If you've received a Form 5564 Notice of Deficiency Waiver from the Internal Revenue Service (IRS), it's essential to understand what it means and how to handle it properly. This notice is typically sent to taxpayers who have been assessed a deficiency in their tax liability, but are eligible to waive the penalty associated with it. In this article, we'll explore five ways to handle a Form 5564 Notice of Deficiency Waiver, helping you navigate the process and avoid any potential pitfalls.

Understanding the Form 5564 Notice of Deficiency Waiver

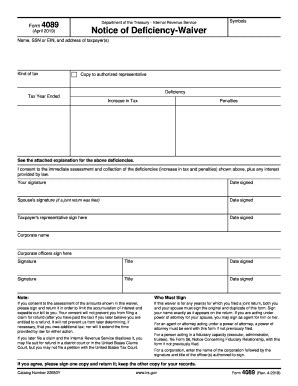

The Form 5564 Notice of Deficiency Waiver is a critical document that requires prompt attention. It's essential to understand the reasons behind the notice and the implications of waiving the penalty. The IRS typically sends this notice when a taxpayer's return is deemed deficient, and the agency believes the taxpayer is eligible to waive the penalty associated with the deficiency.

Why Did I Receive a Form 5564 Notice of Deficiency Waiver?

There are several reasons why you might receive a Form 5564 Notice of Deficiency Waiver. Some common reasons include:

- Failure to report income or claim deductions correctly

- Inaccurate or incomplete tax returns

- Failure to file tax returns or pay taxes on time

- Discrepancies in tax credits or deductions

Option 1: Accept the Waiver and Pay the Deficiency

If you agree with the deficiency assessment and wish to waive the penalty, you can accept the waiver and pay the deficiency. To do this, you'll need to:

- Review the notice carefully and ensure you understand the deficiency amount

- Sign and date the waiver form (Form 5564)

- Return the signed waiver form to the IRS by the specified deadline

- Pay the deficiency amount in full or set up a payment plan with the IRS

Pros and Cons of Accepting the Waiver and Paying the Deficiency

Pros:

- Avoids additional penalties and interest

- Resolves the tax issue promptly

- Allows you to move forward with your tax obligations

Cons:

- Requires payment of the deficiency amount

- May impact your credit score or financial situation

Option 2: Disagree with the Deficiency and Appeal the Notice

If you disagree with the deficiency assessment or believe the waiver is not in your best interest, you can appeal the notice. To do this, you'll need to:

- Review the notice carefully and identify the areas of disagreement

- Gather supporting documentation and evidence to support your claim

- Submit a written appeal to the IRS, explaining your position and providing supporting documentation

- Wait for the IRS to review and respond to your appeal

Pros and Cons of Disagreeing with the Deficiency and Appealing the Notice

Pros:

- Allows you to challenge the deficiency assessment and potentially reduce or eliminate the liability

- Gives you an opportunity to provide additional information and context to support your claim

Cons:

- May lead to additional penalties and interest if the appeal is unsuccessful

- Requires time and effort to gather supporting documentation and submit an appeal

Option 3: Request an Extension to Respond to the Notice

If you need more time to respond to the notice or gather supporting documentation, you can request an extension from the IRS. To do this, you'll need to:

- Submit a written request to the IRS, explaining the reason for the extension and the additional time needed

- Provide supporting documentation or evidence to support your request

- Wait for the IRS to review and respond to your request

Pros and Cons of Requesting an Extension to Respond to the Notice

Pros:

- Gives you additional time to gather supporting documentation and respond to the notice

- May help you avoid penalties and interest associated with late responses

Cons:

- May not be granted if the IRS deems the request unnecessary or unjustified

- Requires prompt action to submit the request and avoid missing the deadline

Option 4: Seek Professional Help from a Tax Attorney or Accountant

If you're unsure about how to handle the Form 5564 Notice of Deficiency Waiver or need expert guidance, consider seeking help from a tax attorney or accountant. They can:

- Review the notice and provide guidance on the best course of action

- Help you gather supporting documentation and evidence to support your claim

- Represent you in appeals or negotiations with the IRS

- Provide guidance on payment plans and deficiency amounts

Pros and Cons of Seeking Professional Help from a Tax Attorney or Accountant

Pros:

- Provides expert guidance and representation

- Helps you navigate the complex tax code and IRS regulations

- May help you avoid penalties and interest associated with incorrect responses

Cons:

- Requires additional costs for professional services

- May not guarantee a successful outcome or reduced liability

Option 5: Ignore the Notice (Not Recommended)

Ignoring the Form 5564 Notice of Deficiency Waiver is not a recommended course of action. Failing to respond or address the notice can lead to:

- Additional penalties and interest on the deficiency amount

- Negative impacts on your credit score and financial situation

- Potential tax liens or levies on your assets

Pros and Cons of Ignoring the Notice

Pros:

- None

Cons:

- Leads to additional penalties and interest

- Negatively impacts credit score and financial situation

- May result in tax liens or levies on assets

In conclusion, receiving a Form 5564 Notice of Deficiency Waiver requires prompt attention and careful consideration. By understanding the notice and exploring the five options outlined above, you can make an informed decision about how to handle the situation and avoid potential pitfalls.

We invite you to share your thoughts and experiences with handling Form 5564 Notices of Deficiency Waiver in the comments below. Have you received a similar notice and successfully resolved the issue? What strategies did you use to navigate the process? Your input can help others facing similar challenges.

FAQ Section:

What is a Form 5564 Notice of Deficiency Waiver?

+A Form 5564 Notice of Deficiency Waiver is a document sent by the IRS to taxpayers who have been assessed a deficiency in their tax liability, but are eligible to waive the penalty associated with it.

What are the consequences of ignoring the Form 5564 Notice of Deficiency Waiver?

+Ignoring the notice can lead to additional penalties and interest on the deficiency amount, negative impacts on credit score and financial situation, and potential tax liens or levies on assets.

Can I appeal the Form 5564 Notice of Deficiency Waiver if I disagree with the deficiency assessment?

+Yes, you can appeal the notice if you disagree with the deficiency assessment. You'll need to submit a written appeal to the IRS, explaining your position and providing supporting documentation.