Are you tired of the hassle and stress that comes with dealing with Form 8949, especially when you have too many transactions to report? You're not alone. Many taxpayers struggle with accurately and efficiently reporting their capital gains and losses on this form. The good news is that there are ways to make the process easier and less time-consuming.

In this article, we will explore seven ways to handle Form 8949 with too many transactions. Whether you're a seasoned investor or a tax professional, these tips and strategies will help you navigate the complexities of Form 8949 and ensure that you're in compliance with the IRS regulations.

Understanding Form 8949

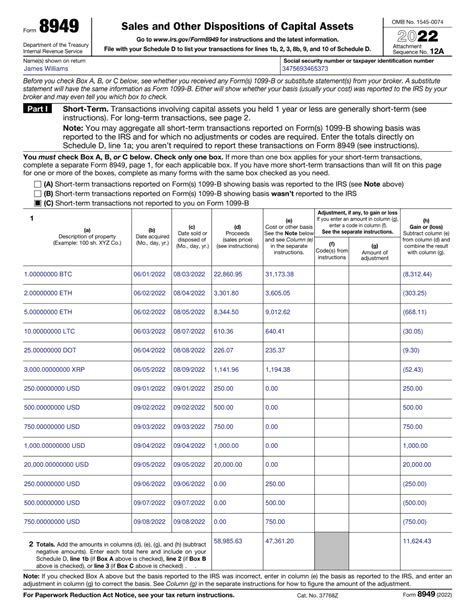

Before we dive into the seven ways to handle Form 8949 with too many transactions, let's take a brief moment to understand what this form is all about. Form 8949 is used to report the sale or exchange of certain capital assets, such as stocks, bonds, and mutual funds. The form is divided into two parts: Part I and Part II. Part I is used to report short-term transactions, while Part II is used to report long-term transactions.

The Challenges of Too Many Transactions

When you have too many transactions to report on Form 8949, it can be overwhelming and time-consuming. The IRS requires that you report each transaction separately, which can result in a lengthy and complicated form. Additionally, the IRS also requires that you attach a statement to the form if you have more than four transactions to report.

Seven Ways to Handle Form 8949 with Too Many Transactions

Now that we've discussed the challenges of dealing with too many transactions on Form 8949, let's explore the seven ways to make the process easier.

1. Use Tax Preparation Software

One of the easiest ways to handle Form 8949 with too many transactions is to use tax preparation software. Programs like TurboTax, H&R Block, and TaxAct can help you accurately and efficiently report your transactions. These programs often have built-in features that can help you import your transactions from your brokerage statements, making it easier to complete the form.

2. Hire a Tax Professional

If you're not comfortable using tax preparation software or if you have complex transactions to report, it may be worth hiring a tax professional. A tax professional can help you accurately complete Form 8949 and ensure that you're in compliance with the IRS regulations.

3. Use a Spreadsheet

Another way to handle Form 8949 with too many transactions is to use a spreadsheet. You can create a spreadsheet to track your transactions throughout the year, making it easier to complete the form when tax time rolls around. You can also use formulas to calculate your gains and losses, making it easier to ensure accuracy.

4. Attach a Statement

If you have more than four transactions to report, you'll need to attach a statement to Form 8949. This statement should include a detailed list of each transaction, including the date of the transaction, the type of asset, and the gain or loss.

5. Use the IRS's Online Tools

The IRS offers several online tools that can help you complete Form 8949, including the IRS's Interactive Tax Assistant and the IRS's Tax Withholding Estimator. These tools can help you determine if you need to file Form 8949 and can also help you calculate your gains and losses.

6. Keep Accurate Records

One of the most important things you can do to handle Form 8949 with too many transactions is to keep accurate records. This includes keeping a record of each transaction, including the date of the transaction, the type of asset, and the gain or loss. You should also keep a record of any supporting documentation, such as brokerage statements and receipts.

7. Consult with the IRS

Finally, if you're having trouble completing Form 8949 or if you have questions about the form, you should consult with the IRS. The IRS offers several resources, including the IRS's website and the IRS's customer service line. You can also consult with a tax professional or a financial advisor.

Conclusion

Handling Form 8949 with too many transactions can be overwhelming and time-consuming. However, by using the seven strategies outlined in this article, you can make the process easier and less stressful. Whether you use tax preparation software, hire a tax professional, or keep accurate records, you can ensure that you're in compliance with the IRS regulations and avoid any potential penalties or fines.

We hope this article has been helpful in providing you with the information and resources you need to handle Form 8949 with too many transactions. If you have any questions or comments, please don't hesitate to reach out.

Take Action

If you're struggling with Form 8949 or if you have questions about the form, take action today. Consult with a tax professional or financial advisor, or use the IRS's online tools to get the help you need. Don't wait until it's too late – take control of your taxes and ensure that you're in compliance with the IRS regulations.

What is Form 8949?

+Form 8949 is used to report the sale or exchange of certain capital assets, such as stocks, bonds, and mutual funds.

How do I report too many transactions on Form 8949?

+If you have more than four transactions to report, you'll need to attach a statement to Form 8949. This statement should include a detailed list of each transaction, including the date of the transaction, the type of asset, and the gain or loss.

Can I use tax preparation software to complete Form 8949?

+Yes, you can use tax preparation software to complete Form 8949. Programs like TurboTax, H&R Block, and TaxAct can help you accurately and efficiently report your transactions.