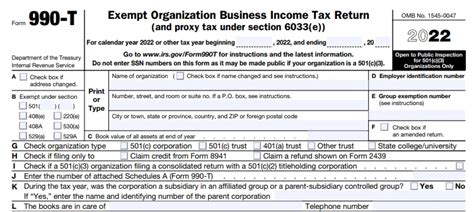

Form 990-T is a crucial tax form for exempt organizations in the United States. It's used to report unrelated business income and calculate the tax owed on that income. Filing Form 990-T accurately is essential to avoid penalties and maintain tax-exempt status. In this article, we'll provide expert guidance on Form 990-T instructions to help exempt organizations navigate the process with ease.

Understanding Form 990-T Purpose and Who Must File

Form 990-T is an annual return that certain tax-exempt organizations must file with the Internal Revenue Service (IRS). The primary purpose of Form 990-T is to report the organization's unrelated business income (UBI) and calculate the tax owed on that income. Exempt organizations with UBI of $1,000 or more are required to file Form 990-T.

Who Must File Form 990-T?

Not all tax-exempt organizations are required to file Form 990-T. The following types of organizations must file Form 990-T:

- Tax-exempt organizations with UBI of $1,000 or more

- Organizations with UBI from certain types of activities, such as debt-financed income, income from controlled organizations, or income from selling goods or services to the general public

- Tax-exempt organizations that have opted to be taxed on their UBI

Form 990-T Filing Requirements

Exempt organizations must file Form 990-T by the 15th day of the 5th month after the end of their tax year. For example, if an organization's tax year ends on December 31, the Form 990-T must be filed by May 15 of the following year.

Part I: Unrelated Business Income

Part I of Form 990-T is used to report an organization's UBI. This section requires detailed information about the organization's business activities, including:

- Gross income from business activities

- Cost of goods sold

- Operating expenses

- Depreciation and amortization

Part II: Tax Computation

Part II of Form 990-T is used to calculate the tax owed on the organization's UBI. This section requires the organization to report its total tax liability, including:

- Regular tax liability

- Alternative minimum tax (AMT) liability

- Other taxes and credits

Part III: Supporting Schedules

Part III of Form 990-T requires organizations to attach supporting schedules to provide additional information about their business activities. These schedules include:

- Schedule A: Publicly Traded Partnerships

- Schedule B: Alternative Minimum Tax (AMT)

- Schedule C: Additional Taxes and Credits

Penalties for Failure to File or Inaccurate Filing

Failure to file Form 990-T or filing an inaccurate return can result in significant penalties. The IRS may impose:

- A penalty of $10 for each day the return is late, up to a maximum of $2,500

- A penalty of 20% of the unpaid tax liability

- Interest on the unpaid tax liability

How to Avoid Penalties

To avoid penalties, exempt organizations must ensure they file Form 990-T accurately and on time. Here are some tips to help:

- Review the instructions carefully

- Ensure all required information is included

- Double-check calculations and supporting schedules

- File electronically to reduce errors and ensure timely filing

Conclusion

Filing Form 990-T is a critical requirement for exempt organizations with unrelated business income. By following the instructions and guidelines outlined in this article, organizations can ensure accurate and timely filing, avoiding penalties and maintaining their tax-exempt status. If you're unsure about any aspect of Form 990-T, consult with a qualified tax professional or seek guidance from the IRS.

Share your thoughts: Have you encountered any challenges while filing Form 990-T? Share your experiences and tips in the comments below.

FAQ Section

Who is required to file Form 990-T?

+Exempt organizations with UBI of $1,000 or more, organizations with UBI from certain types of activities, and organizations that have opted to be taxed on their UBI are required to file Form 990-T.

What is the deadline for filing Form 990-T?

+Form 990-T must be filed by the 15th day of the 5th month after the end of the organization's tax year.

What are the penalties for failure to file or inaccurate filing of Form 990-T?

+The IRS may impose a penalty of $10 for each day the return is late, up to a maximum of $2,500, a penalty of 20% of the unpaid tax liability, and interest on the unpaid tax liability.