As a resident of Virginia, understanding the intricacies of state taxation is crucial to avoid any unwanted surprises during tax season. One of the most critical forms for Virginians to familiarize themselves with is Form 760PY, also known as the Part-Year Resident Return. This form is designed for individuals who have lived in Virginia for only part of the year, making it essential to comprehend the ins and outs of filing accurately.

In this comprehensive guide, we will delve into the world of Form 760PY, exploring its purpose, who needs to file, and a step-by-step walkthrough of the form's sections. Whether you're a newcomer to the Old Dominion State or a seasoned resident, this article will provide you with the knowledge necessary to navigate the complexities of Virginia's tax laws.

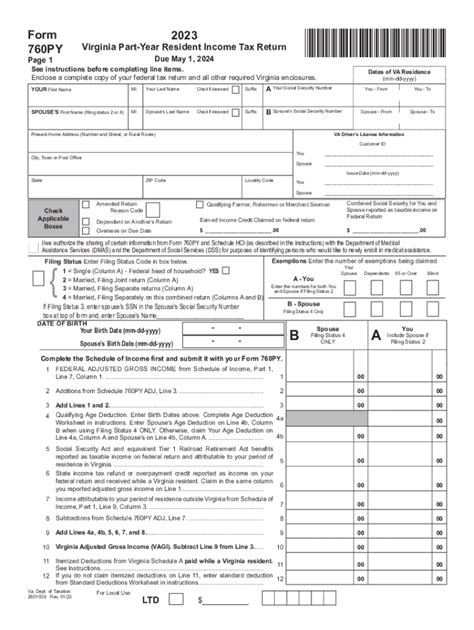

Understanding Form 760PY

Form 760PY is a tax return designed specifically for part-year residents of Virginia. A part-year resident is someone who has lived in Virginia for only a portion of the tax year, either moving into or out of the state during that time. This form is used to report income earned during the period of residency in Virginia.

Who Needs to File Form 760PY?

Not everyone who lives in Virginia needs to file Form 760PY. To determine if you're required to file, consider the following scenarios:

- You moved into Virginia during the tax year and have income to report from the date of your move.

- You moved out of Virginia during the tax year and have income to report up until the date of your move.

- You're a non-resident of Virginia but have income from Virginia sources, such as rental properties or businesses.

If any of these situations apply to you, it's likely you'll need to file Form 760PY.

Section-by-Section Breakdown of Form 760PY

Now that we've established who needs to file Form 760PY, let's dive into the specifics of each section.

Section 1: Residency Information

In this section, you'll need to provide information about your residency status, including:

- Dates of residency in Virginia

- Reason for moving into or out of Virginia

- Address in Virginia (if applicable)

Important Notes:

- If you moved into Virginia during the tax year, you'll need to report all income earned from the date of your move.

- If you moved out of Virginia during the tax year, you'll need to report all income earned up until the date of your move.

Section 2: Income

Section 2: Income

In this section, you'll report all income earned during your period of residency in Virginia. This includes:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

Important Notes:

- You'll need to report all income earned during your period of residency, regardless of the source.

- If you have business income, you may need to complete additional schedules.

Section 3: Deductions and Credits

Section 3: Deductions and Credits

In this section, you'll claim deductions and credits to reduce your tax liability. This includes:

- Standard deduction or itemized deductions

- Personal exemptions

- Credits for taxes paid to other states

Important Notes:

- You can choose to claim the standard deduction or itemize deductions.

- If you're claiming credits for taxes paid to other states, you'll need to complete additional forms.

Section 4: Tax Computation

Section 4: Tax Computation

In this section, you'll calculate your tax liability based on the income and deductions reported in previous sections.

Important Notes:

- You'll need to use the tax tables or calculator to determine your tax liability.

- If you're due a refund, you can choose to have it direct deposited or mailed to you.

Section 5: Payments and Refunds

Section 5: Payments and Refunds

In this section, you'll report any payments made towards your tax liability, including:

- Withholding from wages

- Estimated tax payments

- Prior year's refund applied to this year's tax

Important Notes:

- If you're due a refund, you can choose to have it direct deposited or mailed to you.

- If you owe taxes, you can make a payment online or by mail.

Additional Tips and Reminders

- Make sure to file Form 760PY by the deadline to avoid penalties and interest.

- Keep accurate records of your income, deductions, and credits to ensure accurate reporting.

- If you're unsure about any aspect of the form, consider consulting a tax professional.

Conclusion

Mastering Form 760PY requires attention to detail and a thorough understanding of Virginia's tax laws. By following this guide, you'll be well on your way to accurately completing your part-year resident return. Remember to stay organized, take your time, and don't hesitate to seek help if needed. With these tips and reminders, you'll be confident in your ability to navigate the complexities of Form 760PY.

Who needs to file Form 760PY?

+Individuals who have lived in Virginia for only part of the tax year, either moving into or out of the state during that time, need to file Form 760PY.

What is the deadline for filing Form 760PY?

+The deadline for filing Form 760PY is typically May 1st, but it's essential to check the Virginia Department of Taxation's website for specific deadlines and any extensions.

Can I e-file Form 760PY?

+Yes, you can e-file Form 760PY through the Virginia Department of Taxation's website or through a tax preparation software. E-filing is a convenient and efficient way to file your return.