As a Spark Driver, you're considered an independent contractor, not an employee. This means you're responsible for reporting your income and expenses on your tax return. The Spark Delivery 1099 form is a crucial document that helps you do just that. In this article, we'll break down everything you need to know about the Spark Delivery 1099 form, including what it is, how to read it, and how to use it to file your taxes.

What is a 1099 Form?

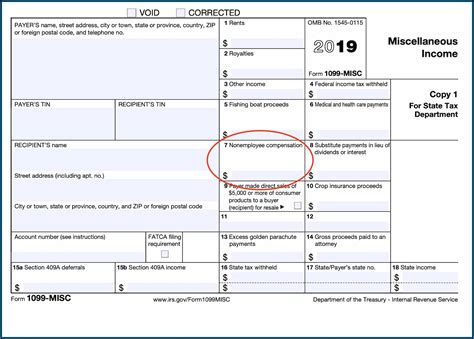

A 1099 form is a tax document used to report various types of income, including freelance work, self-employment income, and other non-employee compensation. The Spark Delivery 1099 form is specifically designed for independent contractors who work with Spark Delivery. It shows the total amount of money you earned from Spark Delivery during the tax year.

What Information is Included on the Spark Delivery 1099 Form?

The Spark Delivery 1099 form includes the following information:

- Your name and address

- Your Taxpayer Identification Number (TIN) or Social Security Number (SSN)

- The Spark Delivery company name and address

- The total amount of money you earned from Spark Delivery during the tax year

- Any federal income tax withheld

- Any state or local taxes withheld

How to Read the Spark Delivery 1099 Form

Reading the Spark Delivery 1099 form is straightforward. Here's a breakdown of what you'll see:

- Box 1: This shows the total amount of money you earned from Spark Delivery during the tax year.

- Box 2: This shows any federal income tax withheld from your earnings.

- Box 3: This shows any state or local taxes withheld from your earnings.

- Box 4: This shows any other income or adjustments.

How to Use the Spark Delivery 1099 Form to File Your Taxes

To file your taxes, you'll need to report the income shown on the Spark Delivery 1099 form on your tax return. Here's how:

- Report the income from Box 1 on Schedule C (Form 1040), which is the form used for self-employment income.

- Report any federal income tax withheld from Box 2 on Form 1040, Line 25.

- Report any state or local taxes withheld from Box 3 on Form 1040, Line 26.

- Keep a copy of the Spark Delivery 1099 form for your records.

What if I Receive Multiple 1099 Forms from Spark Delivery?

If you receive multiple 1099 forms from Spark Delivery, you'll need to report the income from each form on your tax return. You can add up the income from each form and report the total on Schedule C (Form 1040).

What if I Don't Receive a 1099 Form from Spark Delivery?

If you don't receive a 1099 form from Spark Delivery, you're still responsible for reporting your income on your tax return. You can contact Spark Delivery to request a copy of the form or use your own records to report your income.

Tax Deductions for Spark Delivery Independent Contractors

As an independent contractor, you may be eligible for tax deductions related to your Spark Delivery work. Here are some common deductions:

- Business use of your car

- Business use of your phone

- Home office expenses

- Equipment expenses

- Travel expenses

Keep accurate records of your expenses throughout the year to make it easier to claim these deductions on your tax return.

How to File Taxes as a Spark Delivery Independent Contractor

Filing taxes as a Spark Delivery independent contractor is similar to filing taxes as a self-employed individual. Here are the steps:

- Gather all necessary documents, including your Spark Delivery 1099 form and any receipts for expenses.

- Complete Schedule C (Form 1040) to report your business income and expenses.

- Complete Form 1040 to report your personal income and claim any deductions.

- File your tax return by the deadline to avoid penalties.

Frequently Asked Questions

What is the deadline for filing taxes as a Spark Delivery independent contractor?

+The deadline for filing taxes as a Spark Delivery independent contractor is April 15th of each year.

Do I need to pay self-employment tax as a Spark Delivery independent contractor?

+Yes, as a Spark Delivery independent contractor, you're responsible for paying self-employment tax on your net earnings from self-employment.

Can I deduct business expenses on my tax return as a Spark Delivery independent contractor?

+Yes, as a Spark Delivery independent contractor, you can deduct business expenses related to your Spark Delivery work on your tax return.

We hope this guide has helped you understand the Spark Delivery 1099 form and how to use it to file your taxes. Remember to keep accurate records of your income and expenses throughout the year to make tax time easier. If you have any questions or concerns, don't hesitate to reach out to a tax professional for guidance.