Filing taxes as a U.S. citizen or resident can be a daunting task, especially when it comes to reporting foreign investments or entities. One of the most critical forms for taxpayers with foreign interests is Form 8865, also known as the "Return of U.S. Persons With Respect to Certain Foreign Partnerships." Within this form, Schedule O is a crucial component that requires accurate and detailed information. In this article, we will explore the five ways to fill out Form 8865 Schedule O, ensuring you comply with the IRS regulations and avoid potential penalties.

Understanding Form 8865 and Schedule O

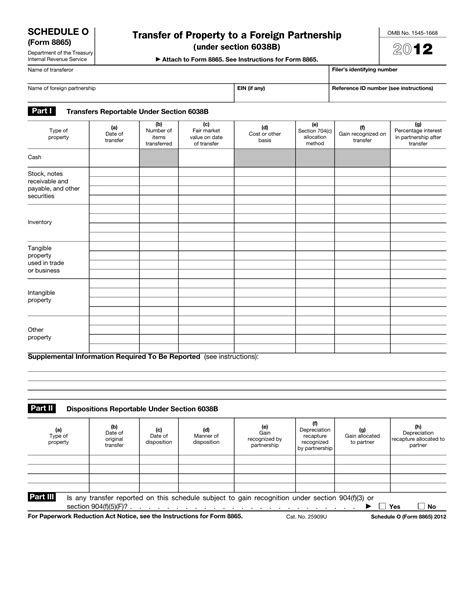

Before diving into the specifics of Schedule O, it's essential to understand the purpose of Form 8865. This form is used by U.S. taxpayers to report their interests in foreign partnerships, including foreign entities treated as partnerships for U.S. tax purposes. Schedule O is a supporting schedule that provides additional information about the foreign partnership, its operations, and the taxpayer's interest in the partnership.

Who Needs to File Form 8865 and Schedule O?

Not all taxpayers with foreign interests need to file Form 8865 and Schedule O. The IRS requires filing if you meet one of the following conditions:

- You are a U.S. citizen or resident who is a partner in a foreign partnership.

- You are a U.S. person who owns 10% or more of the interests in a foreign partnership.

- You are a U.S. person who has control of a foreign partnership.

5 Ways to Fill Out Form 8865 Schedule O

Now that we've covered the basics, let's explore the five ways to fill out Form 8865 Schedule O accurately and efficiently.

1. Identify the Foreign Partnership and Its Operations

The first step in filling out Schedule O is to identify the foreign partnership and its operations. You will need to provide the name, address, and employer identification number (EIN) of the foreign partnership. Additionally, you must describe the partnership's business activities and provide information about its operations, including the country where it is located and the date it was formed.

2. Report the Taxpayer's Interest in the Partnership

Next, you must report the taxpayer's interest in the partnership. This includes the percentage of ownership, the type of interest (e.g., general partner, limited partner), and the date the interest was acquired. You must also provide information about any changes in the taxpayer's interest during the tax year.

3. Provide Financial Information About the Partnership

Schedule O requires you to provide financial information about the partnership, including its total assets, liabilities, and equity. You must also report the partnership's income, deductions, and credits, as well as any distributions made to the taxpayer.

4. Report Any Related-Party Transactions

If the taxpayer has engaged in any related-party transactions with the foreign partnership, you must report these transactions on Schedule O. This includes any transactions between the taxpayer and the partnership, as well as any transactions between the partnership and other related parties.

5. Certify the Information and Sign the Form

Finally, you must certify that the information provided on Schedule O is accurate and complete. The taxpayer must sign the form, and if the taxpayer is a partnership or corporation, the form must be signed by an authorized representative.

Additional Tips and Reminders

To ensure accurate and timely filing of Form 8865 and Schedule O, keep the following tips and reminders in mind:

- File Form 8865 and Schedule O by the due date of the taxpayer's tax return (usually April 15th for individual taxpayers).

- Use the correct form and schedule for the tax year being reported.

- Ensure all information is accurate and complete to avoid penalties and delays.

- Keep records of the foreign partnership and its operations, as well as the taxpayer's interest in the partnership.

Conclusion

Filing Form 8865 and Schedule O can be a complex and time-consuming process, but by following these five ways to fill out the form, you can ensure accurate and timely reporting of your foreign partnership interests. Remember to identify the foreign partnership and its operations, report the taxpayer's interest in the partnership, provide financial information, report any related-party transactions, and certify the information and sign the form. By doing so, you can avoid penalties and ensure compliance with IRS regulations.

What is the purpose of Form 8865 and Schedule O?

+Form 8865 and Schedule O are used to report a U.S. taxpayer's interest in a foreign partnership, including financial information about the partnership and the taxpayer's interest.

Who needs to file Form 8865 and Schedule O?

+U.S. citizens or residents who are partners in a foreign partnership, own 10% or more of the interests in a foreign partnership, or have control of a foreign partnership need to file Form 8865 and Schedule O.

What is the deadline for filing Form 8865 and Schedule O?

+Form 8865 and Schedule O must be filed by the due date of the taxpayer's tax return, usually April 15th for individual taxpayers.