As a nonprofit organization, filing taxes can be a daunting task, especially when it comes to Form 990 EZ Schedule O. This form requires you to provide detailed information about your organization's governance, management, and compliance with tax laws. In this article, we will provide you with 5 tips to help you navigate the complexities of Form 990 EZ Schedule O.

Understanding Form 990 EZ Schedule O

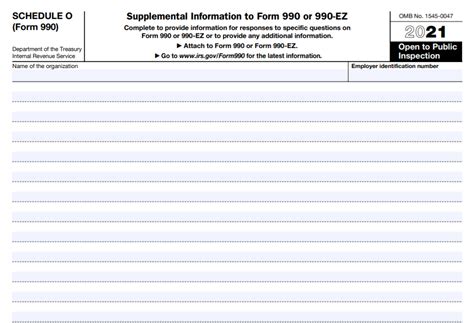

Before we dive into the tips, let's briefly discuss what Form 990 EZ Schedule O is and why it's essential for nonprofit organizations. Form 990 EZ is a simplified version of the Form 990, which is used by smaller nonprofit organizations with annual gross receipts of $200,000 or less and total assets of $500,000 or less. Schedule O is a supplemental schedule that requires additional information about your organization's governance, management, and compliance with tax laws.

Tips for Filing Form 990 EZ Schedule O

Here are five tips to help you accurately and efficiently file Form 990 EZ Schedule O:

Tip 1: Review the Instructions Carefully

Before starting to fill out Form 990 EZ Schedule O, take the time to review the instructions carefully. The instructions provide detailed guidance on how to complete each section, and it's essential to understand the requirements and definitions used throughout the form.

Tip 2: Gather All Necessary Information

To ensure that you complete Form 990 EZ Schedule O accurately, gather all necessary information before starting to fill out the form. This includes:

- Your organization's bylaws and articles of incorporation

- Minutes from board meetings and annual reports

- Information about your officers, directors, and key employees

- Financial statements and records

- Details about your organization's programs and activities

Tip 3: Complete All Sections Accurately

It's essential to complete all sections of Form 990 EZ Schedule O accurately and thoroughly. This includes providing detailed information about your organization's governance, management, and compliance with tax laws. Make sure to answer all questions and provide required attachments.

- Section 1: Officers, Directors, Trustees, and Key Employees

- Section 2: Governance, Management, and Disclosure

- Section 3: Compliance with Tax Laws

Tip 4: Ensure Compliance with Tax Laws

As a nonprofit organization, it's essential to ensure compliance with tax laws. Form 990 EZ Schedule O requires you to provide information about your organization's compliance with tax laws, including:

- Reporting of unrelated business income

- Compliance with lobbying and political activity rules

- Disclosure of insider transactions

Tip 5: Seek Professional Help If Needed

If you're unsure about how to complete Form 990 EZ Schedule O or need help with specific sections, consider seeking professional help. A qualified tax professional or accountant can guide you through the process and ensure that your organization is compliant with tax laws.

By following these tips, you can ensure that your nonprofit organization accurately and efficiently files Form 990 EZ Schedule O.

What is Form 990 EZ Schedule O?

+Form 990 EZ Schedule O is a supplemental schedule that requires additional information about your organization's governance, management, and compliance with tax laws.

Who needs to file Form 990 EZ Schedule O?

+Nonprofit organizations with annual gross receipts of $200,000 or less and total assets of $500,000 or less need to file Form 990 EZ Schedule O.

What is the deadline for filing Form 990 EZ Schedule O?

+The deadline for filing Form 990 EZ Schedule O is the 15th day of the fifth month after the end of your organization's accounting period.