As a business owner in California, it's essential to stay on top of your tax obligations to avoid penalties and fines. One crucial form you need to file is the CA Form 568, which is the Limited Liability Company (LLC) Return of Income. In this article, we'll delve into the CA Form 568 filing deadline and provide valuable tips to ensure you comply with the California Franchise Tax Board (FTB) requirements.

What is CA Form 568?

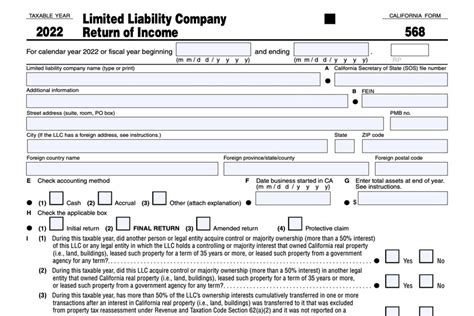

CA Form 568 is the annual tax return form for LLCs operating in California. It's used to report the LLC's income, deductions, and credits, as well as to calculate the annual franchise tax. The form is usually filed by the LLC's tax preparer or accountant, but it's essential for business owners to understand the process and requirements.

CA Form 568 Filing Deadline

The CA Form 568 filing deadline is typically on the 15th day of the fourth month after the end of the LLC's tax year. For most LLCs, this means the deadline is April 15th for calendar-year taxpayers. However, if your LLC uses a fiscal year, the deadline will be the 15th day of the fourth month after the end of your fiscal year.

It's crucial to note that the FTB will impose penalties and interest on late-filed returns. If you're unable to meet the deadline, you can request an automatic six-month extension by filing Form 3537, Payment for Automatic Extension for LLCs.

Who Must File CA Form 568?

Not all LLCs are required to file CA Form 568. To determine if your LLC needs to file, consider the following:

- If your LLC has a California source income of $250,000 or more, you must file CA Form 568.

- If your LLC has a total income of $250,000 or more from all sources, you must file CA Form 568, even if the income is not from California sources.

- If your LLC is a disregarded entity (single-member LLC) and has a California source income of $100,000 or more, you must file CA Form 568.

Tips for Filing CA Form 568

To ensure a smooth filing process, follow these tips:

- Gather necessary documents: Collect all relevant financial statements, including balance sheets, income statements, and schedules of depreciation.

- Use the correct tax year: Ensure you're filing for the correct tax year, as the FTB may request additional information or documentation if the return is filed for the wrong year.

- Report all income: Include all income from California sources, as well as income from other states or countries.

- Claim credits and deductions: Take advantage of available credits and deductions, such as the small business health care credit or the research and development credit.

- File electronically: The FTB recommends e-filing, as it reduces errors and speeds up processing time.

- Pay any owed taxes: If you owe taxes, pay them by the deadline to avoid penalties and interest.

Common Mistakes to Avoid

When filing CA Form 568, be aware of these common mistakes:

- Inaccurate or incomplete information: Double-check your financial statements and ensure all required information is included.

- Missing schedules: Attach all required schedules, such as Schedule K-1 (Member's Share of Income, Deductions, Credits, etc.).

- Late filing: File on time to avoid penalties and interest.

Additional Requirements for LLCs

In addition to filing CA Form 568, LLCs must also comply with other California requirements:

- Annual Statement of Information: File the Statement of Information (Form LLC-12) with the California Secretary of State's office within 90 days of filing your Articles of Organization.

- Business License: Obtain any necessary business licenses or permits from local governments.

Conclusion: Stay Compliant with CA Form 568

Filing CA Form 568 is a critical step in maintaining compliance with California tax laws. By understanding the filing deadline, requirements, and tips outlined in this article, you can ensure your LLC meets its tax obligations and avoids costly penalties. If you're unsure about any aspect of the filing process, consider consulting a tax professional or accountant for guidance.

We encourage you to share your experiences or ask questions about CA Form 568 in the comments below.

What is the CA Form 568 filing deadline?

+The CA Form 568 filing deadline is typically on the 15th day of the fourth month after the end of the LLC's tax year.

Who must file CA Form 568?

+LLCs with a California source income of $250,000 or more, or total income of $250,000 or more from all sources, must file CA Form 568.

What are the penalties for late filing?

+The FTB will impose penalties and interest on late-filed returns.