As the tax season approaches, individuals and businesses are gearing up to file their tax returns. One of the most important forms for North Carolina residents is Form D-400, and specifically, Schedule PN. However, filling out this form can be a daunting task, especially for those who are new to tax filing or have complex financial situations. In this article, we will provide you with a comprehensive guide on how to fill out Form D-400 Schedule PN, highlighting five key ways to make the process easier and more accurate.

Understanding Form D-400 Schedule PN

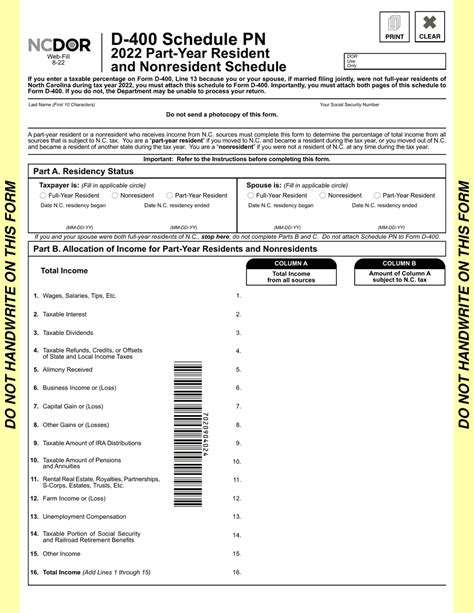

Before we dive into the ways to fill out Form D-400 Schedule PN, let's take a brief moment to understand what this form is all about. Form D-400 is the standard form used for North Carolina state income tax returns. Schedule PN is a supplemental schedule that is used to report certain types of income, deductions, and credits that are specific to North Carolina residents.

1. Gather All Necessary Documents

The first step in filling out Form D-400 Schedule PN is to gather all the necessary documents and information. This includes:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance work, self-employment, or other sources of income

- Your receipts for deductions, such as charitable donations or medical expenses

- Your records of North Carolina state taxes withheld

- Your federal income tax return (Form 1040)

Having all these documents and information readily available will make it easier to fill out the form accurately and efficiently.

2. Determine Your Filing Status

Your filing status will determine which sections of the form you need to complete and which tax rates apply to you. The filing status options for Form D-400 Schedule PN are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your personal circumstances, and make sure to check the corresponding box on the form.

3. Report Your Income

Schedule PN requires you to report certain types of income that are specific to North Carolina residents. This includes:

- Income from freelance work or self-employment

- Income from rental properties

- Income from investments, such as dividends or capital gains

- Income from retirement accounts, such as pensions or annuities

Make sure to report all applicable income on the correct lines of the form, using the corresponding codes and descriptions.

4. Claim Your Deductions and Credits

Schedule PN also allows you to claim certain deductions and credits that can reduce your tax liability. This includes:

- Standard deduction

- Itemized deductions, such as charitable donations or medical expenses

- Credits for education expenses or child care

- Credits for renewable energy or historic preservation

Make sure to claim all applicable deductions and credits on the correct lines of the form, using the corresponding codes and descriptions.

5. Review and Double-Check Your Work

Finally, review your work carefully to ensure that you have completed the form accurately and correctly. Double-check your math calculations, make sure you have signed and dated the form, and verify that you have included all required supporting documentation.

By following these five ways to fill out Form D-400 Schedule PN, you can ensure that your tax return is accurate, complete, and filed on time.

Additional Tips and Reminders

- Make sure to keep a copy of your completed tax return for your records.

- If you are due a refund, consider direct deposit to receive your refund faster.

- If you owe taxes, make sure to pay by the deadline to avoid penalties and interest.

- Consider consulting a tax professional or using tax preparation software to help with the filing process.

We hope this article has provided you with valuable insights and guidance on how to fill out Form D-400 Schedule PN. Remember to stay calm, take your time, and seek help if you need it. Happy filing!

FAQs

What is Form D-400 Schedule PN?

+Form D-400 Schedule PN is a supplemental schedule used to report certain types of income, deductions, and credits that are specific to North Carolina residents.

What documents do I need to fill out Form D-400 Schedule PN?

+You will need your W-2 forms, 1099 forms, receipts for deductions, records of North Carolina state taxes withheld, and your federal income tax return (Form 1040).

Can I file Form D-400 Schedule PN electronically?

+Yes, you can file Form D-400 Schedule PN electronically through the North Carolina Department of Revenue website or through tax preparation software.