In the realm of international taxation, the Form 5471 is a crucial document that the Internal Revenue Service (IRS) uses to track the activities of U.S. citizens who are involved in the management or control of a foreign corporation. Among the various schedules that comprise the Form 5471, Schedule I-1 is a significant component that demands attention to detail and accuracy. As we delve into the world of international tax compliance, it's essential to grasp the intricacies of completing Form 5471 Sch I-1.

Understanding the Purpose of Form 5471 Sch I-1

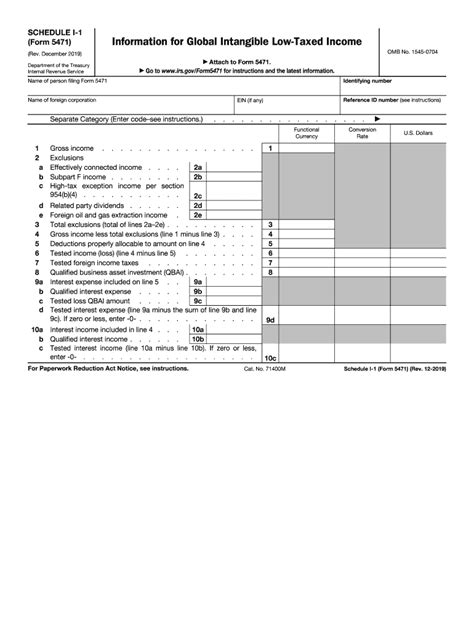

Before we dive into the nitty-gritty of completing the form, it's essential to understand its purpose. Form 5471 Sch I-1 is used to report the income, deductions, and other relevant information related to a foreign corporation that is controlled by U.S. persons. This schedule is a critical component of the Form 5471, as it provides the IRS with a comprehensive view of the foreign corporation's financial activities.

Tip 1: Identify the Relevant Foreign Corporation

The first step in completing Form 5471 Sch I-1 is to identify the relevant foreign corporation. This involves determining whether the foreign corporation is a controlled foreign corporation (CFC) or a non-controlled foreign corporation. A CFC is a foreign corporation that is more than 50% owned by U.S. shareholders. If the foreign corporation meets this criterion, it is subject to the reporting requirements of Form 5471.

Tip 2: Gather the Required Financial Information

To complete Form 5471 Sch I-1, you will need to gather the required financial information related to the foreign corporation. This includes the corporation's income, deductions, and other relevant financial data. It's essential to ensure that the financial information is accurate and complete, as any errors or omissions can result in penalties or even an audit.

Tip 3: Determine the Functional Currency

The functional currency is the currency in which the foreign corporation maintains its financial records. This is an essential aspect of completing Form 5471 Sch I-1, as it will determine the currency in which the financial information is reported. The functional currency can be either the U.S. dollar or the local currency of the foreign corporation.

Tip 4: Complete the Schedules and Attachments

Form 5471 Sch I-1 consists of several schedules and attachments that must be completed accurately. These include:

- Schedule I: Income (or loss) from U.S. sources

- Schedule II: Income (or loss) from foreign sources

- Schedule III: Deductions and credits

- Schedule IV: Other relevant financial information

It's essential to carefully review each schedule and attachment to ensure that all required information is included.

Tip 5: Seek Professional Guidance

Completing Form 5471 Sch I-1 can be a complex and time-consuming process. If you are unsure about any aspect of the form or the reporting requirements, it's essential to seek professional guidance from a qualified tax professional. They can provide you with expert advice and ensure that the form is completed accurately and in compliance with IRS regulations.

Additional Resources

For more information on completing Form 5471 Sch I-1, refer to the following resources:

- IRS Form 5471 Instructions

- IRS Publication 514 (Foreign Tax Credit for Individuals, Estates, and Trusts)

- IRS Publication 555 (Federal Tax Information for U.S. Taxpayers Living Abroad)

Conclusion

Completing Form 5471 Sch I-1 requires attention to detail, accuracy, and a thorough understanding of the reporting requirements. By following these essential tips and seeking professional guidance when needed, you can ensure that the form is completed accurately and in compliance with IRS regulations.

What is the purpose of Form 5471 Sch I-1?

+Form 5471 Sch I-1 is used to report the income, deductions, and other relevant information related to a foreign corporation that is controlled by U.S. persons.

Who is required to file Form 5471 Sch I-1?

+U.S. shareholders who own more than 50% of a foreign corporation are required to file Form 5471 Sch I-1.

What is the deadline for filing Form 5471 Sch I-1?

+The deadline for filing Form 5471 Sch I-1 is typically the same as the deadline for the U.S. tax return (Form 1040).