The Golden State's tax laws can be complex, especially for nonresidents. If you're a nonresident individual who earned income in California, you're required to file a tax return with the state's Franchise Tax Board (FTB). The California Form 540NR is the document you'll need to submit to report your California-source income. In this comprehensive guide, we'll walk you through the ins and outs of the California Form 540NR, helping you navigate the process with ease.

Who Needs to File Form 540NR?

If you're a nonresident individual, you're required to file Form 540NR if you meet any of the following conditions:

- You earned income from California sources, such as wages, salaries, tips, or self-employment income.

- You received California-source income from investments, such as stocks, bonds, or real estate.

- You received California-source income from a trust or estate.

- You're a beneficiary of a California trust or estate.

It's essential to note that even if you don't owe taxes, you may still need to file Form 540NR to report your California-source income.

What is California-Source Income?

California-source income includes income earned from sources within the state, such as:

- Wages, salaries, and tips earned while working in California.

- Self-employment income earned from a business or profession conducted in California.

- Rent and royalties from California real estate or intellectual property.

- Gains from the sale of California real estate or other California assets.

- Dividends and interest from California-based corporations or financial institutions.

Types of Income Not Subject to California Tax

Not all income earned by nonresidents is subject to California tax. For example:

- Income earned from interstate commerce, such as sales of goods or services to customers outside California.

- Income earned from foreign sources, such as foreign investments or foreign-earned wages.

- Income earned from the sale of securities or other intangible assets, unless the asset is California-based.

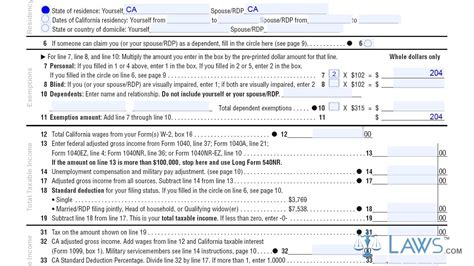

How to File Form 540NR

To file Form 540NR, you'll need to follow these steps:

- Gather your tax documents, including your federal tax return (Form 1040) and any relevant schedules or attachments.

- Complete Form 540NR, reporting your California-source income and claiming any applicable deductions or credits.

- Attach a copy of your federal tax return to Form 540NR.

- Submit Form 540NR to the FTB by the tax filing deadline, which is typically April 15th for individual taxpayers.

E-Filing and Payment Options

The FTB offers e-filing options for Form 540NR, including:

- CalFile: A free e-filing program for individuals with simple returns.

- e-file providers: Private companies that offer e-filing services for a fee.

- Online payment options: You can pay your tax bill online using a credit card or electronic funds transfer.

Deductions and Credits for Nonresidents

As a nonresident, you may be eligible for various deductions and credits on your California tax return. Some common deductions and credits include:

- The standard deduction: A fixed amount you can deduct from your taxable income.

- Itemized deductions: Deductions for specific expenses, such as mortgage interest or charitable contributions.

- The California earned income tax credit (EITC): A refundable credit for low-income working individuals and families.

- The California child and dependent care expenses credit: A nonrefundable credit for child care expenses.

Other Tax Credits and Deductions

Other tax credits and deductions may be available to nonresidents, including:

- The mortgage interest credit: A nonrefundable credit for mortgage interest paid on a primary residence.

- The renters' credit: A nonrefundable credit for renters who pay rent on a primary residence.

- The education expenses deduction: A deduction for education expenses related to a trade or business.

Audit and Examination Procedures

If you're selected for an audit or examination, the FTB will review your tax return to ensure accuracy and compliance with California tax laws. The audit process typically involves:

- A notification letter: The FTB will send you a letter notifying you of the audit or examination.

- A request for documentation: You'll be asked to provide supporting documentation for your tax return, such as receipts or invoices.

- An audit or examination: The FTB will review your documentation and tax return to determine if any errors or discrepancies exist.

Responding to an Audit or Examination

If you're selected for an audit or examination, it's essential to respond promptly and provide all requested documentation. You may also want to consider hiring a tax professional to represent you during the audit process.

Penalties and Interest for Noncompliance

If you fail to file or pay your California tax bill, you may be subject to penalties and interest. The FTB imposes penalties for:

- Late filing: A penalty for filing your tax return after the deadline.

- Late payment: A penalty for paying your tax bill after the deadline.

- Underpayment: A penalty for underpaying your tax bill.

Waiver of Penalties and Interest

In some cases, the FTB may waive penalties and interest if you can demonstrate reasonable cause for noncompliance. You'll need to submit a written request to the FTB, explaining the circumstances that led to your noncompliance.

We hope this comprehensive guide has helped you understand the California Form 540NR and your obligations as a nonresident individual. Remember to file your tax return accurately and on time to avoid penalties and interest. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the FTB for guidance.

We encourage you to share your thoughts and experiences with us. Have you ever filed Form 540NR as a nonresident individual? Do you have any questions about California tax laws? Share your comments below, and let's start a conversation!

What is the deadline for filing Form 540NR?

+The deadline for filing Form 540NR is typically April 15th for individual taxpayers.

Can I e-file Form 540NR?

+Yes, the FTB offers e-filing options for Form 540NR, including CalFile and e-file providers.

What is the standard deduction for nonresidents?

+The standard deduction for nonresidents varies depending on filing status and income level. Consult the FTB website or a tax professional for more information.