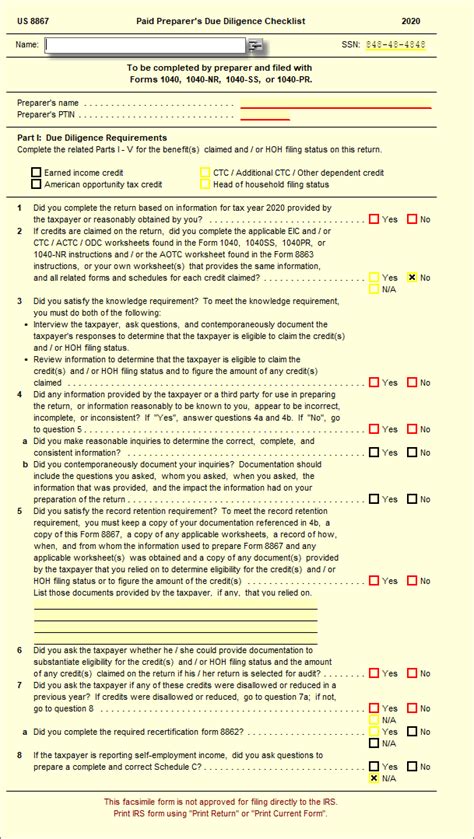

As a tax professional, it's essential to ensure that your clients are in compliance with the Internal Revenue Code (IRC) and the Treasury Regulations. The Form 8867, also known as the Due Diligence Checklist, is a critical tool in this process. This checklist is used to verify that the paid preparer has met the due diligence requirements for the earned income tax credit (EITC), child tax credit, additional child tax credit, and American opportunity tax credit.

1. Client Interview

The client interview is a critical component of the Form 8867 Due Diligence Checklist. During this interview, you should ask your client a series of questions to determine their eligibility for the EITC and other credits. This includes questions about their income, family size, filing status, and residency.

- What is your filing status?

- How many qualifying children do you have?

- What is your adjusted gross income (AGI)?

- Have you received any income from self-employment or investments?

Importance of Client Interview

The client interview is essential in ensuring that you have gathered all the necessary information to complete the tax return accurately. It also helps to identify any potential issues or discrepancies that may arise during the audit process.

2. Documentation Verification

Verification of documentation is another critical item on the Form 8867 Due Diligence Checklist. You should verify your client's identification, Social Security number, and other documentation, such as:

- Identification (driver's license, passport, etc.)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Birth certificates or other documents to verify the age and identity of qualifying children

Tips for Verifying Documentation

When verifying documentation, make sure to check for any discrepancies or inconsistencies. For example, if the client's identification shows a different address than what they provided on the tax return, you should investigate further.

3. Computation of Credits

The computation of credits is a critical component of the Form 8867 Due Diligence Checklist. You should ensure that the credits are calculated accurately and in accordance with the IRC and Treasury Regulations.

- EITC: Use the EITC worksheet to calculate the credit.

- Child tax credit: Use the child tax credit worksheet to calculate the credit.

- Additional child tax credit: Use the additional child tax credit worksheet to calculate the credit.

- American opportunity tax credit: Use the American opportunity tax credit worksheet to calculate the credit.

Importance of Accurate Computation

Accurate computation of credits is essential in ensuring that your client receives the correct amount of credit. Inaccurate computation can result in delays or even audits.

4. Record Keeping

Record keeping is another essential item on the Form 8867 Due Diligence Checklist. You should maintain accurate and detailed records of the client's tax return, including:

- A copy of the tax return

- Supporting documentation (identification, Social Security number, etc.)

- Computation worksheets

- Client interview notes

Importance of Record Keeping

Accurate record keeping is essential in case of an audit. It helps to demonstrate that you have met the due diligence requirements and can provide evidence to support the credits claimed on the tax return.

5. Form 8867 Completion

The final item on the Form 8867 Due Diligence Checklist is the completion of the form itself. You should complete the form accurately and in accordance with the IRC and Treasury Regulations.

- Part I: Client Information

- Part II: Credits Claimed

- Part III: Due Diligence Requirements

- Part IV: Certification

Importance of Accurate Completion

Accurate completion of the Form 8867 is essential in ensuring that you have met the due diligence requirements. Inaccurate completion can result in delays or even audits.

In conclusion, the Form 8867 Due Diligence Checklist is a critical tool in ensuring that tax professionals meet the due diligence requirements for the EITC and other credits. By following the items outlined in this article, you can ensure that you have met the requirements and provided accurate and complete information to your clients.

We encourage you to comment below and share your experiences with the Form 8867 Due Diligence Checklist. Have you encountered any challenges or issues during the process? How do you ensure that you meet the due diligence requirements?

What is the purpose of the Form 8867 Due Diligence Checklist?

+The purpose of the Form 8867 Due Diligence Checklist is to verify that the paid preparer has met the due diligence requirements for the earned income tax credit (EITC), child tax credit, additional child tax credit, and American opportunity tax credit.

What are the essential items on the Form 8867 Due Diligence Checklist?

+The essential items on the Form 8867 Due Diligence Checklist include client interview, documentation verification, computation of credits, record keeping, and Form 8867 completion.

Why is accurate record keeping essential?

+Accurate record keeping is essential in case of an audit. It helps to demonstrate that the tax professional has met the due diligence requirements and can provide evidence to support the credits claimed on the tax return.