Understanding the intricacies of tax compliance can be a daunting task for individuals and businesses alike. One crucial aspect of tax compliance in certain jurisdictions is the requirement for tax clearance certificates, particularly the Form CT-3. In this article, we will delve into the world of Form CT-3, exploring its purpose, benefits, and the steps involved in obtaining this essential tax clearance document.

What is Form CT-3?

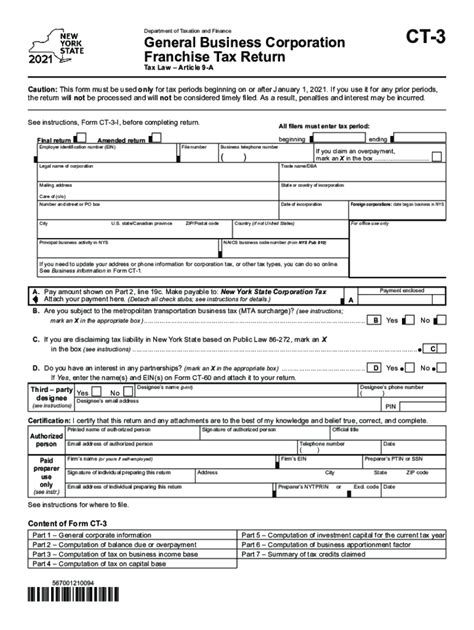

Form CT-3 is a tax clearance certificate required by certain government agencies or financial institutions to verify an individual's or business's tax compliance status. This document serves as proof that the applicant has met their tax obligations, including filing tax returns and paying any due taxes. The Form CT-3 is typically issued by the tax authority or revenue department of the relevant jurisdiction.

Purpose of Form CT-3

The primary purpose of Form CT-3 is to ensure that individuals and businesses are in good standing with the tax authorities. This certificate is often required for various purposes, such as:

- Obtaining a business license or permit

- Accessing government contracts or tenders

- Opening a bank account or securing a loan

- Conducting international trade or transactions

Benefits of Form CT-3

Obtaining a Form CT-3 tax clearance certificate offers several benefits, including:

- Enhanced credibility and reputation

- Improved access to business opportunities and government contracts

- Reduced risk of tax penalties and fines

- Increased confidence in business relationships and transactions

Eligibility Criteria for Form CT-3

To be eligible for a Form CT-3 tax clearance certificate, applicants must meet the following criteria:

- Be registered with the tax authority or revenue department

- Have filed all required tax returns and paid any due taxes

- Not have any outstanding tax liabilities or penalties

- Not be under tax audit or investigation

Documents Required for Form CT-3

To apply for a Form CT-3 tax clearance certificate, applicants must submit the following documents:

- Completed Form CT-3 application

- Proof of tax registration (e.g., tax identification number)

- Copies of tax returns and payment receipts

- Business license or permit (if applicable)

Steps to Obtain Form CT-3

To obtain a Form CT-3 tax clearance certificate, follow these steps:

- Register with the tax authority: Ensure you are registered with the tax authority or revenue department in your jurisdiction.

- File tax returns: File all required tax returns and pay any due taxes.

- Gather required documents: Collect the necessary documents, including proof of tax registration, tax returns, and payment receipts.

- Submit application: Complete the Form CT-3 application and submit it to the tax authority or designated office.

- Wait for processing: Wait for the tax authority to process your application and issue the Form CT-3 certificate.

Common Challenges and Solutions

Applicants may encounter challenges when obtaining a Form CT-3 tax clearance certificate. Common issues include:

- Outstanding tax liabilities: Pay any due taxes and penalties to resolve the issue.

- Incomplete documentation: Ensure all required documents are submitted with the application.

- Delays in processing: Contact the tax authority or designated office to inquire about the status of your application.

Best Practices for Form CT-3

To ensure a smooth application process, follow these best practices:

- Maintain accurate records: Keep accurate and up-to-date tax records to avoid errors or delays.

- Submit complete applications: Ensure all required documents are submitted with the application.

- Communicate with the tax authority: Contact the tax authority or designated office to resolve any issues or concerns.

Conclusion and Next Steps

Obtaining a Form CT-3 tax clearance certificate is a crucial step in ensuring tax compliance and accessing business opportunities. By understanding the purpose, benefits, and requirements of Form CT-3, individuals and businesses can navigate the application process with confidence. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of Form CT-3?

+Form CT-3 is a tax clearance certificate required to verify an individual's or business's tax compliance status.

What are the benefits of obtaining a Form CT-3 certificate?

+The benefits of obtaining a Form CT-3 certificate include enhanced credibility, improved access to business opportunities, reduced risk of tax penalties, and increased confidence in business relationships.

What documents are required to apply for a Form CT-3 certificate?

+The required documents include a completed Form CT-3 application, proof of tax registration, copies of tax returns and payment receipts, and a business license or permit (if applicable).