When it comes to filing taxes or other official documents, accuracy and attention to detail are crucial to avoid any potential issues or delays. One such document that requires careful completion is the Form 1583, also known as the Application for Individual Employer Identification Number (EIN). In this article, we will guide you through the process of filling out Form 1583, providing you with a step-by-step explanation of each section.

What is Form 1583?

Form 1583 is an application used by individuals, businesses, and other entities to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned to each entity for tax purposes, enabling them to file taxes, hire employees, and open business bank accounts.

Why Do I Need an EIN?

Having an EIN is essential for various reasons:

- Filing taxes and tax returns

- Hiring employees and reporting their income

- Opening business bank accounts and securing lines of credit

- Establishing business credibility and legitimacy

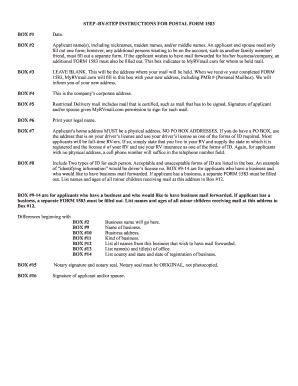

Step-by-Step Guide to Filling Out Form 1583

Now that we have covered the basics, let's dive into the step-by-step process of filling out Form 1583.

Section 1: Entity Information

- Business Name: Enter the exact name of your business or entity as it appears on your tax returns and other official documents.

- Business Address: Provide your business's mailing address, including the street address, city, state, and ZIP code.

- Business Phone Number: Enter your business phone number, including the area code.

Section 2: Responsible Party Information

- Name and Title: Enter the name and title of the responsible party, such as the business owner, CEO, or president.

- Social Security Number or Individual Taxpayer Identification Number (ITIN): Provide the responsible party's Social Security Number or ITIN.

- Address: Enter the responsible party's mailing address, including the street address, city, state, and ZIP code.

Section 3: Type of Entity

- Check the box: Select the type of entity that best describes your business, such as a sole proprietorship, partnership, corporation, or trust.

Section 4: Purpose of EIN

- Check the box: Select the reason why you need an EIN, such as for tax purposes, hiring employees, or opening a business bank account.

Section 5: Signature

- Signature: Sign the form in the designated area, ensuring that you have completed all sections accurately.

Tips and Reminders

Before submitting your Form 1583 application, ensure that:

- You have completed all sections accurately and thoroughly.

- You have provided all required documentation, such as identification and proof of business existence.

- You have signed the form in the designated area.

By following this step-by-step guide, you can ensure that your Form 1583 is completed correctly, reducing the risk of delays or issues with your EIN application.

What is the purpose of Form 1583?

+Form 1583 is an application used to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Who needs an EIN?

+Individuals, businesses, and other entities that need to file taxes, hire employees, or open business bank accounts require an EIN.

How long does it take to process Form 1583?

+The processing time for Form 1583 typically takes 4-6 weeks, but may vary depending on the complexity of the application and the workload of the IRS.

If you have any further questions or concerns about filling out Form 1583 or obtaining an EIN, please don't hesitate to ask. Share your experiences or tips for completing the form in the comments below.