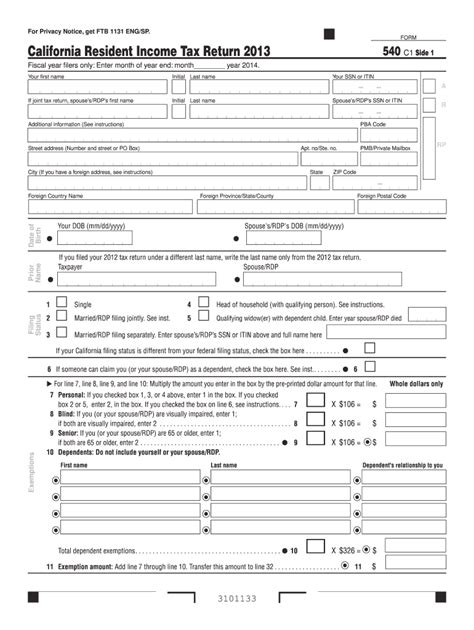

As a California resident, you're likely familiar with the Form 540, which is the state's income tax return form. However, there's a lesser-known aspect of this form that can cause confusion and even lead to penalties: the "No Use Tax" checkbox. In this article, we'll explore what this checkbox means, why it's important, and provide 5 ways to handle it correctly.

Understanding the No Use Tax Checkbox

The No Use Tax checkbox, located on Line 95 of Form 540, is a declaration that you, as a taxpayer, did not owe use tax on any purchases made during the tax year. Use tax is a type of tax levied on purchases made from out-of-state retailers, which are not subject to California sales tax. By checking this box, you're attesting that you either didn't make any purchases subject to use tax or that you've already reported and paid the use tax owed.

Why is the No Use Tax Checkbox Important?

The No Use Tax checkbox may seem like a minor detail, but it's crucial in ensuring compliance with California's tax laws. If you fail to check this box or incorrectly claim that you didn't owe use tax, you may be subject to penalties and interest on the unpaid tax amount. Moreover, the California Franchise Tax Board (FTB) takes use tax compliance seriously and may conduct audits to verify the accuracy of your return.

Consequences of Incorrectly Claiming No Use Tax

If you incorrectly claim that you didn't owe use tax, you may face:

- Penalties: Up to 40% of the unpaid use tax amount

- Interest: Accrues on the unpaid tax amount from the original due date of the return

- Audit: The FTB may conduct an audit to verify the accuracy of your return

5 Ways to Handle the No Use Tax Checkbox

To avoid any potential issues, follow these 5 steps to handle the No Use Tax checkbox correctly:

1. Keep Accurate Records

Maintain detailed records of all purchases made during the tax year, including receipts, invoices, and bank statements. This will help you determine if you owe use tax and ensure you're reporting it accurately.

2. Understand Use Tax Rates

Familiarize yourself with California's use tax rates, which range from 7.25% to 10.25% depending on the location. This will help you calculate the correct amount of use tax owed.

3. Report Use Tax on Schedule CA (540)

If you owe use tax, report it on Schedule CA (540), which is the California adjustment schedule. You'll need to complete Part III of the schedule to report the use tax owed.

4. File Form 540 with the Correct Information

When filing your Form 540, ensure you correctly complete the No Use Tax checkbox. If you owe use tax, check the box indicating that you're reporting use tax on Schedule CA (540).

5. Seek Professional Help if Needed

If you're unsure about how to handle the No Use Tax checkbox or need help with calculating use tax owed, consider consulting a tax professional. They can provide guidance on ensuring compliance with California's tax laws.

By following these steps, you'll be able to handle the No Use Tax checkbox correctly and avoid any potential penalties or interest. Remember to stay informed and consult a tax professional if you're unsure about any aspect of California's tax laws.

What is the purpose of the No Use Tax checkbox on Form 540?

+The No Use Tax checkbox is a declaration that you, as a taxpayer, did not owe use tax on any purchases made during the tax year.

What happens if I incorrectly claim that I didn't owe use tax?

+If you incorrectly claim that you didn't owe use tax, you may face penalties, interest, and audit by the California Franchise Tax Board (FTB).

How do I calculate the correct amount of use tax owed?

+To calculate the correct amount of use tax owed, you'll need to understand California's use tax rates and keep accurate records of all purchases made during the tax year.