As the economy continues to fluctuate, many individuals and businesses find themselves struggling with debt. In some cases, the only viable option may be to declare insolvency, which can have significant tax implications. Fortunately, the IRS offers tax relief for debtors through Insolvency Worksheet Form 982. In this article, we will delve into the world of tax relief for debtors, exploring the ins and outs of Form 982 and how it can help alleviate the financial burden of insolvency.

Understanding Insolvency and Tax Relief

Insolvency occurs when an individual or business is unable to pay their debts, resulting in a significant reduction in their net worth. This can happen due to various reasons, such as job loss, medical expenses, or business failure. When debtors are insolvent, they may be able to discharge some or all of their debts, which can lead to tax implications.

The IRS considers discharged debt as taxable income, unless the debtor can demonstrate insolvency. This is where Form 982 comes into play. By completing this form, debtors can claim tax relief for the discharged debt, reducing their tax liability.

What is Form 982?

Form 982, also known as the "Reduction of Tax Attributes Due to Discharge of Indebtedness," is an IRS form used to report the reduction of tax attributes due to the discharge of indebtedness. Debtors use this form to claim tax relief for discharged debt, which can help alleviate the financial burden of insolvency.

Who Can Use Form 982?

Form 982 is available to individuals and businesses that have had debt discharged due to insolvency. This includes:

- Individuals who have filed for bankruptcy

- Businesses that have closed or are in the process of closing

- Debtors who have negotiated a settlement with their creditors

- Debtors who have had debt forgiven or cancelled

To qualify for tax relief, debtors must demonstrate insolvency, which means they must show that their total liabilities exceed their total assets.

How to Complete Form 982

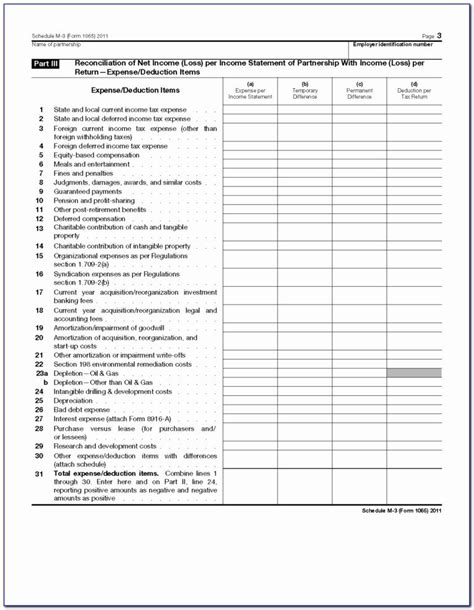

Completing Form 982 requires debtors to provide detailed information about their discharged debt and financial situation. The form is divided into several sections, including:

- Section 1: Discharged Debt

- Section 2: Reduction of Tax Attributes

- Section 3: Insolvency Worksheet

Debtors must complete the Insolvency Worksheet to determine the amount of discharged debt that is eligible for tax relief. The worksheet requires debtors to list their total assets and liabilities, as well as the amount of discharged debt.

Tax Relief for Debtors

Form 982 provides tax relief for debtors by reducing their tax liability. The amount of tax relief available depends on the amount of discharged debt and the debtor's financial situation.

Debtors can claim tax relief for the following types of debt:

- Credit card debt

- Medical debt

- Business debt

- Mortgage debt (in some cases)

The tax relief available through Form 982 can be substantial, and can help debtors recover from financial difficulties.

Example of Tax Relief

Let's say John, a self-employed individual, has accumulated significant credit card debt due to business expenses. He files for bankruptcy and has $50,000 of credit card debt discharged. John completes Form 982 and determines that he is eligible for tax relief.

As a result, John is able to reduce his tax liability by $50,000, which can help him recover from his financial difficulties.

Conclusion

Insolvency Worksheet Form 982 provides valuable tax relief for debtors who have had debt discharged due to insolvency. By completing this form, debtors can reduce their tax liability and alleviate the financial burden of insolvency.

If you are struggling with debt and are considering filing for bankruptcy or negotiating a settlement with your creditors, it's essential to consult with a tax professional to determine if you are eligible for tax relief through Form 982.

Remember, tax relief is available to those who need it most. Don't hesitate to reach out to a tax professional to explore your options.

We hope this article has provided valuable insights into the world of tax relief for debtors. Share your thoughts and experiences with us in the comments below!

What is Form 982?

+Form 982 is an IRS form used to report the reduction of tax attributes due to the discharge of indebtedness.

Who can use Form 982?

+Form 982 is available to individuals and businesses that have had debt discharged due to insolvency.

How much tax relief can I claim through Form 982?

+The amount of tax relief available through Form 982 depends on the amount of discharged debt and the debtor's financial situation.