The world of international taxation can be complex and nuanced, especially when it comes to reporting requirements for U.S. taxpayers with interests in foreign corporations. One crucial form that plays a vital role in this landscape is Form 5471, and specifically, Schedule G. This schedule is a crucial component of the form, providing essential information about the controlled foreign corporation's (CFC) income and activities. Here are five key facts about Form 5471 Schedule G that you should know.

What is Form 5471 Schedule G?

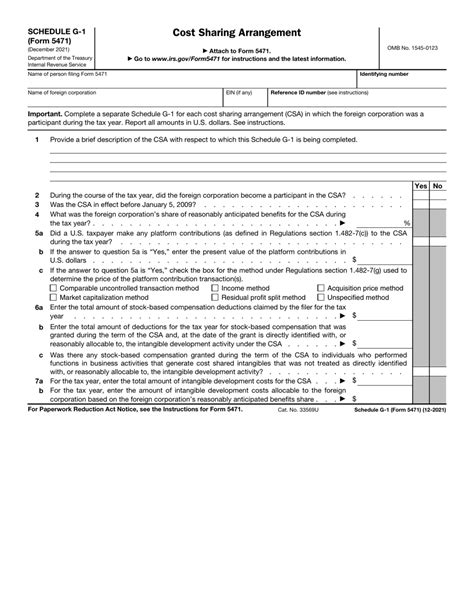

Form 5471 is an annual information return required by the Internal Revenue Service (IRS) for certain U.S. taxpayers with interests in foreign corporations. The form is divided into several schedules, each providing different types of information. Schedule G is specifically designed to report the CFC's income statement, which is a crucial aspect of the form. It provides a detailed breakdown of the CFC's income, expenses, and profits, giving the IRS a comprehensive view of the CFC's financial activities.

Who Needs to File Form 5471 Schedule G?

To determine who needs to file Form 5471 Schedule G, we must first understand who is required to file Form 5471. Generally, the form is required for U.S. taxpayers who have control over a foreign corporation or have a significant ownership interest in such a corporation. Control is defined as owning more than 50% of the total voting power or value of the foreign corporation's stock. U.S. taxpayers with a 10% or greater interest in a CFC are also required to file the form. If you fall into any of these categories, you will likely need to complete Schedule G as part of your Form 5471 filing.

What Information is Required on Schedule G?

Schedule G is essentially an income statement for the CFC, requiring detailed information about the corporation's income and expenses. The schedule is divided into several sections, including:

- Gross income: This includes all income earned by the CFC, such as sales, services, and investments.

- Cost of goods sold: This section reports the direct costs associated with producing the CFC's products or services.

- Operating expenses: These are the day-to-day expenses incurred by the CFC, such as salaries, rent, and utilities.

- Non-operating income and expenses: This section includes income and expenses not related to the CFC's primary business operations, such as interest income or foreign exchange gains/losses.

- Net income: This is the CFC's total profit or loss for the tax year.

Penalties for Failure to File or Inaccurate Reporting

Failure to file Form 5471 or providing inaccurate information on Schedule G can result in severe penalties. The IRS may impose a penalty of $10,000 for each annual accounting period for which the form is not filed or is filed late. Additional penalties may apply if the failure to file is deemed willful or reckless. Inaccurate reporting can also lead to penalties, including the loss of foreign tax credits or the imposition of additional taxes.

Benefits of Accurate and Timely Reporting

Accurate and timely reporting on Form 5471 Schedule G is essential for several reasons:

- Avoidance of penalties: By filing the form on time and providing accurate information, U.S. taxpayers can avoid costly penalties and interest.

- Compliance with tax laws: Filing Form 5471 demonstrates compliance with U.S. tax laws and regulations, reducing the risk of audits or examinations.

- Foreign tax credits: Accurate reporting on Schedule G can help U.S. taxpayers claim foreign tax credits, reducing their U.S. tax liability.

Best Practices for Preparing Schedule G

To ensure accurate and timely reporting on Form 5471 Schedule G, consider the following best practices:

- Maintain accurate financial records: Keep detailed financial records for the CFC, including income statements, balance sheets, and general ledgers.

- Consult with a tax professional: If you are unsure about the reporting requirements or need assistance with preparing Schedule G, consult with a qualified tax professional.

- File electronically: The IRS offers electronic filing options for Form 5471, which can help reduce errors and improve processing times.

Conclusion and Next Steps

Form 5471 Schedule G is a critical component of the international taxation landscape. By understanding the requirements and benefits of accurate and timely reporting, U.S. taxpayers can avoid costly penalties and ensure compliance with U.S. tax laws. If you have any questions or concerns about preparing Schedule G, consult with a qualified tax professional or seek guidance from the IRS.

We encourage you to share your thoughts and experiences with Form 5471 Schedule G in the comments below. Have you encountered any challenges or successes when preparing this schedule? Your input can help others navigate the complexities of international taxation.

What is the purpose of Form 5471 Schedule G?

+Form 5471 Schedule G is used to report the income statement of a controlled foreign corporation (CFC). It provides a detailed breakdown of the CFC's income, expenses, and profits, giving the IRS a comprehensive view of the CFC's financial activities.

Who is required to file Form 5471 Schedule G?

+U.S. taxpayers who have control over a foreign corporation or have a significant ownership interest in such a corporation are required to file Form 5471, which includes Schedule G.

What are the penalties for failure to file or inaccurate reporting on Schedule G?

+Failure to file Form 5471 or providing inaccurate information on Schedule G can result in severe penalties, including a $10,000 penalty for each annual accounting period and additional penalties for willful or reckless failure to file.