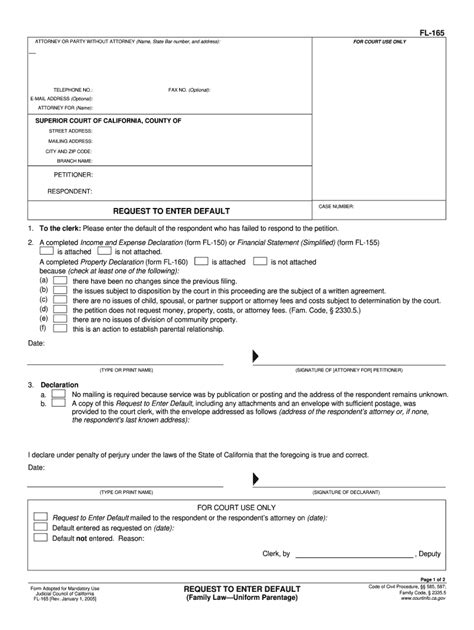

The process of divorce can be overwhelming, especially when it comes to navigating the complex world of family law forms. One of the most important documents in the divorce process is the Income and Expense Declaration, also known as Form FL-165. In this article, we will break down the Form FL-165, explaining its purpose, the information required, and provide a step-by-step guide on how to fill it out accurately.

The Importance of Form FL-165

Form FL-165 is a crucial document in the divorce process, as it provides the court with a comprehensive picture of your financial situation. The form requires you to disclose your income, expenses, assets, and debts, which helps the court determine issues such as spousal support, child support, and property division.

What Information is Required on Form FL-165?

Form FL-165 is a lengthy document that requires you to provide detailed information about your financial situation. The form is divided into several sections, including:

- Income: You will need to disclose all sources of income, including employment, self-employment, investments, and any other regular income.

- Expenses: You will need to list all of your monthly expenses, including housing, transportation, food, and entertainment.

- Assets: You will need to disclose all of your assets, including real estate, vehicles, bank accounts, and investments.

- Debts: You will need to list all of your debts, including credit cards, loans, and mortgages.

Step-by-Step Guide to Filing Form FL-165

Filling out Form FL-165 can be a daunting task, but by breaking it down into smaller sections, you can ensure that you provide accurate and complete information. Here is a step-by-step guide to help you fill out the form:

Step 1: Gather Required Documents

Before you start filling out Form FL-165, you will need to gather all of the required documents, including:

- Pay stubs

- Tax returns

- Bank statements

- Investment accounts

- Loan documents

- Credit card statements

Step 2: Complete the Income Section

The income section requires you to disclose all sources of income. You will need to provide the following information:

- Employer's name and address

- Job title and dates of employment

- Gross income

- Net income

Step 3: Complete the Expense Section

The expense section requires you to list all of your monthly expenses. You will need to provide the following information:

- Housing expenses (rent/mortgage, utilities, maintenance)

- Transportation expenses (car loan/lease, insurance, gas)

- Food expenses (groceries, dining out)

- Entertainment expenses (hobbies, travel, entertainment)

Step 4: Complete the Asset Section

The asset section requires you to disclose all of your assets. You will need to provide the following information:

- Real estate (property address, value, mortgage balance)

- Vehicles (make, model, year, value)

- Bank accounts (account number, balance)

- Investments (stock, bonds, mutual funds)

Step 5: Complete the Debt Section

The debt section requires you to list all of your debts. You will need to provide the following information:

- Credit cards (account number, balance, monthly payment)

- Loans (account number, balance, monthly payment)

- Mortgages (account number, balance, monthly payment)

Step 6: Review and Sign the Form

Once you have completed all of the sections, review the form carefully to ensure that you have provided accurate and complete information. Sign the form and date it.

Tips for Filing Form FL-165

Filing Form FL-165 can be a challenging task, but by following these tips, you can ensure that you provide accurate and complete information:

- Be honest and transparent: Provide accurate and complete information about your financial situation.

- Use clear and concise language: Avoid using jargon or technical terms that may be difficult to understand.

- Provide supporting documentation: Attach supporting documentation, such as pay stubs and bank statements, to the form.

- Review the form carefully: Review the form carefully to ensure that you have provided accurate and complete information.

Conclusion

Filing Form FL-165 is a critical step in the divorce process. By providing accurate and complete information about your financial situation, you can help the court determine issues such as spousal support, child support, and property division. Remember to be honest and transparent, use clear and concise language, provide supporting documentation, and review the form carefully to ensure that you have provided accurate and complete information.

Frequently Asked Questions

Q: What is Form FL-165?

Form FL-165 is the Income and Expense Declaration form, which is a required document in the divorce process. It provides the court with a comprehensive picture of your financial situation.

Q: What information is required on Form FL-165?

The form requires you to disclose your income, expenses, assets, and debts.

Q: How do I file Form FL-165?

You can file Form FL-165 with the court, either in person or by mail. You will need to provide supporting documentation, such as pay stubs and bank statements.

Q: What happens if I don't file Form FL-165?

If you don't file Form FL-165, the court may not have enough information to determine issues such as spousal support, child support, and property division.

Q: Can I file Form FL-165 electronically?

Yes, you can file Form FL-165 electronically through the court's website.

FAQ Section HTML:

What is Form FL-165?

+Form FL-165 is the Income and Expense Declaration form, which is a required document in the divorce process. It provides the court with a comprehensive picture of your financial situation.

What information is required on Form FL-165?

+The form requires you to disclose your income, expenses, assets, and debts.

How do I file Form FL-165?

+You can file Form FL-165 with the court, either in person or by mail. You will need to provide supporting documentation, such as pay stubs and bank statements.

What happens if I don't file Form FL-165?

+If you don't file Form FL-165, the court may not have enough information to determine issues such as spousal support, child support, and property division.

Can I file Form FL-165 electronically?

+Yes, you can file Form FL-165 electronically through the court's website.