Owing taxes to the Internal Revenue Service (IRS) can be a stressful and overwhelming experience, especially if you're unable to pay the full amount at once. Fortunately, the IRS offers a solution to help individuals and businesses manage their tax debt through the Installment Agreement (IA) program. The Form 9465, Installment Agreement Request, is a fillable form that allows taxpayers to apply for a monthly payment plan to settle their tax liability. In this article, we'll guide you through the process of filling out Form 9465, its benefits, and the requirements for a successful application.

What is Form 9465?

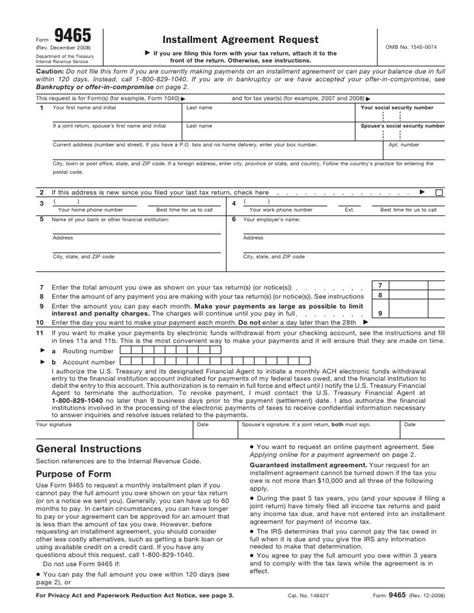

Form 9465 is a fillable form used by the IRS to process requests for Installment Agreements. This form is typically used by individuals and businesses that are unable to pay their tax liability in full. By submitting Form 9465, taxpayers can propose a monthly payment plan that fits their financial situation, making it easier to manage their tax debt.

Benefits of Form 9465

Filing Form 9465 offers several benefits, including:

- Avoids penalties and interest: By setting up an Installment Agreement, you can avoid additional penalties and interest on your tax debt.

- Prevents wage garnishment: The IRS may garnish your wages if you don't pay your tax debt. An Installment Agreement can prevent this from happening.

- Reduces financial stress: Breaking down your tax debt into manageable monthly payments can reduce financial stress and make it easier to budget.

- Improves credit score: Making timely payments under an Installment Agreement can help improve your credit score.

Eligibility Requirements

To be eligible for an Installment Agreement, you must meet the following requirements:

- File all required tax returns: You must have filed all required tax returns and paid any related taxes, interest, and penalties.

- Owe $50,000 or less: The total amount you owe, including taxes, interest, and penalties, must be $50,000 or less.

- Not have an open bankruptcy case: You cannot have an open bankruptcy case or be in the process of filing for bankruptcy.

- Not have had an Installment Agreement in the last 5 years: You must not have had an Installment Agreement in the last 5 years, unless you're applying for a new agreement due to a change in financial circumstances.

How to Fill Out Form 9465

Filling out Form 9465 requires careful attention to detail. Here's a step-by-step guide to help you complete the form:

- Section 1: Taxpayer Information: Provide your name, address, and Social Security number or Employer Identification Number (EIN).

- Section 2: Tax Liability Information: List the tax years and amounts you owe for each year.

- Section 3: Proposed Monthly Payment: Calculate your proposed monthly payment based on your financial situation.

- Section 4: Financial Information: Provide detailed financial information, including your income, expenses, assets, and liabilities.

- Section 5: Certification: Sign and date the form, certifying that the information provided is accurate and complete.

Common Mistakes to Avoid

- Inaccurate or incomplete information: Ensure that all information provided is accurate and complete.

- Insufficient monthly payment: Calculate your proposed monthly payment carefully to avoid insufficient payments.

- Missing signatures: Make sure to sign and date the form.

What to Expect After Filing Form 9465

After filing Form 9465, the IRS will review your application and respond with one of the following outcomes:

- Approved: Your Installment Agreement is approved, and you'll receive a letter with the terms of your agreement.

- Denied: Your application is denied, and you'll receive a letter explaining the reason for the denial.

- Additional Information Required: The IRS may request additional information to process your application.

Conclusion

Filing Form 9465 is a straightforward process that can help you manage your tax debt through an Installment Agreement. By understanding the benefits, eligibility requirements, and filling out the form correctly, you can take the first step towards resolving your tax liability. If you're struggling to pay your taxes, don't hesitate to reach out to a tax professional or the IRS for assistance.

Take Action

- Download Form 9465: Visit the IRS website to download and fill out Form 9465.

- Consult a Tax Professional: If you're unsure about the process, consider consulting a tax professional for guidance.

- Contact the IRS: Reach out to the IRS directly for assistance with your Installment Agreement application.

What is the difference between Form 9465 and Form 433-D?

+Form 9465 is used to request an Installment Agreement, while Form 433-D is used to provide financial information to support your Installment Agreement application.

Can I apply for an Installment Agreement online?

+No, you cannot apply for an Installment Agreement online. You must file Form 9465 by mail or fax.

How long does it take to process an Installment Agreement application?

+The processing time for an Installment Agreement application varies, but it typically takes 30-60 days.