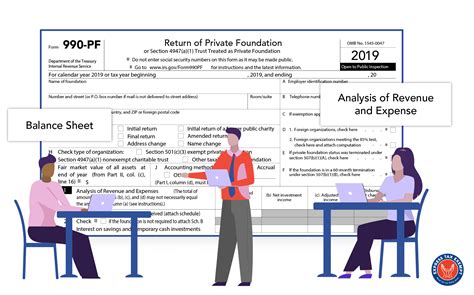

Form 990 is a crucial document that non-profit organizations in the United States must file annually with the Internal Revenue Service (IRS) to maintain their tax-exempt status. Within this form, Schedule A is a vital component that provides detailed information about the organization's public charity status and financial affairs. Mastering Form 990 Schedule A instructions is essential for non-profits to ensure compliance with IRS regulations and maintain transparency. Here are six valuable tips to help you navigate the process.

Understanding the Purpose of Schedule A

Schedule A is designed to provide information about the organization's public charity status, financial support, and fundraising activities. It serves as a critical component of the Form 990, allowing the IRS to assess the non-profit's eligibility for tax-exempt status. By understanding the purpose of Schedule A, you'll be better equipped to accurately complete the form and avoid potential errors.

Benefits of Accurate Schedule A Completion

Completing Schedule A accurately is crucial for several reasons:

- Maintains tax-exempt status: The IRS reviews Schedule A to determine if the non-profit meets the requirements for public charity status.

- Enhances transparency: Schedule A provides stakeholders with a clear understanding of the organization's financial affairs and fundraising activities.

- Supports fundraising efforts: By demonstrating a strong financial foundation, non-profits can increase donor confidence and attract more funding opportunities.

Tips for Mastering Form 990 Schedule A Instructions

To ensure accurate completion of Schedule A, follow these six tips:

Tip 1: Review the Form 990 Instructions

Before starting Schedule A, carefully review the Form 990 instructions provided by the IRS. This will help you understand the specific requirements and definitions used throughout the form.

Tip 2: Gather Necessary Financial Information

Ensure you have all necessary financial documents and records, including:

- Financial statements (balance sheet, income statement)

- Donor records

- Fundraising event details

- Grants and contributions

Tip 3: Determine Public Charity Status

Schedule A requires you to determine if your organization qualifies as a public charity. Review the IRS guidelines to determine if your non-profit meets the requirements for public charity status.

Tip 4: Calculate Public Support Percentage

Calculate the public support percentage by dividing the total public support by the total revenue. This percentage is critical in determining public charity status.

Tip 5: Complete Schedule A Sections Accurately

Complete each section of Schedule A accurately, including:

- Section A: Public Charity Status and Public Support

- Section B: Total Revenue and Public Support

- Section C: Fundraising Activities

Tip 6: Review and Revise Before Submission

Carefully review Schedule A for accuracy and completeness. Revise any errors or discrepancies before submitting the Form 990 to the IRS.

Conclusion

Mastering Form 990 Schedule A instructions requires attention to detail, thorough understanding of the IRS guidelines, and accurate completion of the form. By following these six tips, non-profits can ensure compliance with IRS regulations, maintain transparency, and demonstrate their commitment to financial responsibility.

What is the purpose of Schedule A in Form 990?

+Schedule A provides information about the organization's public charity status, financial support, and fundraising activities.

How do I determine if my organization qualifies as a public charity?

+Review the IRS guidelines to determine if your non-profit meets the requirements for public charity status.

What is the public support percentage, and how is it calculated?

+The public support percentage is calculated by dividing the total public support by the total revenue.

By following these tips and mastering Form 990 Schedule A instructions, non-profits can ensure compliance, transparency, and financial responsibility.