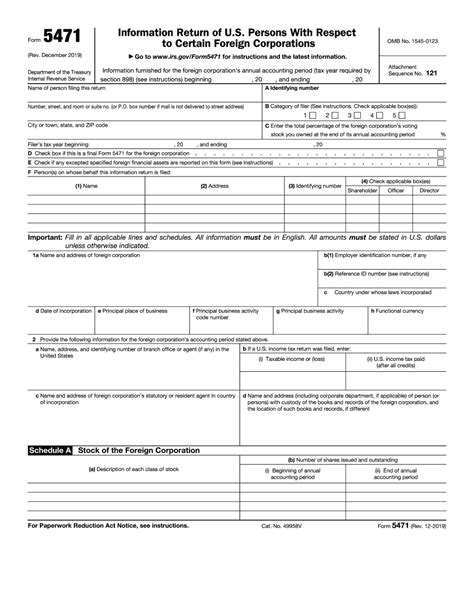

Form 5471 is a crucial document for United States taxpayers who are required to report certain transactions with foreign corporations. The form is used to report the income, deductions, and credits of a foreign corporation that is controlled by a U.S. person. One of the key components of Form 5471 is Schedule I-1, which is used to report the balance sheet of the foreign corporation. In this article, we will provide a step-by-step guide to completing Schedule I-1 of Form 5471.

Understanding the Purpose of Schedule I-1

Before we dive into the instructions, it's essential to understand the purpose of Schedule I-1. This schedule is used to report the balance sheet of the foreign corporation, which includes its assets, liabilities, and equity. The information reported on Schedule I-1 is used to determine the foreign corporation's income, deductions, and credits, which are then reported on Form 5471.

Who Must File Schedule I-1?

Not all taxpayers who file Form 5471 are required to complete Schedule I-1. Only certain U.S. persons who have a controlling interest in a foreign corporation must file Schedule I-1. A controlling interest is defined as owning more than 50% of the foreign corporation's voting power or value.

Step-by-Step Instructions for Completing Schedule I-1

Now that we have covered the purpose and who must file Schedule I-1, let's move on to the step-by-step instructions for completing the schedule.

Part I: Assets

Part I of Schedule I-1 is used to report the foreign corporation's assets. The following assets must be reported:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Property, plant, and equipment

- Intangible assets

- Other assets

Each asset must be reported at its fair market value, which is the price that would be paid for the asset in an arm's-length transaction.

Part II: Liabilities

Part II of Schedule I-1 is used to report the foreign corporation's liabilities. The following liabilities must be reported:

- Accounts payable

- Short-term debt

- Long-term debt

- Other liabilities

Each liability must be reported at its face value, which is the amount that the foreign corporation is required to pay.

Part III: Equity

Part III of Schedule I-1 is used to report the foreign corporation's equity. The following equity accounts must be reported:

- Common stock

- Preferred stock

- Retained earnings

- Other equity

Each equity account must be reported at its par value or fair market value, whichever is applicable.

Additional Information

In addition to the information reported on Schedule I-1, taxpayers must also provide additional information, including:

- The foreign corporation's functional currency

- The exchange rate used to translate the foreign corporation's financial statements

- The foreign corporation's accounting method

Penalties for Failure to File or Failure to Comply

Taxpayers who fail to file Form 5471 or Schedule I-1, or who fail to comply with the reporting requirements, may be subject to penalties and fines. The penalty for failure to file Form 5471 is $10,000, and the penalty for failure to comply with the reporting requirements is $10,000 per year.

Conclusion

Completing Schedule I-1 of Form 5471 can be a complex and time-consuming process. However, by following the step-by-step instructions outlined in this article, taxpayers can ensure that they are in compliance with the reporting requirements. It's essential to note that the IRS takes non-compliance seriously, and taxpayers who fail to file or comply with the reporting requirements may be subject to penalties and fines.

We hope this article has provided you with a comprehensive understanding of Schedule I-1 of Form 5471. If you have any questions or concerns, please don't hesitate to reach out to a tax professional or the IRS.

What is Form 5471?

+Form 5471 is a document used by the IRS to report the income, deductions, and credits of a foreign corporation that is controlled by a U.S. person.

Who must file Schedule I-1?

+Only certain U.S. persons who have a controlling interest in a foreign corporation must file Schedule I-1.

What is the penalty for failure to file Form 5471?

+The penalty for failure to file Form 5471 is $10,000.