Filing taxes can be a daunting task, especially when it comes to reporting investment gains and losses. If you're a Robinhood user, you're likely familiar with the platform's simplicity and ease of use. However, when it comes to tax season, things can get a bit more complicated. In this article, we'll walk you through the process of filing Form 8949 with Robinhood, providing a step-by-step guide to help you navigate the process with confidence.

Understanding Form 8949

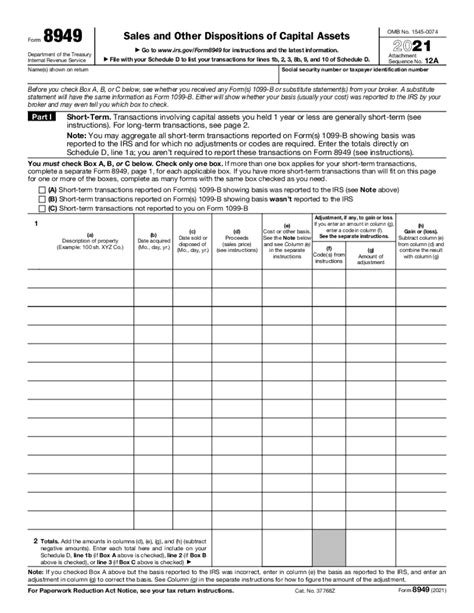

Form 8949 is a crucial document used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds. As a Robinhood user, you'll need to file this form to report your investment gains and losses for the tax year. The form is divided into two parts: Part I for short-term transactions and Part II for long-term transactions.

Why Do I Need to File Form 8949?

Filing Form 8949 is mandatory if you've sold or exchanged capital assets during the tax year. This includes stocks, options, ETFs, and other securities. Even if you've only made a few trades, you'll still need to file this form to report your gains and losses.

Gathering Necessary Documents

Before you start filing Form 8949, make sure you have the following documents:

- Your Robinhood account statements

- Your Form 1099-B (if applicable)

- Your tax return from the previous year (if applicable)

What's a Form 1099-B?

A Form 1099-B is a document provided by your broker (in this case, Robinhood) that reports the proceeds from the sale of your securities. You'll receive this form if you've sold securities during the tax year. The form will show the date of sale, the proceeds from the sale, and any costs or fees associated with the transaction.

Step-by-Step Guide to Filing Form 8949 with Robinhood

Now that you have all the necessary documents, let's walk through the step-by-step process of filing Form 8949 with Robinhood:

- Log in to your Robinhood account: Start by logging in to your Robinhood account. Make sure you have your account statements and Form 1099-B (if applicable) ready.

- Gather your transaction data: Robinhood provides a convenient way to export your transaction data. Go to the "Account" section, click on "Tax Documents," and select "Form 8949." You'll be able to download a CSV file containing your transaction data.

- Sort and categorize your transactions: Sort your transactions by date and categorize them as either short-term or long-term. Short-term transactions are those held for one year or less, while long-term transactions are those held for more than one year.

- Complete Part I (Short-Term Transactions): Fill out Part I of Form 8949, reporting your short-term transactions. You'll need to provide the following information:

- Date of sale

- Proceeds from sale

- Cost or other basis

- Gain or loss

- Complete Part II (Long-Term Transactions): Fill out Part II of Form 8949, reporting your long-term transactions. You'll need to provide the same information as in Part I.

- Calculate your gains and losses: Calculate your total gains and losses for both short-term and long-term transactions. You can use the data from your Robinhood account statements and Form 1099-B to help with this calculation.

- Report your gains and losses on Schedule D: Report your gains and losses on Schedule D of your tax return. You'll need to complete Form 8949 and attach it to your tax return.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing Form 8949 with Robinhood:

- Make sure to report all your transactions, including those with gains and losses.

- Keep accurate records of your transactions, including dates, proceeds, and costs.

- Consult with a tax professional if you're unsure about any part of the process.

- File your tax return on time to avoid penalties and interest.

Conclusion

Filing Form 8949 with Robinhood may seem daunting, but with this step-by-step guide, you'll be able to navigate the process with confidence. Remember to gather all necessary documents, sort and categorize your transactions, and report your gains and losses accurately. Don't hesitate to consult with a tax professional if you need help. By following these steps, you'll be able to file your tax return with ease and avoid any potential penalties or interest.

What is Form 8949?

+Form 8949 is a tax form used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds.

Do I need to file Form 8949 if I only made a few trades?

+Yes, you'll need to file Form 8949 even if you only made a few trades during the tax year.

What is a Form 1099-B?

+A Form 1099-B is a document provided by your broker that reports the proceeds from the sale of your securities.