Filing taxes as a business owner in Connecticut can be a complex and daunting task. Among the numerous forms and documents required, the CT 1120 form stands out as a crucial part of the state's tax filing process for corporations. In this article, we will delve into the world of the CT 1120 form, exploring its purpose, key components, and the steps required to file it accurately.

As a business owner in Connecticut, it is essential to understand the importance of filing the CT 1120 form. This form serves as the state's corporate income tax return, requiring businesses to report their income, deductions, and tax credits. The CT 1120 form is used to calculate the business's tax liability and to claim any applicable tax credits or refunds.

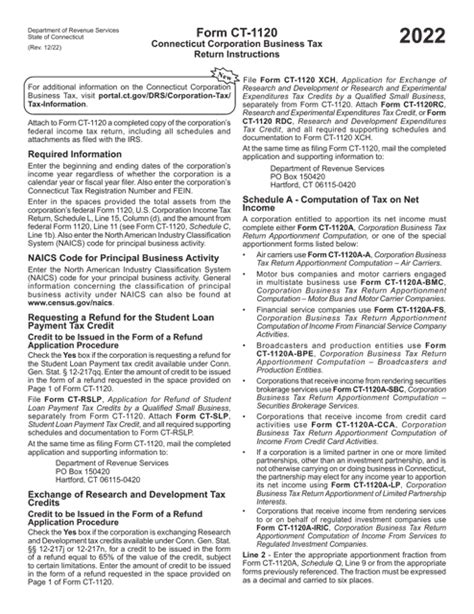

Key Components of the CT 1120 Form

To accurately file the CT 1120 form, businesses must provide specific information and complete various sections. The form is divided into several parts, including:

- Business Information: This section requires businesses to provide their name, address, and federal employer identification number (FEIN).

- Income: In this section, businesses must report their total income from all sources, including sales, interest, and dividends.

- Deductions: Businesses can claim various deductions, such as cost of goods sold, operating expenses, and depreciation.

- Tax Credits: This section allows businesses to claim tax credits for items like research and development, job creation, and renewable energy investments.

Who Needs to File the CT 1120 Form?

Not all businesses in Connecticut are required to file the CT 1120 form. The following types of businesses must file this form:

- C Corporations: C corporations are required to file the CT 1120 form, regardless of their income level.

- S Corporations: S corporations with Connecticut-sourced income must file the CT 1120 form.

- Limited Liability Companies (LLCs): LLCs that are taxed as corporations must file the CT 1120 form.

- Partnerships: Partnerships with Connecticut-sourced income must file the CT 1120 form.

Filing Requirements and Deadlines

To avoid penalties and interest, businesses must file the CT 1120 form by the designated deadline. The filing deadline for the CT 1120 form is typically the 15th day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31st, the filing deadline would be April 15th.

In addition to the filing deadline, businesses must also comply with the following requirements:

- Estimated Tax Payments: Businesses must make estimated tax payments throughout the year if their tax liability exceeds $500.

- Extension Requests: Businesses can request an automatic six-month extension of time to file the CT 1120 form.

How to File the CT 1120 Form

Businesses can file the CT 1120 form electronically or by mail. The Connecticut Department of Revenue Services (DRS) recommends electronic filing, as it is faster and more secure. To file electronically, businesses can use the DRS's online portal or a third-party tax preparation software.

If filing by mail, businesses should send the completed CT 1120 form and any required attachments to the following address:

Connecticut Department of Revenue Services State of Connecticut P.O. Box 2974 Hartford, CT 06104-2974

Tips for Accurate Filing

To ensure accurate filing and avoid common mistakes, businesses should:

- Consult the Instructions: Carefully review the instructions for the CT 1120 form and any relevant tax laws or regulations.

- Gather Required Documents: Collect all necessary documents, including financial statements, receipts, and tax credits.

- Use Tax Preparation Software: Consider using tax preparation software to simplify the filing process and reduce errors.

By following these tips and understanding the requirements and components of the CT 1120 form, businesses in Connecticut can ensure accurate and timely filing, avoiding costly penalties and interest.

Conclusion

Filing the CT 1120 form is a critical part of the tax filing process for businesses in Connecticut. By understanding the purpose, key components, and filing requirements, businesses can ensure accurate and timely filing, reducing the risk of errors and penalties. Whether filing electronically or by mail, businesses should carefully review the instructions and gather all necessary documents to ensure a smooth and successful filing experience.

If you have any questions or concerns about the CT 1120 form or any other aspect of Connecticut business taxes, we encourage you to share them in the comments section below.

What is the CT 1120 form used for?

+The CT 1120 form is used as the state's corporate income tax return, requiring businesses to report their income, deductions, and tax credits.

Who needs to file the CT 1120 form?

+C corporations, S corporations, limited liability companies (LLCs) taxed as corporations, and partnerships with Connecticut-sourced income must file the CT 1120 form.

What is the filing deadline for the CT 1120 form?

+The filing deadline for the CT 1120 form is typically the 15th day of the fourth month following the end of the tax year.