Partnerships play a vital role in the business world, offering a structure that allows multiple individuals or entities to collaborate and share profits and losses. When it comes to tax season, partnerships must navigate the complexities of tax law to ensure compliance and optimize their tax obligations. Two crucial tax forms for partnerships are Form 8825 and Form 1065. In this article, we will delve into the details of these forms, comparing their purposes, requirements, and implications for partnership tax returns.

Understanding Partnership Taxation

Before diving into the specifics of Forms 8825 and 1065, it's essential to grasp the basics of partnership taxation. Partnerships are pass-through entities, meaning that the business income is only taxed at the individual partner level, not at the partnership level. This approach simplifies the tax process, as partnerships do not pay federal income tax. Instead, partners report their share of partnership income, deductions, and credits on their personal tax returns.

Form 8825: Rental Income and Expenses

Form 8825, also known as the "Rental Income and Expenses" form, is used to report rental income and expenses related to real estate activities. Partnerships that engage in rental activities, such as owning rental properties or participating in real estate investment trusts (REITs), must complete this form.

Key Components of Form 8825:

- Reporting rental income and expenses

- Calculating net rental income or loss

- Claiming deductions for mortgage interest, property taxes, and operating expenses

- Reporting capital gains or losses from the sale of rental properties

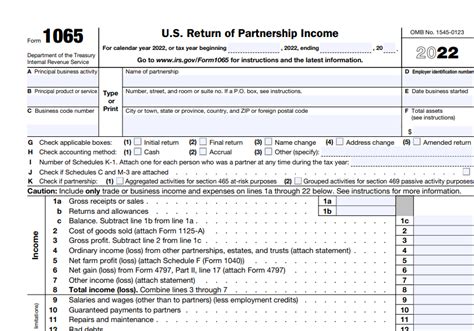

Form 1065: U.S. Return of Partnership Income

Form 1065, also known as the "U.S. Return of Partnership Income" form, is the primary tax return form for partnerships. This form is used to report the partnership's income, deductions, and credits, as well as to allocate these items to the individual partners.

Key Components of Form 1065:

- Reporting partnership income from various sources, such as business operations, investments, and rentals

- Claiming deductions for business expenses, such as salaries, rent, and utilities

- Reporting capital gains or losses from the sale of partnership assets

- Allocating partnership income, deductions, and credits to individual partners

Comparison of Forms 8825 and 1065

While both forms are essential for partnership tax returns, they serve distinct purposes. Form 8825 focuses on rental income and expenses, whereas Form 1065 provides a comprehensive overview of the partnership's income, deductions, and credits.

Key Similarities:

- Both forms are used to report income and expenses related to partnership activities

- Both forms require partnerships to calculate net income or loss

- Both forms allow partnerships to claim deductions and credits

Key Differences:

- Form 8825 is specific to rental income and expenses, whereas Form 1065 encompasses a broader range of partnership activities

- Form 8825 is used to report rental income and expenses, whereas Form 1065 reports partnership income from various sources

- Form 8825 is typically used in conjunction with Form 1065, as rental income and expenses are reported on the partnership's primary tax return

Best Practices for Completing Forms 8825 and 1065

To ensure accurate and timely completion of Forms 8825 and 1065, partnerships should follow these best practices:

- Maintain accurate and detailed records of rental income and expenses, as well as partnership income, deductions, and credits

- Consult with a tax professional or accountant to ensure compliance with tax laws and regulations

- Use tax preparation software or services to streamline the tax preparation process

- Review and revise the forms carefully before submission to avoid errors or omissions

Conclusion:

In conclusion, Forms 8825 and 1065 are crucial components of partnership tax returns. While Form 8825 focuses on rental income and expenses, Form 1065 provides a comprehensive overview of the partnership's income, deductions, and credits. By understanding the purposes, requirements, and implications of these forms, partnerships can ensure compliance with tax laws and optimize their tax obligations.

FAQ Section:

What is the purpose of Form 8825?

+Form 8825 is used to report rental income and expenses related to real estate activities.

What is the purpose of Form 1065?

+Form 1065 is the primary tax return form for partnerships, used to report the partnership's income, deductions, and credits.

Do I need to file both Forms 8825 and 1065?

+Yes, partnerships that engage in rental activities must file Form 8825 in addition to Form 1065.