Filing tax returns can be a daunting task, especially when it comes to complex forms like Form 8958. However, with a clear understanding of the process and a step-by-step guide, you can complete Form 8958 successfully and avoid any potential errors or delays. In this article, we will walk you through the 5 essential steps to complete Form 8958 accurately and efficiently.

What is Form 8958?

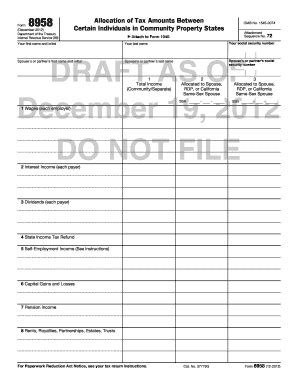

Before we dive into the steps to complete Form 8958, let's first understand what this form is all about. Form 8958, also known as the "Allocation of Tax Amounts" form, is used by the U.S. government to allocate tax amounts to specific accounts or entities. This form is typically used by employers, payers, and other entities that are required to report tax amounts to the IRS.

Step 1: Gather Required Information

To complete Form 8958, you will need to gather specific information about the tax amounts you are allocating. This information includes:

- Taxpayer Identification Number (TIN)

- Tax year

- Type of tax (e.g., income tax, payroll tax, etc.)

- Amount of tax

- Account or entity information

Make sure you have all the necessary information before proceeding to the next step.

Step 2: Fill Out Form 8958

Now that you have all the required information, it's time to fill out Form 8958. The form consists of several sections, including:

- Section 1: Taxpayer Information

- Section 2: Tax Amounts

- Section 3: Allocation of Tax Amounts

Carefully review each section and fill in the required information. Make sure to use the correct tax year and TIN.

Section 1: Taxpayer Information

In this section, you will need to provide your taxpayer identification number (TIN), tax year, and type of tax.

Section 2: Tax Amounts

In this section, you will need to report the total tax amount and the amount of tax allocated to each account or entity.

Section 3: Allocation of Tax Amounts

In this section, you will need to allocate the tax amounts to specific accounts or entities.

Step 3: Review and Verify Information

Before submitting Form 8958, it's essential to review and verify the information you have provided. Check for any errors or discrepancies in the tax amounts, TIN, or account information.

Common Errors to Avoid

- Incorrect TIN

- Incorrect tax year

- Incorrect tax amounts

- Missing or incomplete information

Make sure to correct any errors or discrepancies before proceeding to the next step.

Step 4: Submit Form 8958

Once you have reviewed and verified the information, you can submit Form 8958 to the IRS. You can submit the form electronically or by mail.

Electronic Submission

You can submit Form 8958 electronically through the IRS's Electronic Federal Tax Payment System (EFTPS).

Mail Submission

You can also submit Form 8958 by mail to the IRS address listed in the instructions.

Step 5: Maintain Records

Finally, it's essential to maintain accurate records of Form 8958, including the submission confirmation and any supporting documentation.

Importance of Record-Keeping

- Ensures compliance with IRS regulations

- Provides proof of submission

- Facilitates audit and examination processes

Make sure to keep records for at least three years in case of an audit or examination.

By following these 5 steps, you can complete Form 8958 successfully and avoid any potential errors or delays. Remember to gather required information, fill out the form accurately, review and verify information, submit the form, and maintain records.

What is Form 8958 used for?

+Form 8958 is used to allocate tax amounts to specific accounts or entities.

Who needs to file Form 8958?

+Employers, payers, and other entities that are required to report tax amounts to the IRS need to file Form 8958.

How do I submit Form 8958?

+You can submit Form 8958 electronically through the IRS's Electronic Federal Tax Payment System (EFTPS) or by mail to the IRS address listed in the instructions.