Form 8812, also known as the "Additional Child Tax Credit," is a crucial document for taxpayers who claim the Child Tax Credit (CTC) or the Additional Child Tax Credit (ACTC). Accurately completing this form can help you avoid any potential delays or issues with your tax refund. In this article, we will discuss seven tips to help you complete Form 8812 accurately.

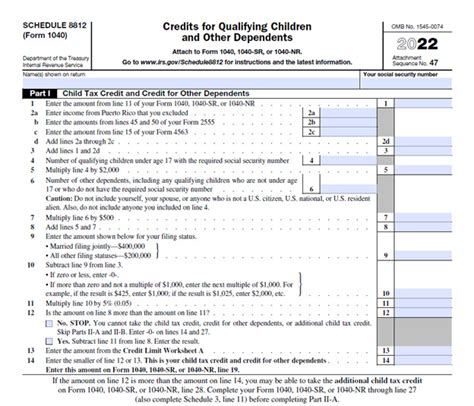

Understanding Form 8812 Form 8812 is used to calculate the Additional Child Tax Credit, which is a refundable credit that may be available to taxpayers who claim the Child Tax Credit. The form is typically filed by taxpayers who have qualifying children under the age of 17 and meet certain income and residency requirements.

Tip 1: Gather Required Documents Before starting to fill out Form 8812, make sure you have all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your qualifying child's Social Security number or ITIN

- Your tax return (Form 1040) and Schedule 8812

- Your employer's name, address, and employer identification number (EIN)

- Any other relevant documentation, such as proof of income and residency

Tip 2: Determine Your Qualifying Child A qualifying child is a child who meets certain requirements, including:

- The child must be under the age of 17 as of December 31st of the tax year

- The child must be your son, daughter, stepchild, foster child, brother, sister, or a descendant of any of these (such as a grandchild)

- The child must have lived with you for more than six months of the tax year

- The child must not have filed a joint return for the tax year (unless it's only to claim a refund)

Tip 3: Calculate Your Modified Adjusted Gross Income (MAGI) Your MAGI is used to determine the amount of the Child Tax Credit you're eligible for. To calculate your MAGI, start with your adjusted gross income (AGI) and add back any foreign earned income exclusion, foreign housing exclusion, or any deductions for student loan interest or tuition and fees.

Tip 4: Complete Schedule 8812 Schedule 8812 is used to calculate the Additional Child Tax Credit. You'll need to complete this schedule to determine the amount of the credit you're eligible for. Make sure to follow the instructions carefully and complete all the required fields.

Tip 5: Claim the Credit on Form 1040 Once you've completed Schedule 8812, you'll need to claim the credit on Form 1040. Report the credit on Line 17 of Form 1040 and attach Schedule 8812 to your tax return.

Tip 6: Review and Double-Check Your Work Before submitting your tax return, review and double-check your work to ensure accuracy. Make sure you've completed all the required fields and that your calculations are correct.

Tip 7: Seek Professional Help If Needed If you're unsure about how to complete Form 8812 or have questions about the Child Tax Credit, consider seeking professional help. A tax professional or accountant can help you navigate the process and ensure you're eligible for the maximum credit.

By following these seven tips, you can ensure that you complete Form 8812 accurately and claim the Child Tax Credit you're eligible for.

Additional Tips and Reminders

- Make sure to file Form 8812 by the tax filing deadline to avoid any potential delays or issues with your tax refund.

- If you're eligible for the Additional Child Tax Credit, you may also be eligible for other tax credits, such as the Earned Income Tax Credit (EITC).

- Keep accurate records of your tax return and supporting documentation in case of an audit or if you need to reference your tax information in the future.

We hope this article has provided you with helpful tips and information on how to complete Form 8812 accurately. Remember to review and double-check your work, and don't hesitate to seek professional help if needed.

Who is eligible for the Child Tax Credit?

+The Child Tax Credit is available to taxpayers who have qualifying children under the age of 17 and meet certain income and residency requirements.

What is the deadline for filing Form 8812?

+Form 8812 must be filed by the tax filing deadline, which is typically April 15th of each year.

Can I claim the Child Tax Credit if I don't have a Social Security number?

+No, you must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN) to claim the Child Tax Credit.