The intricacies of tax forms can be overwhelming, especially when dealing with the nuances of investment income. Form 8949, specifically, is a crucial document for individuals and businesses that engage in buying and selling securities. One of the often-misunderstood aspects of this form is the "Code Q" designation. In this article, we'll delve into the world of Form 8949 Code Q, breaking down its significance and providing essential facts to ensure accurate reporting.

What is Form 8949?

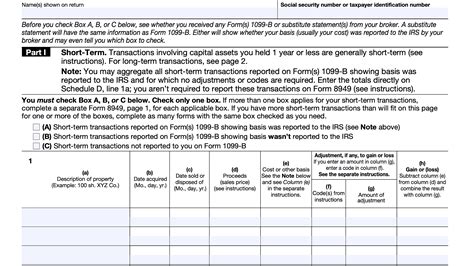

Before diving into Code Q, it's essential to understand the purpose of Form 8949. This form is used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds. It's a critical component of an individual's or business's tax return, as it helps the IRS calculate capital gains and losses. Form 8949 is typically filed in conjunction with Schedule D (Capital Gains and Losses).

Understanding Code Q

Code Q is one of the various codes used on Form 8949 to indicate the type of transaction being reported. Specifically, Code Q is used to denote a "wash sale." A wash sale occurs when an individual sells a security at a loss and, within 30 days before or after the sale, buys a "substantially identical" security. This can include the same stock, bond, or mutual fund, as well as a contract or option to acquire the same security.

5 Essential Facts About Form 8949 Code Q

-

Wash Sale Rule: The wash sale rule is designed to prevent individuals from claiming a loss on a security sale while still holding a substantially identical security. This rule is intended to prevent tax evasion and ensure that individuals do not artificially inflate their losses.

-

Impact on Capital Gains: When a wash sale occurs, the loss on the sale of the original security is disallowed for the current tax year. Instead, the loss is added to the cost basis of the replacement security. This can impact an individual's capital gains and losses, potentially leading to a higher tax liability.

-

Reporting Requirements: When reporting a wash sale on Form 8949, individuals must enter "Q" in the "Code" column. This indicates that the sale is subject to the wash sale rule. Additionally, the individual must report the wash sale loss on Schedule D.

-

Consequences of Non-Compliance: Failure to report a wash sale on Form 8949 can result in penalties and interest. The IRS may also disallow the loss, leading to a higher tax liability.

-

Record Keeping: Accurate record keeping is essential when dealing with wash sales. Individuals should maintain detailed records of their transactions, including the sale and purchase dates, security identification, and cost basis. This will help ensure accurate reporting on Form 8949.

Tips for Accurate Reporting

To ensure accurate reporting on Form 8949, follow these tips:

- Keep detailed records of all transactions, including sales, purchases, and wash sales.

- Use a tax professional or accounting software to help with reporting and calculations.

- Review Form 8949 and Schedule D carefully before filing to ensure accuracy.

- Be aware of the wash sale rule and its implications for capital gains and losses.

Common Mistakes to Avoid

When reporting on Form 8949, be aware of the following common mistakes:

- Failure to report wash sales

- Incorrect calculation of capital gains and losses

- Inaccurate record keeping

- Failure to file Form 8949 or Schedule D

Conclusion: Unlocking Form 8949 Code Q

Form 8949 Code Q is an essential aspect of tax reporting for individuals and businesses engaging in securities transactions. By understanding the wash sale rule and its implications, individuals can ensure accurate reporting and avoid costly penalties. Remember to keep detailed records, use tax professionals or accounting software, and review forms carefully before filing.

Now that you've unlocked the secrets of Form 8949 Code Q, take the next step in mastering tax reporting. Share your experiences, ask questions, or provide tips in the comments section below. Don't forget to share this article with others who may benefit from this knowledge.

What is the purpose of Form 8949?

+Form 8949 is used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds.

What is a wash sale?

+A wash sale occurs when an individual sells a security at a loss and, within 30 days before or after the sale, buys a substantially identical security.

How do I report a wash sale on Form 8949?

+Enter "Q" in the "Code" column and report the wash sale loss on Schedule D.