As a taxpayer, you may have encountered various IRS forms that can be overwhelming to understand. Two of the most commonly used forms are Form 8821 and Form 2848. While they may seem similar, these forms serve distinct purposes and have different requirements. In this article, we will delve into the details of each form, highlighting their key differences, and providing examples to help you better understand when to use each one.

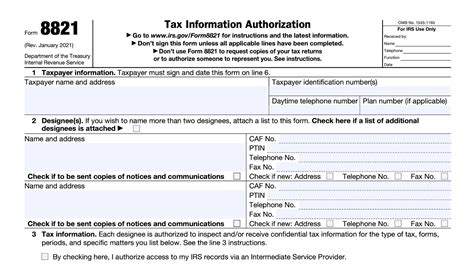

Understanding Form 8821: Tax Information Authorization

What is Form 8821?

Form 8821, also known as the Tax Information Authorization, is an IRS form that allows taxpayers to authorize the IRS to disclose their tax information to a third party. This form is typically used by taxpayers who want to grant permission to a tax professional, accountant, or attorney to access their tax information, such as tax returns, transcripts, or account information.

Key Features of Form 8821:

- Authorizes the IRS to disclose tax information to a designated third party

- Grants access to specific tax information, such as tax returns, transcripts, or account information

- Can be used for individual or business tax information

- Has a specific expiration date, typically 12-18 months

Understanding Form 2848: Power of Attorney and Declaration of Representative

What is Form 2848?

Form 2848, also known as the Power of Attorney and Declaration of Representative, is an IRS form that allows taxpayers to appoint a representative to act on their behalf in tax matters. This form is typically used by taxpayers who want to grant authority to a tax professional, accountant, or attorney to represent them in tax disputes, audits, or other tax-related matters.

Key Features of Form 2848:

- Appoints a representative to act on behalf of the taxpayer in tax matters

- Grants authority to represent the taxpayer in tax disputes, audits, or other tax-related matters

- Can be used for individual or business tax matters

- Has a specific expiration date, typically 12-18 months

Comparing Form 8821 and Form 2848: Key Differences

While both forms are used to grant access to tax information or representation, there are key differences between them:

- Purpose: Form 8821 is used to authorize the disclosure of tax information, while Form 2848 is used to appoint a representative to act on behalf of the taxpayer in tax matters.

- Authority: Form 8821 grants limited authority to access specific tax information, while Form 2848 grants broader authority to represent the taxpayer in tax disputes, audits, or other tax-related matters.

- Expiration: Both forms have specific expiration dates, but Form 2848 typically has a longer expiration period than Form 8821.

When to Use Each Form: Examples and Scenarios

To help you better understand when to use each form, here are some examples and scenarios:

- Using Form 8821: You want to grant permission to your accountant to access your tax returns and transcripts to prepare your tax return. You can use Form 8821 to authorize the IRS to disclose your tax information to your accountant.

- Using Form 2848: You are facing an IRS audit and want to appoint a tax attorney to represent you in the audit process. You can use Form 2848 to grant authority to your tax attorney to act on your behalf in the audit.

Frequently Asked Questions

What is the difference between Form 8821 and Form 2848?

Form 8821 is used to authorize the disclosure of tax information, while Form 2848 is used to appoint a representative to act on behalf of the taxpayer in tax matters.Can I use Form 8821 for business tax information?

Yes, you can use Form 8821 to grant permission to access business tax information, such as business tax returns or transcripts.How long does Form 2848 remain in effect?

Form 2848 typically remains in effect for 12-18 months, but can be revoked or terminated at any time.Conclusion

In conclusion, while Form 8821 and Form 2848 are both used to grant access to tax information or representation, they serve distinct purposes and have different requirements. Understanding the key differences between these forms can help you navigate the tax preparation process with confidence. Whether you need to grant permission to access tax information or appoint a representative to act on your behalf, using the correct form can help ensure a smooth and efficient tax experience.

What is the purpose of Form 8821?

+Form 8821 is used to authorize the IRS to disclose tax information to a designated third party.

Can I use Form 2848 for individual tax matters?

+Yes, you can use Form 2848 to appoint a representative to act on your behalf in individual tax matters.

How long does Form 8821 remain in effect?

+Form 8821 typically remains in effect for 12-18 months, but can be revoked or terminated at any time.