Completing Form CD 419 can be a daunting task, but with the right guidance, you can navigate the process successfully. Whether you're a seasoned professional or a newcomer to the world of customs declaration, understanding the intricacies of this form is crucial to avoid delays, fines, or even the seizure of your goods. Here are five ways to ensure you complete Form CD 419 with ease and accuracy.

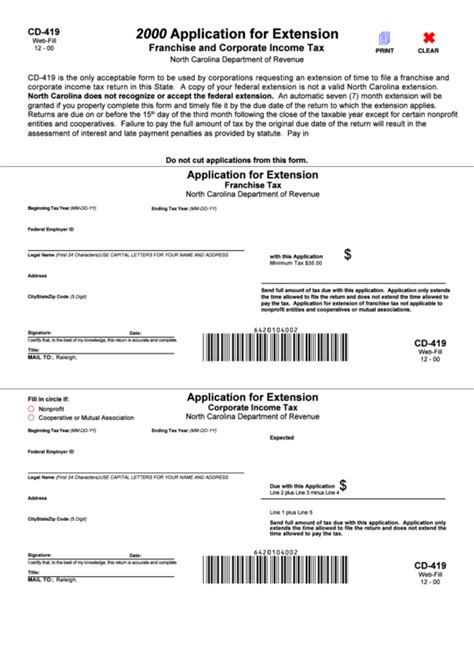

Understanding the Purpose of Form CD 419

Before diving into the completion process, it's essential to understand the purpose of Form CD 419. This customs declaration form is used to declare the details of goods being imported or exported, ensuring compliance with customs regulations and facilitating smooth clearance. The form requires precise information about the goods, including their description, quantity, value, and country of origin.

Key Components of Form CD 419

To complete Form CD 419 successfully, you need to be familiar with its key components. These include:

- Goods Description: Provide a detailed and accurate description of the goods being declared.

- HS Code: Identify the correct Harmonized System (HS) code for each item.

- Quantity and Value: Declare the quantity and value of each item.

- Country of Origin: Specify the country where the goods were manufactured or produced.

Tips for Accurate Completion

Accurate completion of Form CD 419 is crucial to avoid errors and ensure smooth clearance. Here are some tips to help you achieve accuracy:

- Verify Information: Double-check all information, including goods descriptions, HS codes, quantities, and values.

- Use Correct Units: Ensure you use the correct units of measurement for quantities.

- Provide Additional Information: Include any additional information required for specific types of goods, such as hazardous materials or perishable items.

Common Mistakes to Avoid

To avoid delays or fines, it's essential to steer clear of common mistakes when completing Form CD 419. These include:

- Inaccurate Goods Descriptions: Failing to provide accurate and detailed descriptions of goods.

- Incorrect HS Codes: Using incorrect or outdated HS codes.

- Insufficient Information: Failing to provide required information, such as country of origin or quantity.

Leveraging Technology for Simplified Completion

In today's digital age, technology can significantly simplify the completion of Form CD 419. Here are some ways to leverage technology:

- Electronic Data Interchange (EDI): Use EDI systems to transmit customs declarations electronically.

- Customs Clearance Software: Utilize software specifically designed for customs clearance to streamline the process.

- Online Resources: Take advantage of online resources, such as customs websites and trade portals, to access relevant information and guidance.

Benefits of Technology-Enabled Completion

Technology-enabled completion of Form CD 419 offers numerous benefits, including:

- Increased Efficiency: Reduced processing times and faster clearance.

- Improved Accuracy: Minimized errors and reduced risk of fines or penalties.

- Enhanced Compliance: Simplified compliance with customs regulations and requirements.

Seeking Professional Assistance

If you're unsure about any aspect of completing Form CD 419, it's recommended to seek professional assistance. Here are some options:

- Customs Brokers: Engage the services of a licensed customs broker to guide you through the process.

- Trade Consultants: Consult with trade experts who specialize in customs clearance and compliance.

- Online Forums: Participate in online forums and discussion groups to connect with experienced professionals and seek advice.

Benefits of Professional Assistance

Seeking professional assistance offers numerous benefits, including:

- Expert Guidance: Access to experienced professionals who can guide you through the process.

- Customized Solutions: Tailored solutions to meet your specific needs and requirements.

- Reduced Risk: Minimized risk of errors, fines, or penalties.

What is the purpose of Form CD 419?

+Form CD 419 is a customs declaration form used to declare the details of goods being imported or exported, ensuring compliance with customs regulations and facilitating smooth clearance.

What are the key components of Form CD 419?

+The key components of Form CD 419 include goods description, HS code, quantity and value, and country of origin.

How can technology simplify the completion of Form CD 419?

+Technology can simplify the completion of Form CD 419 through electronic data interchange (EDI), customs clearance software, and online resources.

By following these five ways to complete Form CD 419 successfully, you can ensure accurate and efficient customs clearance, minimizing the risk of errors, fines, or penalties. Remember to leverage technology, seek professional assistance when needed, and stay informed about customs regulations and requirements.