Are you a parent or guardian who received qualified dividends or capital gains from the sale of securities? If so, you may need to file Form 8814 and Form 8815 with the IRS. These forms are used to report the tax on a child's unearned income, also known as the "kiddie tax." In this article, we'll provide you with 5 tips for filing Form 8814 and Form 8815, making it easier for you to navigate the process.

Filing taxes can be a daunting task, especially when it involves reporting a child's unearned income. The kiddie tax was created to prevent parents from shifting investment income to their children to take advantage of lower tax rates. By understanding how to file Form 8814 and Form 8815, you can ensure that you're in compliance with IRS regulations and avoid any potential penalties.

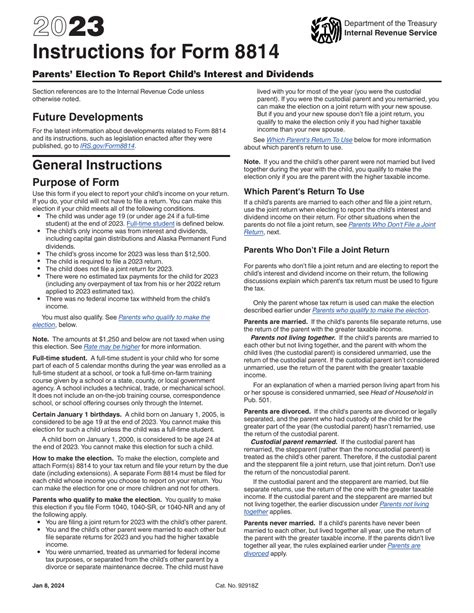

What is Form 8814?

Form 8814, also known as the Parents' Election to Report Child's Interest and Dividends, is used to report a child's unearned income on the parent's tax return. By filing Form 8814, you can elect to report your child's interest and dividends on your tax return, rather than filing a separate tax return for your child. This form is typically used for children under the age of 18 who have unearned income from investments, such as stocks, bonds, or mutual funds.

Who Needs to File Form 8814?

Not all parents need to file Form 8814. To qualify, your child must meet certain requirements:

- Be under the age of 18

- Have unearned income from investments, such as interest, dividends, or capital gains

- Have a parent who claims them as a dependent on their tax return

- Have unearned income that exceeds $2,200 (for tax year 2022)

If your child meets these requirements, you may need to file Form 8814. However, if your child's unearned income is below the threshold, you may not need to file this form.

What is Form 8815?

Form 8815, also known as the Exclusion of Interest and Dividends Attributable to Children Under Section 871(n), is used to report the tax on a child's unearned income. This form is used in conjunction with Form 8814 and is required if your child's unearned income exceeds the threshold.

Who Needs to File Form 8815?

If your child's unearned income exceeds the threshold, you'll need to file Form 8815. This form is used to calculate the tax on your child's unearned income, which will be reported on your tax return.

Tips for Filing Form 8814 and Form 8815

Here are 5 tips for filing Form 8814 and Form 8815:

- Determine if you need to file: Before filing Form 8814 and Form 8815, determine if your child's unearned income exceeds the threshold. If it doesn't, you may not need to file these forms.

- Gather required documents: Make sure you have all the required documents, including your child's investment statements and tax returns from previous years.

- Complete Form 8814 accurately: When completing Form 8814, make sure to accurately report your child's unearned income and calculate the tax owed.

- Use Form 8815 to calculate the tax: If your child's unearned income exceeds the threshold, use Form 8815 to calculate the tax owed.

- Consult a tax professional: If you're unsure about how to file Form 8814 and Form 8815, consider consulting a tax professional. They can help you navigate the process and ensure you're in compliance with IRS regulations.

By following these tips, you can ensure that you're filing Form 8814 and Form 8815 correctly and avoiding any potential penalties.

Common Mistakes to Avoid

When filing Form 8814 and Form 8815, there are several common mistakes to avoid:

- Failing to report all unearned income: Make sure to report all of your child's unearned income, including interest, dividends, and capital gains.

- Miscalculating the tax owed: Use Form 8815 to accurately calculate the tax owed on your child's unearned income.

- Missing the filing deadline: Make sure to file Form 8814 and Form 8815 by the tax filing deadline to avoid any potential penalties.

By avoiding these common mistakes, you can ensure that you're in compliance with IRS regulations and avoiding any potential penalties.

Conclusion

Filing Form 8814 and Form 8815 can be a complex process, but by following these tips, you can ensure that you're in compliance with IRS regulations. Remember to determine if you need to file, gather required documents, complete Form 8814 accurately, use Form 8815 to calculate the tax, and consult a tax professional if needed. By avoiding common mistakes and following these tips, you can ensure that you're filing these forms correctly and avoiding any potential penalties.

Now that you've read this article, we invite you to share your thoughts and experiences with filing Form 8814 and Form 8815. Have you encountered any challenges or successes when filing these forms? Share your comments below, and we'll respond with helpful advice and guidance.

FAQ Section:

Who needs to file Form 8814?

+Parents who claim their child as a dependent and have a child under the age of 18 with unearned income from investments need to file Form 8814.

What is the threshold for filing Form 8815?

+The threshold for filing Form 8815 is $2,200 (for tax year 2022). If your child's unearned income exceeds this threshold, you'll need to file Form 8815.

Can I file Form 8814 and Form 8815 electronically?

+Yes, you can file Form 8814 and Form 8815 electronically through the IRS website or through a tax preparation software.