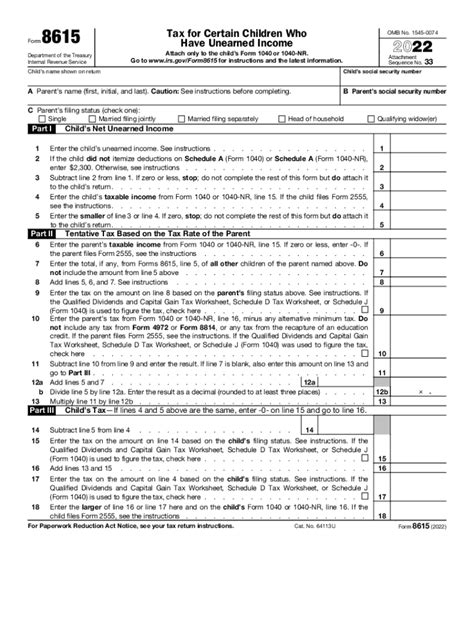

As the tax season approaches, individuals and families with dependents under the age of 18, or with income derived from sources such as trusts and estates, must navigate the complexities of Form 8615. This form, also known as the Dependents' Investment Income, is a crucial component of the tax filing process. One of the most critical sections of this form is Line 6, which can be a source of confusion for many taxpayers. In this article, we will delve into the intricacies of Form 8615 Line 6, providing clarity and guidance to ensure accurate tax filing.

Understanding Form 8615

Before we dive into the specifics of Line 6, it's essential to understand the purpose and scope of Form 8615. This form is used to report the investment income of dependents, which includes income derived from sources such as:

- Dividends

- Capital gains

- Interest income

- Income from trusts and estates

The form is designed to ensure that the tax liability of the dependent is accurately calculated and reported. It's typically filed by parents or guardians on behalf of their dependents.

The Importance of Line 6

Line 6 of Form 8615 is used to calculate the net unearned income of the dependent. This figure is critical in determining the tax liability of the dependent. The net unearned income is calculated by subtracting the deductions and exemptions from the total unearned income.

Breaking Down Line 6

To accurately complete Line 6, taxpayers must follow these steps:

- Calculate the total unearned income of the dependent by adding the income from all sources, including dividends, capital gains, and interest income.

- Calculate the deductions and exemptions applicable to the dependent's income. This may include the standard deduction, personal exemption, and other deductions.

- Subtract the deductions and exemptions from the total unearned income to arrive at the net unearned income.

Common Mistakes to Avoid

When completing Line 6, taxpayers should be aware of the following common mistakes:

- Failing to report all sources of unearned income

- Incorrectly calculating deductions and exemptions

- Failing to subtract deductions and exemptions from the total unearned income

Practical Examples and Statistical Data

To illustrate the calculation of Line 6, let's consider the following example:

Suppose a dependent has a total unearned income of $10,000, consisting of $5,000 in dividends and $5,000 in interest income. The dependent is also eligible for a standard deduction of $2,000 and a personal exemption of $1,000.

Using the steps outlined above, the net unearned income would be calculated as follows:

Total unearned income: $10,000 Deductions and exemptions: $2,000 (standard deduction) + $1,000 (personal exemption) = $3,000 Net unearned income: $10,000 - $3,000 = $7,000

Benefits of Accurate Completion

Accurately completing Line 6 is crucial to ensure that the dependent's tax liability is correctly calculated. This can result in several benefits, including:

- Reduced tax liability

- Avoidance of penalties and fines

- Increased refund

Best Practices for Tax Filing

To ensure accurate and efficient tax filing, taxpayers should follow these best practices:

- Keep accurate and detailed records of the dependent's income and expenses

- Consult with a tax professional or accountant to ensure accurate completion of Form 8615

- Review and double-check the form for errors and inaccuracies

Conclusion

In conclusion, accurately completing Line 6 of Form 8615 is crucial to ensure that the dependent's tax liability is correctly calculated. By following the steps outlined above and avoiding common mistakes, taxpayers can ensure accurate and efficient tax filing. Remember to keep accurate records, consult with a tax professional, and review the form carefully to avoid errors and inaccuracies.

What is Form 8615 used for?

+Form 8615 is used to report the investment income of dependents, including income derived from sources such as dividends, capital gains, and interest income.

How is the net unearned income calculated on Line 6?

+The net unearned income is calculated by subtracting the deductions and exemptions from the total unearned income.

What are the benefits of accurately completing Line 6?

+Accurately completing Line 6 can result in reduced tax liability, avoidance of penalties and fines, and increased refund.