Dealing with tax refund issues can be frustrating, especially when it involves a Form 886-A. This form is used by the Internal Revenue Service (IRS) to explain the changes or corrections made to a taxpayer's return, often resulting in a frozen refund. If you're facing a Form 886-A frozen refund issue, you're not alone. Many taxpayers experience this problem, and fortunately, there are steps you can take to resolve it. In this article, we'll explore five ways to fix Form 886-A frozen refund issues, ensuring you receive your refund as quickly as possible.

Understanding Form 886-A

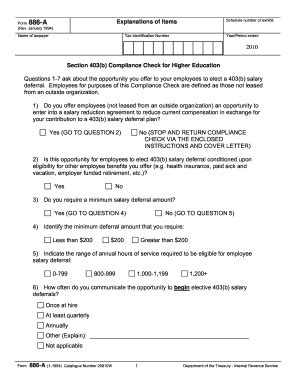

Before diving into the solutions, it's essential to understand what Form 886-A is and why it's used. Form 886-A is an examination changes report, which is sent to taxpayers when the IRS makes changes to their tax return. This form outlines the corrections or adjustments made, along with the reasons for these changes. While Form 886-A is an essential part of the tax audit process, it can sometimes lead to frozen refunds, leaving taxpayers wondering what to do next.

Solution 1: Review and Respond to the Form 886-A

One of the most effective ways to resolve a Form 886-A frozen refund issue is to review the form carefully and respond to any questions or concerns raised by the IRS. When you receive Form 886-A, thoroughly examine the changes made to your return and ensure you understand the reasons behind them. If you disagree with the changes, you can respond to the IRS by mail or phone, providing supporting documentation to justify your position. By addressing the issues raised in Form 886-A, you can help resolve the frozen refund issue and get your refund processed.

Solution 2: Verify Your Identity

In some cases, a frozen refund may be caused by identity verification issues. If the IRS suspects identity theft or has difficulty verifying your identity, your refund may be delayed. To resolve this issue, you can contact the IRS Identity Protection Specialized Unit (IPSU) at 1-800-908-4490. The IPSU will guide you through the process of verifying your identity, which may involve providing documentation, such as a passport or driver's license. Once your identity is verified, the IRS can process your refund.

What to Do If You Receive a Notice from the IRS

If you receive a notice from the IRS, it's essential to take action promptly. The notice may request additional information or documentation to support your tax return. Failure to respond to the notice can lead to further delays or even result in the loss of your refund. When responding to an IRS notice, ensure you:

- Read the notice carefully and understand the request

- Gather the required documentation and information

- Respond to the notice within the specified timeframe (usually 30 days)

Solution 3: Contact the IRS Account Transactions Team

If you've reviewed Form 886-A and responded to any questions or concerns, but your refund remains frozen, you can contact the IRS Account Transactions Team. This team can help resolve issues related to frozen refunds, including those caused by Form 886-A. When contacting the team, be prepared to provide your tax return information, including your name, Social Security number, and tax year. You can reach the Account Transactions Team by calling 1-800-829-1040.

Solution 4: Consider Hiring a Tax Professional

If you're experiencing difficulty resolving a Form 886-A frozen refund issue on your own, consider hiring a tax professional. A tax expert can help you navigate the process, communicate with the IRS, and ensure you receive your refund as quickly as possible. When selecting a tax professional, choose someone with experience in resolving tax disputes and frozen refunds. They can help you:

- Review Form 886-A and identify potential issues

- Respond to IRS notices and correspondence

- Communicate with the IRS on your behalf

Solution 5: File a Taxpayer Advocate Service (TAS) Request

If you've exhausted all other options and your refund remains frozen, you can file a request with the Taxpayer Advocate Service (TAS). The TAS is an independent organization within the IRS that helps taxpayers resolve disputes and issues. When filing a TAS request, you'll need to provide documentation, including Form 886-A and any correspondence with the IRS. The TAS can help resolve frozen refund issues and ensure you receive your refund as quickly as possible.

Conclusion

Resolving a Form 886-A frozen refund issue can be challenging, but there are steps you can take to ensure you receive your refund as quickly as possible. By reviewing and responding to Form 886-A, verifying your identity, contacting the IRS Account Transactions Team, hiring a tax professional, and filing a TAS request, you can overcome frozen refund issues and get your refund processed. Remember to stay calm, patient, and persistent, and don't hesitate to seek help when needed.

What is Form 886-A?

+Form 886-A is an examination changes report used by the IRS to explain the changes or corrections made to a taxpayer's return.

Why is my refund frozen?

+Your refund may be frozen due to various reasons, including identity verification issues, incomplete or inaccurate information on your tax return, or unresolved tax disputes.

How long does it take to resolve a frozen refund issue?

+The time it takes to resolve a frozen refund issue varies depending on the complexity of the issue and the speed of response from the taxpayer and the IRS. It can take several weeks to several months to resolve the issue.