As the tax landscape continues to evolve, it's essential for businesses and individuals to stay up-to-date on the latest forms and filing requirements. One such form that has gained attention in recent years is the Form 8822-B, Change of Address or Responsible Person - Business. In this article, we will delve into the world of Form 8822-B, providing a comprehensive, step-by-step guide to help you navigate its intricacies.

The importance of accurate address information cannot be overstated, as it affects the receipt of crucial tax-related correspondence, including notices, bills, and refunds. Moreover, maintaining accurate records is vital for compliance with tax laws and regulations. By understanding how to properly complete and file Form 8822-B, you can ensure that your business stays on the right track.

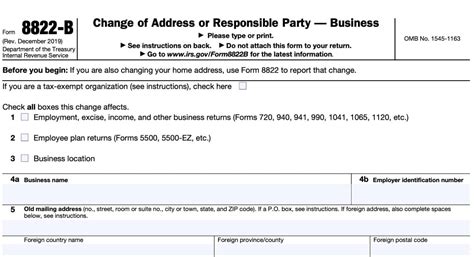

Understanding Form 8822-B

Form 8822-B, Change of Address or Responsible Person - Business, is a crucial document used by businesses to notify the Internal Revenue Service (IRS) of changes to their address or responsible person. This form serves as a means of updating the IRS's records, ensuring that all correspondence and tax-related materials are sent to the correct address or individual.

When to Use Form 8822-B

Before diving into the instructions, it's essential to understand when to use Form 8822-B. This form is typically used in the following situations:

- Changing the business address

- Changing the responsible person (e.g., officer, owner, or partner)

- Updating the mailing address

- Notifying the IRS of a name change (e.g., business name or DBA)

Step-by-Step Instructions for Form 8822-B

Completing Form 8822-B requires attention to detail and accuracy. Follow these step-by-step instructions to ensure that your form is properly filled out:

Section 1: Business Information

In this section, provide the following information:

- Business name

- Employer Identification Number (EIN)

- Old address (if applicable)

Section 2: Change of Address or Responsible Person

In this section, indicate the type of change being made:

- Check the box for "Change of Address" or "Change of Responsible Person"

- Provide the new address or responsible person's information

Section 3: Certification

In this section:

- Sign and date the form

- Provide the title of the signer (e.g., officer, owner, or partner)

Filing Form 8822-B

Once the form is complete, it's essential to file it with the IRS. The filing process varies depending on the type of change being made:

- Mail the form to the IRS address listed in the instructions

- Fax the form to the IRS fax number listed in the instructions

- File the form electronically through the IRS's online portal (if available)

Tips and Reminders

To ensure a smooth filing process, keep the following tips in mind:

- Use black ink and clear, legible handwriting

- Make sure to sign and date the form

- Keep a copy of the completed form for your records

- Verify the IRS's address and fax number before filing

Common Mistakes to Avoid

When completing Form 8822-B, avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Incorrect IRS address or fax number

- Delayed filing, which may result in missed tax-related correspondence

Conclusion

In conclusion, Form 8822-B is a vital document for businesses looking to update their address or responsible person with the IRS. By following the step-by-step instructions outlined in this guide, you can ensure that your form is properly completed and filed. Remember to stay vigilant and avoid common mistakes to maintain compliance with tax laws and regulations.

Take Action Today!

Don't wait until it's too late! Take action today by reviewing your business's address and responsible person information. If changes are necessary, complete and file Form 8822-B to ensure that your business stays on the right track.

Share Your Thoughts!

Have you encountered any challenges while completing Form 8822-B? Share your thoughts and experiences in the comments below! Your input will help others navigate the complexities of tax-related forms.

What is the purpose of Form 8822-B?

+Form 8822-B is used by businesses to notify the IRS of changes to their address or responsible person.

When should I use Form 8822-B?

+Use Form 8822-B when changing the business address, responsible person, mailing address, or notifying the IRS of a name change.

How do I file Form 8822-B?

+File Form 8822-B by mail, fax, or electronically through the IRS's online portal (if available).