The Internal Revenue Service (IRS) requires certain organizations to file an annual information return, known as Form 8958. This form is used to report information about the organization's tax-exempt status, financial activities, and governance practices. In this article, we will delve into the details of Form 8958, including its purpose, who is required to file, and what information is reported.

What is Form 8958?

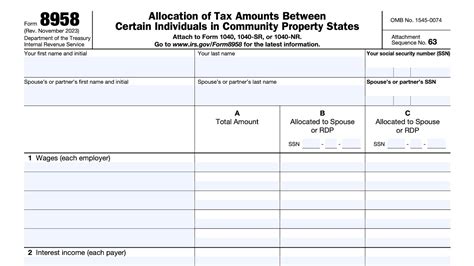

Form 8958 is an annual information return that must be filed by certain tax-exempt organizations with the IRS. The form is used to report information about the organization's tax-exempt status, financial activities, and governance practices. The information reported on Form 8958 is used by the IRS to monitor compliance with tax laws and regulations.

Who is Required to File Form 8958?

Not all tax-exempt organizations are required to file Form 8958. The form is required to be filed by organizations that are exempt from federal income tax under Section 501(a) of the Internal Revenue Code, including:

- Charitable organizations (501(c)(3))

- Social welfare organizations (501(c)(4))

- Labor unions (501(c)(5))

- Trade associations (501(c)(6))

- Veterans' organizations (501(c)(19))

Additionally, certain other organizations may be required to file Form 8958, including:

- Private foundations

- Pension plans

- Employee benefit plans

What Information is Reported on Form 8958?

Form 8958 requires organizations to report a wide range of information, including:

- Organization's name, address, and employer identification number (EIN)

- Type of tax-exempt organization

- Financial information, including:

- Total assets

- Total liabilities

- Total revenue

- Total expenses

- Governance information, including:

- Names and titles of officers and directors

- Compensation paid to officers and directors

- Governance policies and procedures

- Program service accomplishments and financial information

- Lobbying activities and expenditures

- Foreign financial transactions and interests

How to File Form 8958

Form 8958 must be filed electronically with the IRS. Organizations can use the IRS's Electronic Filing System (EFS) to file the form. The form must be filed by the 15th day of the fifth month after the end of the organization's tax year.

Penalties for Failure to File

Failure to file Form 8958 can result in penalties and fines. The IRS may impose a penalty of $20 per day, up to a maximum of $10,000, for failure to file the form. Additionally, the IRS may revoke the organization's tax-exempt status if it fails to file the form for three consecutive years.

Tips for Filing Form 8958

- Ensure accurate and complete information is reported on the form.

- File the form electronically to avoid paper filing errors.

- Keep accurate and detailed records to support the information reported on the form.

- Consult with a tax professional or attorney if you have questions or concerns about filing the form.

Common Mistakes to Avoid

- Failing to report all required financial information.

- Failing to report governance information, including officer and director compensation.

- Failing to report program service accomplishments and financial information.

- Failing to report lobbying activities and expenditures.

Conclusion

Form 8958 is an important annual information return that tax-exempt organizations must file with the IRS. The form requires organizations to report a wide range of information, including financial information, governance information, and program service accomplishments. By understanding the requirements and tips for filing Form 8958, organizations can ensure compliance with tax laws and regulations.

We encourage readers to share their experiences and insights about filing Form 8958 in the comments below. Additionally, if you have any questions or concerns about filing the form, please don't hesitate to reach out to a tax professional or attorney.

What is the deadline for filing Form 8958?

+The deadline for filing Form 8958 is the 15th day of the fifth month after the end of the organization's tax year.

Who is required to file Form 8958?

+Form 8958 is required to be filed by tax-exempt organizations, including charitable organizations, social welfare organizations, labor unions, trade associations, and veterans' organizations.

What information is reported on Form 8958?

+Form 8958 requires organizations to report financial information, governance information, program service accomplishments, and lobbying activities and expenditures.