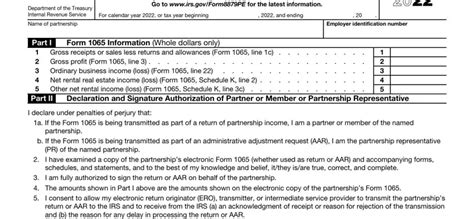

The IRS Form 8879-Pe, also known as the IRS e-file Signature Authorization for Form 1065, is a crucial document for partnerships and multi-member LLCs that want to e-file their tax returns. However, understanding this form can be a daunting task, especially for those who are new to the world of taxation. In this article, we will break down the Form 8879-Pe into five manageable sections, making it easier for you to comprehend and navigate.

What is Form 8879-Pe?

Form 8879-Pe is an authorization form that allows the IRS to accept a partnership's or multi-member LLC's electronic tax return as if it were signed by the partner or member. This form is required for partnerships and multi-member LLCs that want to e-file their tax returns, as the IRS cannot accept electronically filed tax returns without this authorization.

Why is Form 8879-Pe necessary?

The IRS requires Form 8879-Pe to ensure that the partnership or multi-member LLC has authorized the e-filed tax return. This form serves as a digital signature, confirming that the partnership or multi-member LLC has reviewed and approved the tax return before submitting it to the IRS.

Who needs to sign Form 8879-Pe?

The partnership or multi-member LLC must designate a partner or member to sign Form 8879-Pe. This designated individual is typically the partner or member who is responsible for filing the tax return. The IRS requires the signer to be a partner or member who has the authority to make decisions on behalf of the partnership or multi-member LLC.

What are the requirements for signing Form 8879-Pe?

To sign Form 8879-Pe, the designated partner or member must meet certain requirements. These requirements include:

- Being a partner or member of the partnership or multi-member LLC

- Having the authority to make decisions on behalf of the partnership or multi-member LLC

- Being authorized to sign the tax return on behalf of the partnership or multi-member LLC

How to complete Form 8879-Pe

Completing Form 8879-Pe is a straightforward process. Here are the steps to follow:

- Download the form from the IRS website or use tax preparation software that includes the form.

- Fill in the partnership's or multi-member LLC's name, address, and Employer Identification Number (EIN).

- Identify the designated partner or member who will sign the form.

- Enter the tax year for which the form is being completed.

- Sign and date the form.

What to do after completing Form 8879-Pe

Once you have completed Form 8879-Pe, you will need to attach it to the tax return and submit it to the IRS. Make sure to keep a copy of the form for your records, as you may need to refer to it in the future.

Common mistakes to avoid when completing Form 8879-Pe

When completing Form 8879-Pe, there are several common mistakes to avoid. These include:

- Failing to sign and date the form

- Not including the partnership's or multi-member LLC's EIN

- Not designating the correct partner or member to sign the form

- Failing to attach the form to the tax return

Consequences of not completing Form 8879-Pe correctly

If you fail to complete Form 8879-Pe correctly, the IRS may reject your tax return. This can lead to delays in processing your tax return and may even result in penalties and fines.

Best practices for managing Form 8879-Pe

To ensure that you manage Form 8879-Pe correctly, follow these best practices:

- Keep a copy of the form for your records

- Make sure to complete the form accurately and thoroughly

- Attach the form to the tax return and submit it to the IRS on time

- Review and update the form annually to ensure that the designated partner or member is still authorized to sign

Conclusion

Understanding Form 8879-Pe is crucial for partnerships and multi-member LLCs that want to e-file their tax returns. By following the steps outlined in this article, you can ensure that you complete the form correctly and avoid common mistakes. Remember to keep a copy of the form for your records and to review and update it annually to ensure compliance with IRS regulations.

What is the purpose of Form 8879-Pe?

+Form 8879-Pe is an authorization form that allows the IRS to accept a partnership's or multi-member LLC's electronic tax return as if it were signed by the partner or member.

Who needs to sign Form 8879-Pe?

+The partnership or multi-member LLC must designate a partner or member to sign Form 8879-Pe. This designated individual is typically the partner or member who is responsible for filing the tax return.

What are the consequences of not completing Form 8879-Pe correctly?

+If you fail to complete Form 8879-Pe correctly, the IRS may reject your tax return. This can lead to delays in processing your tax return and may even result in penalties and fines.