When it comes to filing taxes, accuracy and attention to detail are crucial. Form 8958, also known as the "Allocation of Tax Basis" form, is an essential document for partnerships and S corporations to allocate tax basis to their partners or shareholders. Filling out Form 8958 correctly is vital to avoid any errors or penalties. In this article, we will walk you through the 5 steps to fill out Form 8958 correctly.

Step 1: Gather Necessary Information

Before you start filling out Form 8958, gather all the necessary information and documents. This includes:

- Partnership or S corporation's tax return (Form 1065 or Form 1120S)

- Partners' or shareholders' capital accounts

- Tax basis of partnership or S corporation assets

- Any adjustments to tax basis due to depreciation, amortization, or other factors

Having all the necessary information readily available will help you fill out the form accurately and efficiently.

Why is Gathering Information Important?

Gathering information is crucial because it helps you ensure that you are allocating the correct tax basis to each partner or shareholder. Inaccurate or incomplete information can lead to errors, penalties, and even audits.

Step 2: Determine the Tax Basis of Partnership or S Corporation Assets

The tax basis of partnership or S corporation assets is a critical component of Form 8958. To determine the tax basis, you need to consider the following:

- The initial cost of the asset

- Any adjustments due to depreciation, amortization, or other factors

- Any gains or losses recognized on the sale or disposition of the asset

How to Calculate Tax Basis

To calculate the tax basis, you can use the following formula:

Tax Basis = Initial Cost + Adjustments - Depreciation

For example, let's say the partnership purchased an asset for $100,000 and depreciated it by $20,000 over the year. The tax basis would be:

Tax Basis = $100,000 + $0 (no adjustments) - $20,000 = $80,000

Step 3: Allocate Tax Basis to Partners or Shareholders

Once you have determined the tax basis of partnership or S corporation assets, you need to allocate it to each partner or shareholder. This is done based on their percentage of ownership or capital account balance.

How to Allocate Tax Basis

To allocate tax basis, you can use the following formula:

Allocated Tax Basis = Tax Basis x Percentage of Ownership

For example, let's say the partnership has two partners, John and Jane, with a 60% and 40% ownership interest, respectively. The tax basis of the asset is $80,000.

Allocated Tax Basis (John) = $80,000 x 0.60 = $48,000 Allocated Tax Basis (Jane) = $80,000 x 0.40 = $32,000

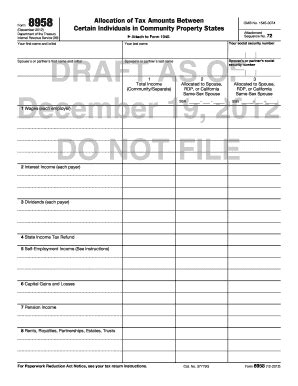

Step 4: Complete Form 8958

Now that you have gathered the necessary information, determined the tax basis of partnership or S corporation assets, and allocated it to each partner or shareholder, you can complete Form 8958.

What to Include on Form 8958

Form 8958 requires the following information:

- Partnership or S corporation's name and tax identification number

- Tax basis of partnership or S corporation assets

- Allocated tax basis to each partner or shareholder

- Percentage of ownership or capital account balance for each partner or shareholder

Step 5: Review and Submit Form 8958

Finally, review Form 8958 carefully to ensure that all the information is accurate and complete. Once you have reviewed the form, submit it to the IRS along with your partnership or S corporation's tax return.

Why is Reviewing Form 8958 Important?

Reviewing Form 8958 is crucial because it helps you catch any errors or inaccuracies before submitting the form to the IRS. This can help you avoid penalties, audits, and other issues down the line.

By following these 5 steps, you can ensure that you fill out Form 8958 correctly and accurately allocate tax basis to each partner or shareholder. Remember to gather all the necessary information, determine the tax basis of partnership or S corporation assets, allocate it to each partner or shareholder, complete Form 8958, and review and submit the form carefully.

We hope this article has been helpful in guiding you through the process of filling out Form 8958. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the IRS directly.

What is Form 8958 used for?

+Form 8958 is used to allocate tax basis to partners or shareholders of a partnership or S corporation.

Who needs to file Form 8958?

+Partnerships and S corporations need to file Form 8958 to allocate tax basis to their partners or shareholders.

What is the deadline for filing Form 8958?

+The deadline for filing Form 8958 is the same as the deadline for filing the partnership or S corporation's tax return.