Decoding Form 8949 Code E for Capital Gains Reporting

Capital gains reporting can be a daunting task, especially when it comes to deciphering the various codes and forms required by the Internal Revenue Service (IRS). One of the most common codes used for capital gains reporting is Code E, which is used to report the sale of securities that are not reported on Form 1099-B. In this article, we will delve into the world of Form 8949 Code E, exploring what it is, how it is used, and the steps to report capital gains using this code.

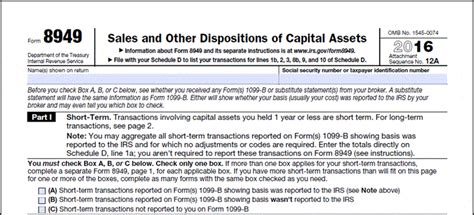

Understanding Form 8949

Before we dive into the specifics of Code E, it's essential to understand the purpose of Form 8949. Form 8949 is a tax form used to report the sale or exchange of capital assets, such as stocks, bonds, and mutual funds. The form is used to calculate the gain or loss from the sale of these assets, which is then reported on Schedule D of the taxpayer's individual tax return.

What is Code E?

Code E is used to report the sale of securities that are not reported on Form 1099-B. Form 1099-B is used to report the sale of securities that are traded on an exchange, such as stocks and bonds. However, not all securities are traded on an exchange, and that's where Code E comes in. Code E is used to report the sale of securities that are not traded on an exchange, such as private company stock or securities that are not publicly traded.

How to Report Capital Gains using Code E

Reporting capital gains using Code E involves several steps. Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Information

To report capital gains using Code E, you will need to gather information about the security that was sold. This includes the date of sale, the proceeds from the sale, and the cost basis of the security.

Step 2: Determine the Gain or Loss

Next, you will need to determine the gain or loss from the sale of the security. This is calculated by subtracting the cost basis from the proceeds of the sale.

Step 3: Complete Form 8949

Once you have determined the gain or loss, you will need to complete Form 8949. This involves reporting the sale of the security on Part II of the form, which is specifically designed for reporting sales of securities that are not reported on Form 1099-B.

Step 4: Report the Gain or Loss on Schedule D

Finally, you will need to report the gain or loss on Schedule D of your individual tax return. This involves transferring the information from Form 8949 to Schedule D.

Common Mistakes to Avoid

When reporting capital gains using Code E, there are several common mistakes to avoid. Here are a few:

- Failure to report the sale of securities that are not traded on an exchange

- Incorrect calculation of the gain or loss

- Failure to complete Form 8949 correctly

- Failure to report the gain or loss on Schedule D

Benefits of Accurate Reporting

Accurate reporting of capital gains using Code E can have several benefits, including:

- Avoiding penalties and fines for incorrect reporting

- Reducing the risk of audit

- Ensuring compliance with IRS regulations

- Avoiding overpayment of taxes

Conclusion: Staying Compliant

Reporting capital gains using Code E requires attention to detail and a thorough understanding of the reporting requirements. By following the steps outlined in this article and avoiding common mistakes, you can ensure compliance with IRS regulations and avoid penalties and fines. Remember to stay informed about changes to tax laws and regulations, and consult with a tax professional if you are unsure about any aspect of capital gains reporting.

What is Form 8949 used for?

+Form 8949 is used to report the sale or exchange of capital assets, such as stocks, bonds, and mutual funds.

What is Code E used for?

+Code E is used to report the sale of securities that are not traded on an exchange.

How do I report capital gains using Code E?

+To report capital gains using Code E, you will need to gather information about the security that was sold, determine the gain or loss, complete Form 8949, and report the gain or loss on Schedule D.